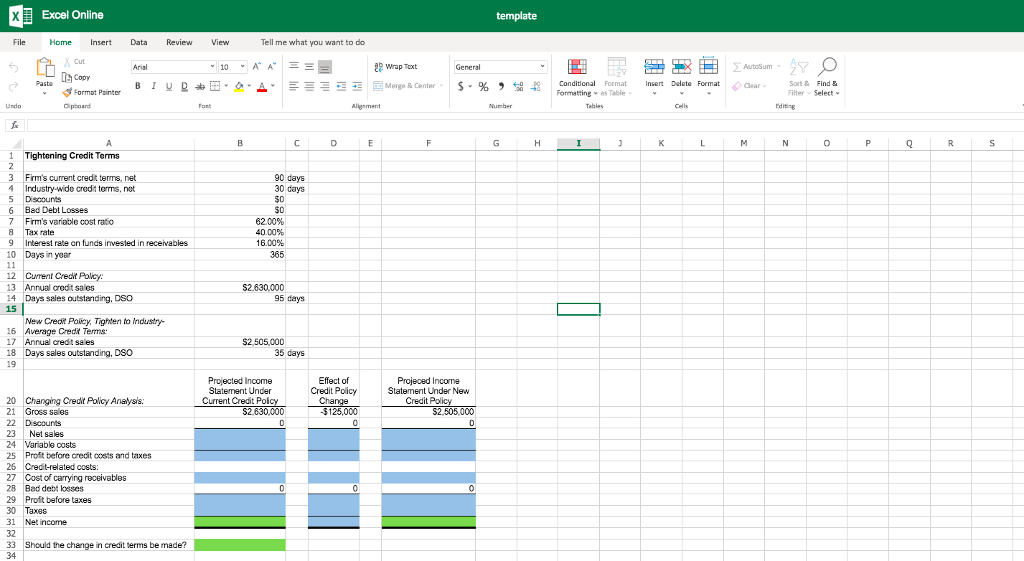

Question: File Undo 5 A 1 Tightening Credit Terms Excel Online Home Insert 6 Bad Debt Losses 14 Paste 15 X Cut Copy Format Painter

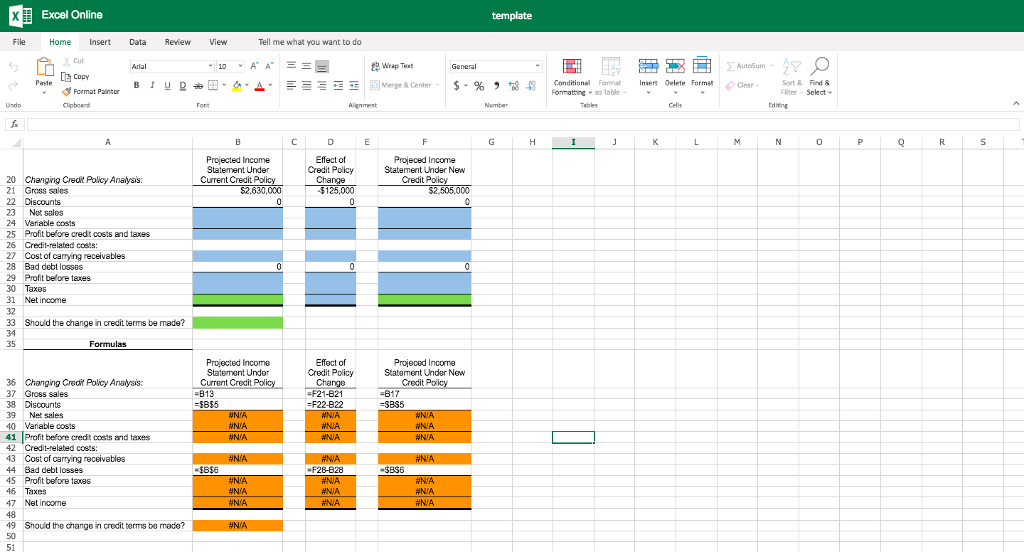

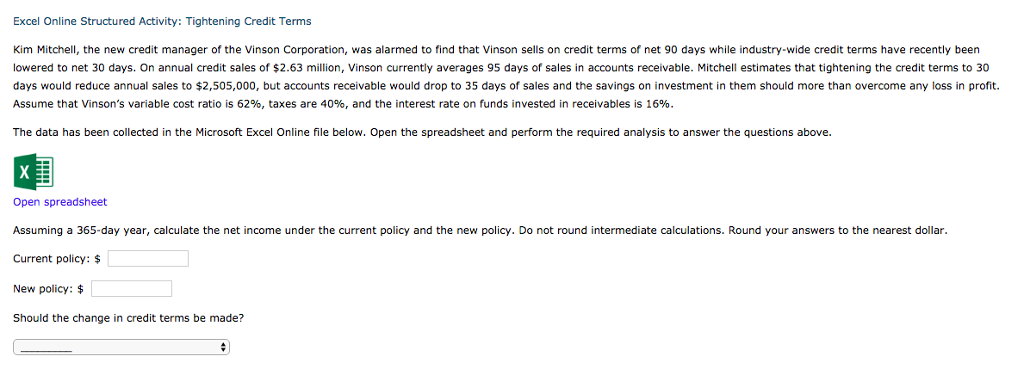

File Undo 5 A 1 Tightening Credit Terms Excel Online Home Insert 6 Bad Debt Losses 14 Paste 15 X Cut Copy Format Painter Clipboard 16 10 Days in year 12 Current Credit Policy: 13 Annual credit sales Firm's current credit terms, net Industry-wide credit terms, net Discounts Firm's variable cost ratio Tax rate 9 Interest rate on funds invested in receivables 22 23 33 34 Data 17 Annual credit sales Arial Days sales outstanding, DSO 18 Days sales outstanding, DSO New Credit Policy, Tighten to Industry Average Credit Terms: 20 Changing Credit Policy Analysis: 21 Gross sales 29 Profit before taxes 30 Taxes 31 Net income 32 Discounts Net sales 24 Variable costs 25 Profit before credit costs and taxes 26 Credit-related costs: 27 Cost of carrying receivables 28 Bad debt losses Review View IURA- Should the change in credit terms be made? Font Tell me what you want to do 10 A A B 62.00% 40.00% 16.00% 365 $2,505,000 Projected Income Statement Under === 90 days 30 days SO $0 E $2,630,000 95 days C Current Credit Policy $2,630,000 0 35 days === D Alignment Effect of Credit Policy Change -$125,000 0 0 E Wrap Text Merge & Center - F General $ % 48 Projeced Income Statement Under New Credit Policy $2,505,000 0 template 0 Number G H Conditional Format Formatting as Table Tables I | J A 500 SI X H Insert Delete Format K Cells L Autosum Clear M AT O Sort & Find & Filter - Select Editing N 0 P Q R S x Excel Online File 5 Undo fox Home Insert X Cut [Copy Format Painter Clipboard 7 Paste 20 21 Gross sales 22 Discounts 23 Net sales 24 Variable costs 25 A Changing Credit Policy Analysis: 26 27 28 Bad debt losses 29 Profit before taxes 30 Taxes 31 Net income Credit-related costs: Cost of carrying receivables Data Profit before credit costs and taxes Arial Formulas BIUD 32 33 Should the change in credit terms be made? 34 35 42 Credit-related costs: 43 Cost of carrying receivables 36 Changing Credit Policy Analysis: 37 Gross sales 38 Discounts Review 39 Net sales 40 Variable costs 41 Profit before credit costs and taxes 44 Bad debt losses 45 Profit before taxes 46 Taxes 47 Net income 48 49 Should the change in credit terms be made? 50 51 View Font 10 B -B13 -$8$5 -$B$6 Projected Income Statement Under Current Credit Policy $2,630,000 0 Projected Income Statement Under Current Credit Policy #N/A #N/A #N/A Tell me what you want to do #N/A A A A #N/A #N/A #N/A #N/A 0 === SEEED D Effect of Credit Policy Change -$125,000 0 Change =F21-821 -F22-822 Effect of Credit Policy #N/A #N/A #N/A Alignment #N/A -F28-828 #N/A #N/A #N/A 0 2Wrap Text Merge & Center E F =817 =SBS5 Projeced Income Statement Under New Credit Policy -$B$6 General $2,505,000 #N/A #N/A #N/A Projeced Income Statement Under New Credit Policy #N/A $-% 98 48 #N/A #N/A #N/A 0 0 template Number G H H HAG Conditional Format Formatting as Table. I Tables J Gydy IX A Insert Delete Format K Cells L AutoSum Clear M 20 Sort & Find & Filter Select - Editing N 0 P Q R S Excel Online Structured Activity: Tightening Credit Terms Kim Mitchell, the new credit manager of the Vinson Corporation, was alarmed to find that Vinson sells on credit terms of net 90 days while industry-wide credit terms have recently been lowered to net 30 days. On annual credit sales of $2.63 million, Vinson currently averages 95 days of sales in accounts receivable. Mitchell estimates that tightening the credit terms to 30 days would reduce annual sales to $2,505,000, but accounts receivable would drop to 35 days of sales and the savings on investment in them should more than overcome any loss in profit. Assume that Vinson's variable cost ratio is 62%, taxes are 40%, and the interest rate on funds invested in receivables is 16%. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions above. Open spreadsheet. Assuming a 365-day year, calculate the net income under the current policy and the new policy. Do not round intermediate calculations. Round your answers to the nearest dollar. Current policy: $ New policy: $ Should the change in credit terms be made? +

Step by Step Solution

There are 3 Steps involved in it

To address the question regarding whether the change in credit terms should be made we need to calculate the net income under the current credit polic... View full answer

Get step-by-step solutions from verified subject matter experts