Question: Files E C File * Apps Dashboard untitled X C Search Textbook Solutions Ches x + - 2 x C:/Users/kimbe/Downloads/ch19_Exercises_SetB_17e.pdf Q RO Course Home M

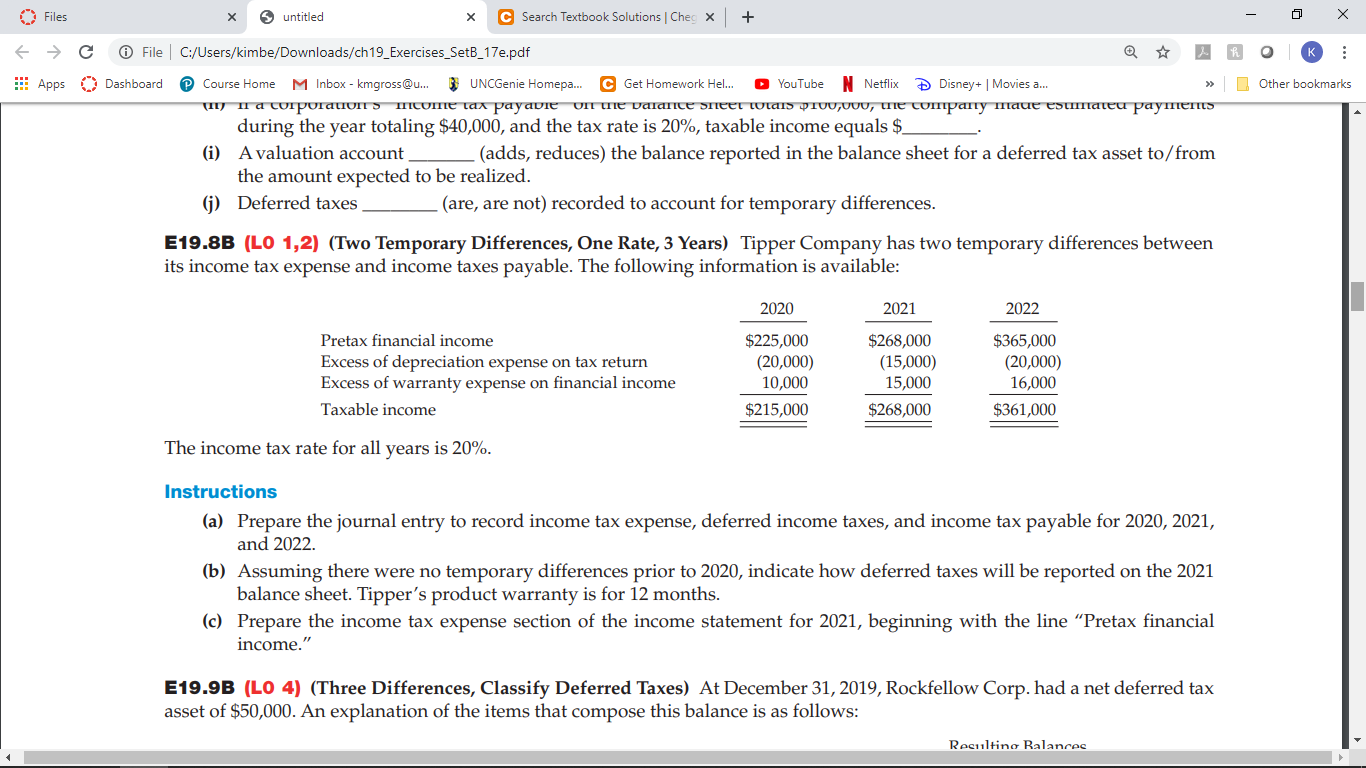

Files E C File * Apps Dashboard untitled X C Search Textbook Solutions Ches x + - 2 x C:/Users/kimbe/Downloads/ch19_Exercises_SetB_17e.pdf Q RO Course Home M Inbox - kmgross@u... BUNCGenie Homepa... C Get Homework Hel... YouTube N Netflix Disney+ | Movies .... >> Other bookmarks CILJ II a corporation MICUITE tax payavre IT te valance sheet mulans PIUUUUU, the company maue estimateu payment during the year totaling $40,000, and the tax rate is 20%, taxable income equals $ (i) A valuation account_ (adds, reduces the balance reported in the balance sheet for a deferred tax asset to/from the amount expected to be realized. 6) Deferred taxes _(are, are not) recorded to account for temporary differences. E19.8B (LO 1,2) (Two Temporary Differences, One Rate, 3 Years) Tipper Company has two temporary differences between its income tax expense and income taxes payable. The following information is available: 2020 2021 2022 Pretax financial income Excess of depreciation expense on tax return Excess of warranty expense on financial income Taxable income $225,000 (20,000) 10,000 $215,000 $268,000 (15,000) 15,000 $268,000 $365,000 (20,000) 16,000 $361,000 The income tax rate for all years is 20%. Instructions (a) Prepare the journal entry to record income tax expense, deferred income taxes, and income tax payable for 2020, 2021, and 2022. (b) Assuming there were no temporary differences prior to 2020, indicate how deferred taxes will be reported on the 2021 balance sheet. Tipper's product warranty is for 12 months. (c) Prepare the income tax expense section of the income statement for 2021, beginning with the line "Pretax financial income." E19.9B (LO 4) (Three Differences, Classify Deferred Taxes) At December 31, 2019, Rockfellow Corp. had a net deferred tax asset of $50,000. An explanation of the items that compose this balance is as follows: Resulting Balances Files E C File * Apps Dashboard untitled X C Search Textbook Solutions Ches x + - 2 x C:/Users/kimbe/Downloads/ch19_Exercises_SetB_17e.pdf Q RO Course Home M Inbox - kmgross@u... BUNCGenie Homepa... C Get Homework Hel... YouTube N Netflix Disney+ | Movies .... >> Other bookmarks CILJ II a corporation MICUITE tax payavre IT te valance sheet mulans PIUUUUU, the company maue estimateu payment during the year totaling $40,000, and the tax rate is 20%, taxable income equals $ (i) A valuation account_ (adds, reduces the balance reported in the balance sheet for a deferred tax asset to/from the amount expected to be realized. 6) Deferred taxes _(are, are not) recorded to account for temporary differences. E19.8B (LO 1,2) (Two Temporary Differences, One Rate, 3 Years) Tipper Company has two temporary differences between its income tax expense and income taxes payable. The following information is available: 2020 2021 2022 Pretax financial income Excess of depreciation expense on tax return Excess of warranty expense on financial income Taxable income $225,000 (20,000) 10,000 $215,000 $268,000 (15,000) 15,000 $268,000 $365,000 (20,000) 16,000 $361,000 The income tax rate for all years is 20%. Instructions (a) Prepare the journal entry to record income tax expense, deferred income taxes, and income tax payable for 2020, 2021, and 2022. (b) Assuming there were no temporary differences prior to 2020, indicate how deferred taxes will be reported on the 2021 balance sheet. Tipper's product warranty is for 12 months. (c) Prepare the income tax expense section of the income statement for 2021, beginning with the line "Pretax financial income." E19.9B (LO 4) (Three Differences, Classify Deferred Taxes) At December 31, 2019, Rockfellow Corp. had a net deferred tax asset of $50,000. An explanation of the items that compose this balance is as follows: Resulting Balances

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts