Question: Fill Form 4 5 6 2 Modified Accelerated Cost Recovery System ( MACRS ) and Bonus Depreciation, Listed Property, Limitation on Depreciation of Luxury Automobiles

Fill Form Modified Accelerated Cost Recovery System MACRS and Bonus Depreciation, Listed Property, Limitation on Depreciation of Luxury Automobiles LO

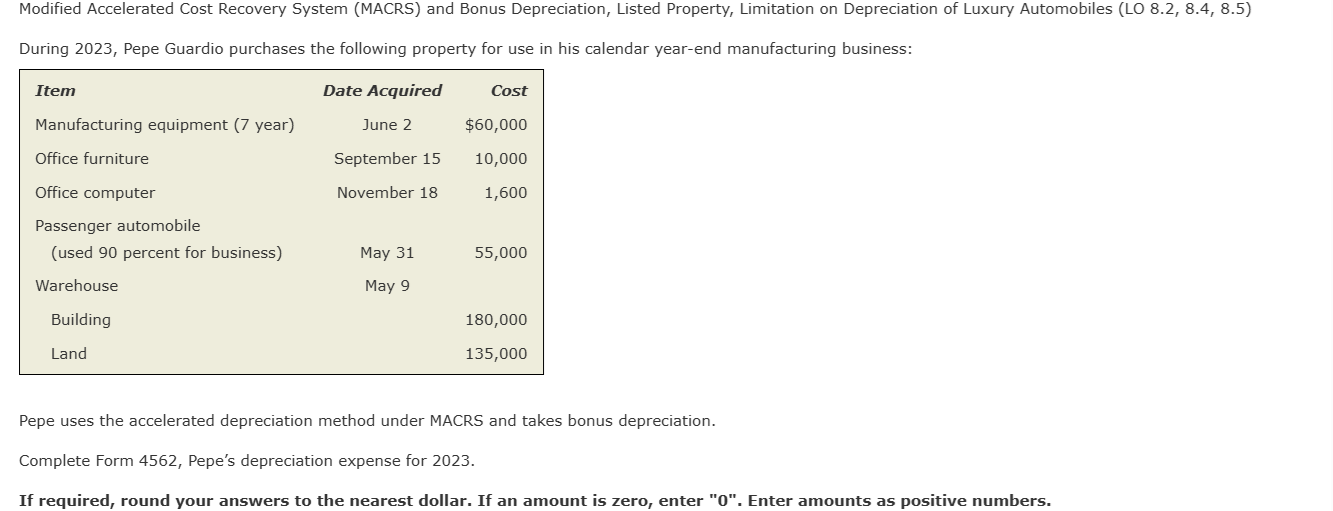

During Pepe Guardio purchases the following property for use in his calendar yearend manufacturing business:Passenger automobile used percent for business

Pepe uses the accelerated depreciation method under MACRS and takes bonus depreciation.

Complete Form Pepe's depreciation expense for

If required, round your answers to the nearest dollar. If an amount is zero, enter Enter amounts as positive numbers. Part III

MACRS Depreciation Dont include listed property. See instructions.

Section A

begintabularlll

hline MACRS deductions for assets placed in service in tax years beginning before ldots ldots ldots & &

hline If you are electing to group any assets placed in service during the tax year into one or more general asset accounts, check here & multicolumnc

hline

endtabular

Section BAssets Placed in Service During Tax Year Using the General Depreciation System

begintabularlllllll

hline a Classification of property & b Month and year placed in service & c Basis for depreciation businessinvestment use onlysee instructions & d Recovery period & e Convention & f Method & g Depreciation deduction

hline a year property & & & & & &

hline b year property & & square & yrs ~ checkmark & & & square

hline c year property & & square & mathrmyrsquad checkmark & HY quad checkmark & &

hline d year property & & & & & &

hline e year property & & & & & &

hline f year property & & & & & &

hline g year property & & & yrs & & SL &

hline multirowh Residential rental property & & & yrs & MM & SL &

hline & & & yrs & MM & SL &

hline multirowi Nonresidential real property & checkmark & begintabularl

square

endtabular & yrs & MM & SL & square

hline & & & & MM & SL &

hline

endtabular

Section CAssets Placed in Service During Tax Year Using the Alternative Depreciation System Listed property. Enter amount from line

Total. Add amounts from line lines through lines and in column g and line Enter here and on the appropriate lines of your return. Partnerships and S corporationssee instructions For assets shown above and placed in service during the current year, enter the portion of the basis attributable to section A costs Part V Listed Property Include automobiles, certain other vehicles, certain aircraft, and property used for entertainment, recreation, or amusement.

Note: For any vehicle for which you are using the standard mileage rate or deducting lease expense, complete only ab columns a through c of Section A all of Section B and Section C if applicable.

Section ADepreciation and Other Information Caution: See the instructions for limits for passenger automobiles.g

Method ConventionType of property list vehicles firstBusiness investment use percentageCost or other basisBasis for depreciation business investment use onlyDepreciation deductionElected section cost Special depreciation allowance

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock