Question: Fill in all the missing information and answer the question completely. 5) Assume Company D, has the following Capital Structure. Debt 30%, Pref Stock 10%,

Fill in all the missing information and answer the question completely.

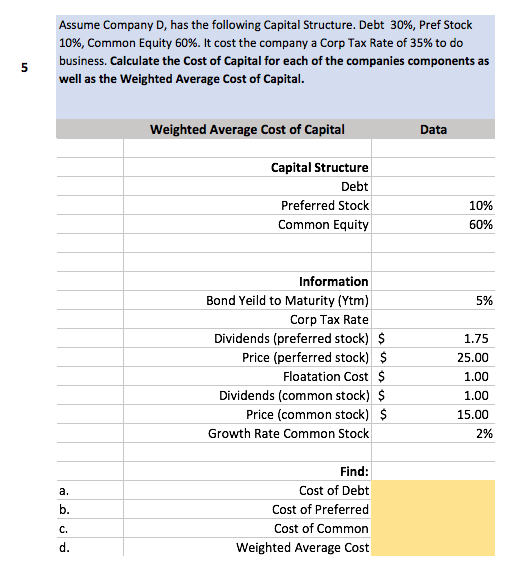

5) Assume Company D, has the following Capital Structure. Debt 30%, Pref Stock 10%, Common Equity 60%. It cost the company a Corp Tax Rate of 35% to do business. Calculate the Cost of Capital for each of the companies components as well as the Weighted Average Cost of Capital.

Assume Company D, has the following Capital Structure. Debt 30%, Pref Stock 10%, Common Equity 60%. It cost the company a Corp Tax Rate of 35% to do business. Calculate the Cost of Capital for each of the companies components as well as the Weighted Average Cost of Capital 5 Weighted Average Cost of Capital Data Capital Structure Debt Preferred Stock Common Equity 10% 60% Information Bond Yeild to Maturity (Ytm) Corp Tax Rate 5% Dividends (preferred stock) $ Price (perferred stock) $ 1.75 25.00 1.00 1.00 15.00 2% Floatation Cost Dividends (common stock) $ Price (common stock)$ Growth Rate Common Stock Find: Cost of Debt Cost of Preferred Cost of Common Weighted Average Cost C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts