Question: Fill in the August section only! Assets (August) Create journal entries to record the following transactions and record in the company's general ledger. 9. A

Fill in the August section only!

Fill in the August section only!

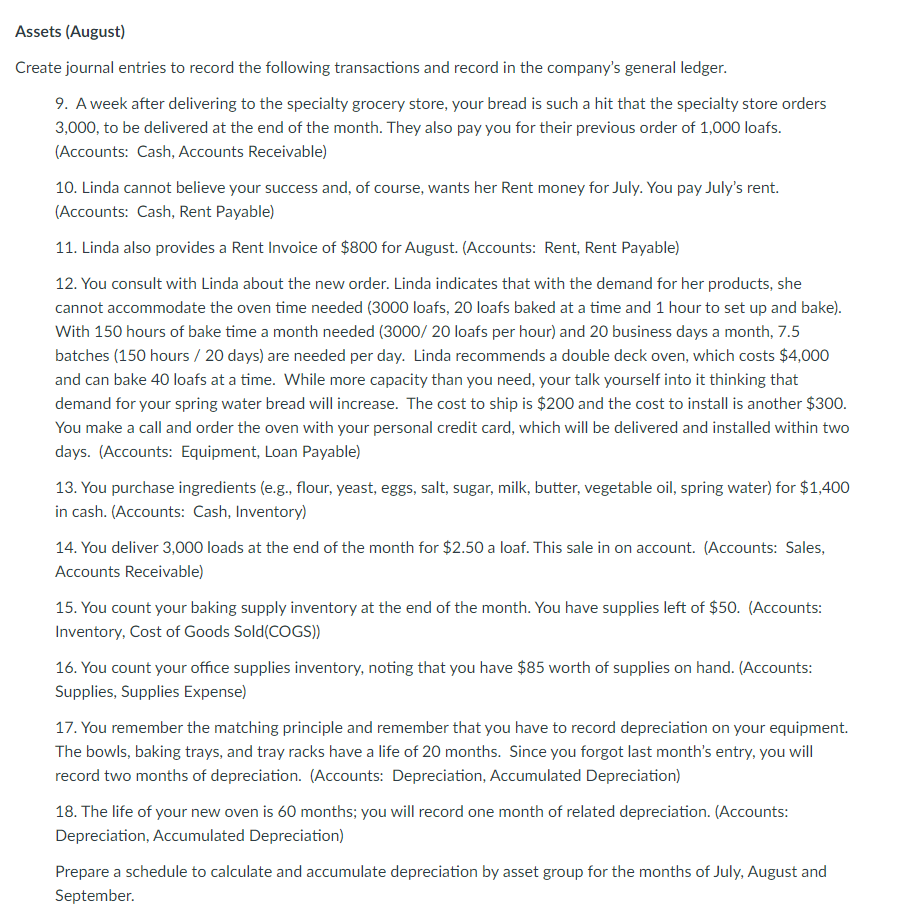

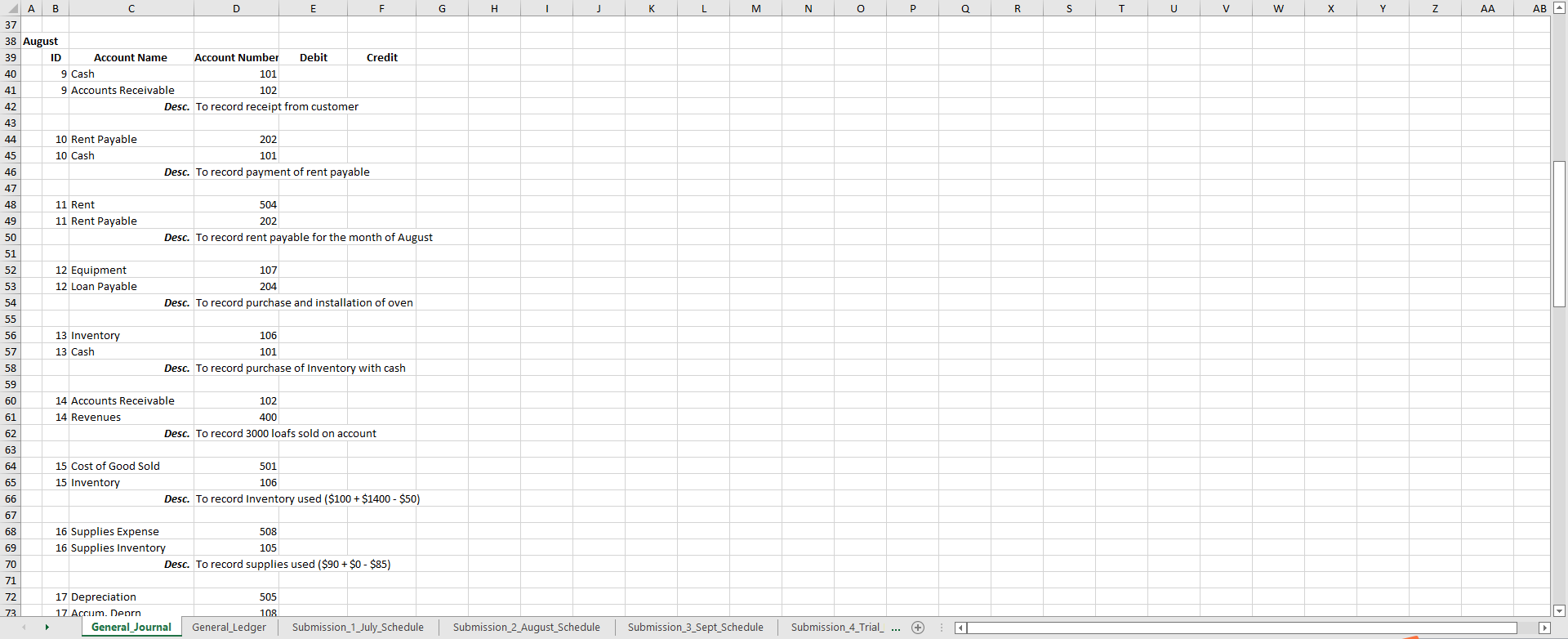

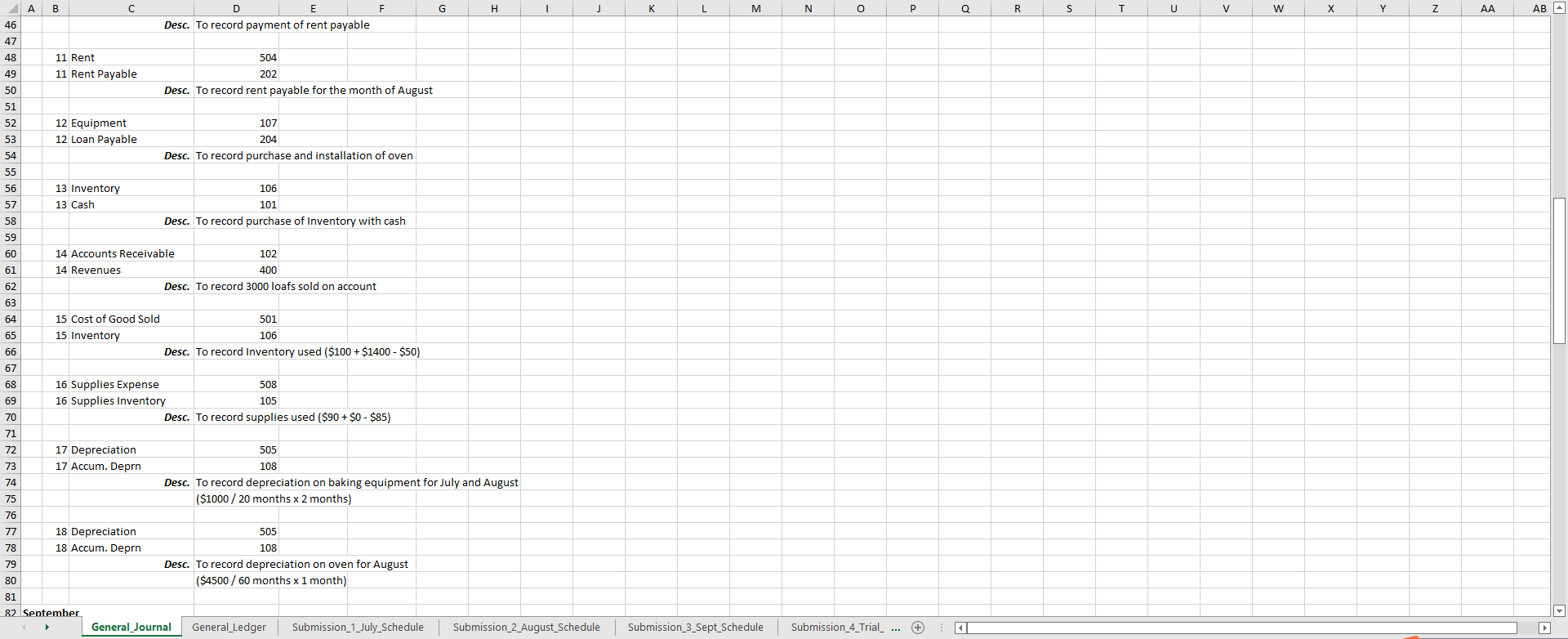

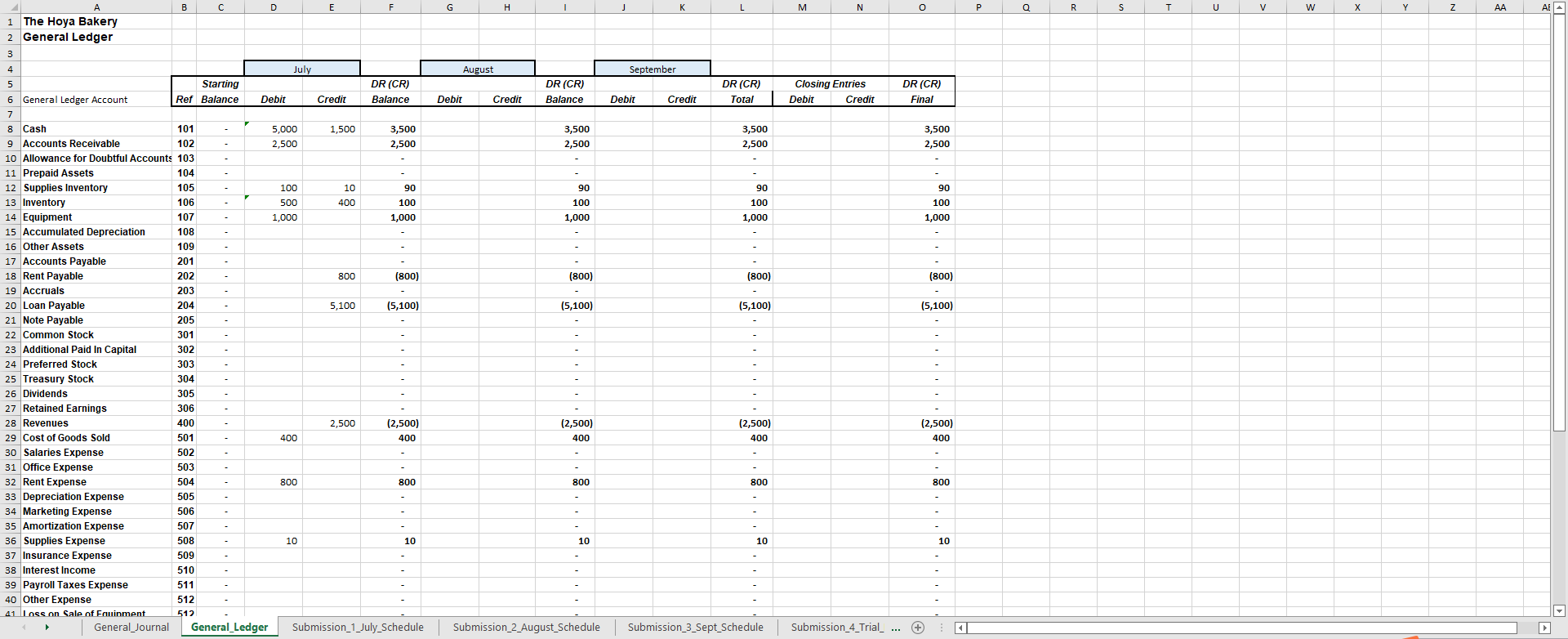

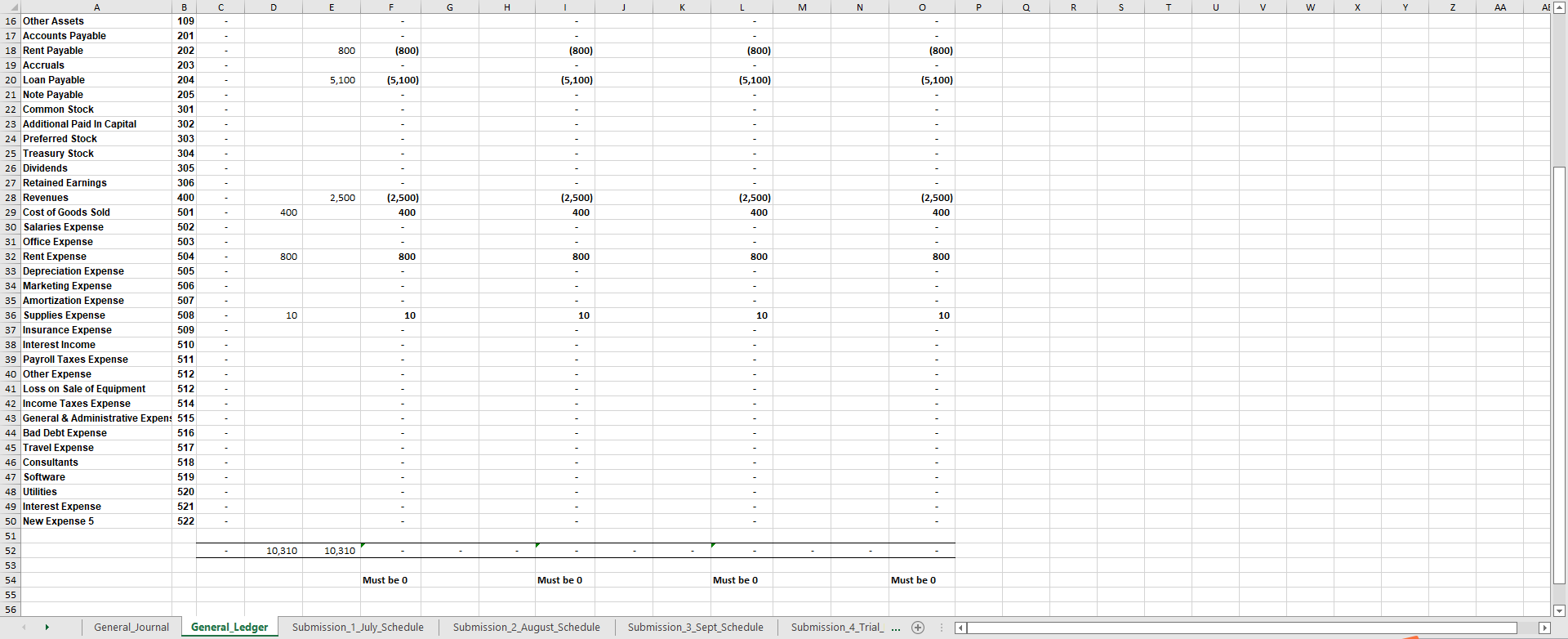

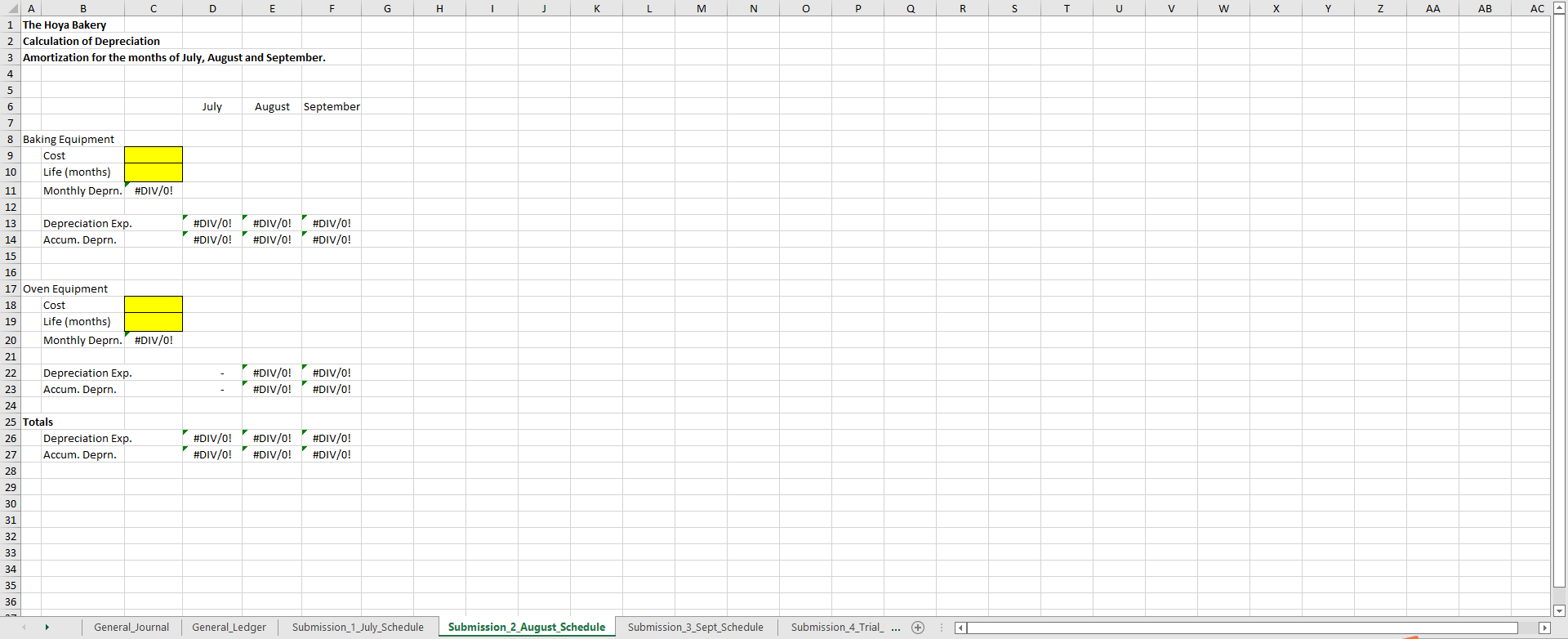

Assets (August) Create journal entries to record the following transactions and record in the company's general ledger. 9. A week after delivering to the specialty grocery store, your bread is such a hit that the specialty store orders 3,000, to be delivered at the end of the month. They also pay you for their previous order of 1,000 loafs. (Accounts: Cash, Accounts Receivable) 10. Linda cannot believe your success and, of course, wants her Rent money for July. You pay July's rent. (Accounts: Cash, Rent Payable) 11. Linda also provides a Rent Invoice of $800 for August. (Accounts: Rent, Rent Payable) 12. You consult with Linda about the new order. Linda indicates that with the demand for her products, she cannot accommodate the oven time needed (3000 loafs, 20 loafs baked at a time and 1 hour to set up and bake). With 150 hours of bake time a month needed (3000/ 20 loafs per hour) and 20 business days a month, 7.5 batches (150 hours / 20 days) are needed per day. Linda recommends a double deck oven, which costs $4,000 and can bake 40 loafs at a time. While more capacity than you need, your talk yourself into it thinking that demand for your spring water bread will increase. The cost to ship is $200 and the cost to install is another $300. You make a call and order the oven with your personal credit card, which will be delivered and installed within two days. (Accounts: Equipment, Loan Payable) 13. You purchase ingredients (e.g., flour, yeast, eggs, salt, sugar, milk, butter, vegetable oil, spring water) for $1,400 in cash. (Accounts: Cash, Inventory) 14. You deliver 3,000 loads at the end of the month for $2.50 a loaf. This sale in on account. (Accounts: Sales, Accounts Receivable) 15. You count your baking supply inventory at the end of the month. You have supplies left of $50. (Accounts: Inventory, Cost of Goods Sold(COGS)) 16. You count your office supplies inventory, noting that you have $85 worth of supplies on hand. (Accounts: Supplies, Supplies Expense) 17. You remember the matching principle and remember that you have to record depreciation on your equipment. The bowls, baking trays, and tray racks have a life of 20 months. Since you forgot last month's entry, you will record two months of depreciation. (Accounts: Depreciation, Accumulated Depreciation) 18. The life of your new oven is 60 months; you will record one month of related depreciation. (Accounts: Depreciation, Accumulated Depreciation) Prepare a schedule to calculate and accumulate depreciation by asset group for the months of July, August and September H 1 K L M N o P R S T U V w Y Z Z AA AB A A B D F G 37 38 August 39 ID Account Name Account Number Debit Credit 40 9 Cash 101 41 9 Accounts Receivable 102 42 Desc. To record receipt from customer 43 44 10 Rent Payable 202 45 10 Cash 101 46 Desc. To record payment of rent payable 47 48 11 Rent 504 49 11 Rent Payable 202 50 Desc. To record rent payable for the month of August 51 52 12 Equipment 107 53 12 Loan Payable 204 54 Desc. To record purchase and installation of oven 55 56 13 Inventory 106 57 13 Cash 101 58 Desc. To record purchase of Inventory with cash 59 60 14 Accounts Receivable 102 61 14 Revenues 400 62 Desc. To record 3000 loafs sold on account 63 64 15 Cost of Good Sold 15 Inventory 65 501 106 Desc. To record Inventory used ($100 + $1400 - $50) 66 67 68 69 70 16 Supplies Expense 508 16 Supplies Inventory 105 Desc. To record supplies used ($90 + $0 - $85) 71 72 73 17 Depreciation 17 Accum. Denrn General Journal 505 108 General_Ledger Submission_1_July_Schedule Submission_2_August_Schedule Submission_3_Sept_Schedule Submission_4_Trial_ ... + A B F G H 1 K L M N o P R S T U V w Y Z Z AA AB A D Desc. To record payment of rent payable 46 47 48 11 Rent 11 Rent Payable 49 50 504 202 Desc. To record rent payable for the month of August 51 52 12 Equipment 12 Loan Payable 53 54 107 204 Desc. To record purchase and installation of oven 55 56 13 Inventory 13 Cash 57 106 101 Desc. To record purchase of Inventory with cash 58 59 60 61 14 Accounts Receivable 102 14 Revenues 400 Desc. To record 3000 loafs sold on account 62 63 64 65 15 Cost of Good Sold 501 15 Inventory 106 Desc. To record Inventory used ($100 + $1400 - $50) 66 67 68 69 16 Supplies Expense 508 16 Supplies Inventory 105 Desc. To record supplies used ($90 + $0 - $85) 70 71 72 17 Depreciation 17 Accum. Deprn 73 505 108 Desc. To record depreciation on baking equipment for July and August ($1000 / 20 months x 2 months) 74 75 76 77 18 Depreciation 18 Accum. Deprn 78 505 108 Desc. To record depreciation on oven for August ($4500 / 60 months x 1 month) 79 80 81 82 September General Journal General Ledger Submission_1_July_Schedule Submission_2_August_Schedule Submission_3_Sept_Schedule Submission_4_Trial_ ... + G L M N o P Q R s T U v w X Y z AA A August September DR (CR) DR (CR) Balance Closing Entries Debit Credit DR (CR) Final Debit Credit Debit Credit Total 3,500 3,500 3,500 2,500 2,500 2,500 2,500 - - - 90 100 1,000 90 100 1,000 90 100 1,000 (800) (800) (800) (5,100) (5,100) (5,100) A D E 1 The Hoya Bakery 2 General Ledger 3 4 July 5 Starting DR (CR) 6 General Ledger Account Ref Balance Debit Credit Balance 7 8 Cash 101 5,000 1,500 3,500 9 Accounts Receivable 102 2,500 10 Allowance for Doubtful Accounts 103 11 Prepaid Assets 104 12 Supplies Inventory 105 100 10 90 13 Inventory 106 500 400 100 14 Equipment 107 1,000 1,000 15 Accumulated Depreciation 108 16 Other Assets 109 17 Accounts Payable 201 18 Rent Payable 202 800 (800) 19 Accruals 203 20 Loan Payable 204 5.100 (5,100) 21 Note Payable 205 22 Common Stock 301 23 Additional Paid In Capital 302 24 Preferred Stock 303 25 Treasury Stock 304 26 Dividends 305 27 Retained Earnings 306 28 Revenues 400 2,500 (2,500) 29 Cost of Goods Sold 501 400 400 30 Salaries Expense 502 31 Office Expense 503 32 Rent Expense 504 800 800 33 Depreciation Expense 505 34 Marketing Expense 506 35 Amortization Expense 507 36 Supplies Expense 508 10 10 37 Insurance Expense 509 38 Interest Income 510 39 Payroll Taxes Expense 511 40 Other Expense 512 41 Loss on Sale of Fruinment 512 General Journal General_Ledger Submission_1_July_Schedule (2,500) 400 (2,500) 400 (2,500) 400 800 800 800 10 10 10 - Submission_2 August_Schedule Submission_3_Sept_Schedule Submission_4_Trial_ ... (+ c D E F G 1 K L M N o P Q R s T U v w X Y z AA ALA 800 (800) (800) (800) (800) 5,100 (5,100) (5,100) (5,100) (5,100) - 2,500 (2,500) 400 (2,500) 400 (2,500) 400 (2,500) 400 400 800 800 800 800 800 - B 16 Other Assets 109 17 Accounts Payable 201 18 Rent Payable 202 19 Accruals 203 20 Loan Payable 204 21 Note Payable 205 22 Common Stock 301 23 Additional Paid In Capital 302 24 Preferred Stock 303 25 Treasury Stock 304 26 Dividends 305 27 Retained Earnings 306 28 Revenues 400 29 Cost of Goods Sold 501 30 Salaries Expense 502 31 Office Expense 503 32 Rent Expense 504 33 Depreciation Expense 505 34 Marketing Expense 506 35 Amortization Expense 507 36 Supplies Expense 508 37 Insurance Expense 509 38 Interest Income 510 39 Payroll Taxes Expense 511 40 Other Expense 512 41 Loss on Sale of Equipment 512 42 Income Taxes Expense 514 43 General & Administrative Expen: 515 44 Bad Debt Expense 516 45 Travel Expense 517 46 Consultants 518 47 Software 519 48 Utilities 520 49 Interest Expense 521 50 New Expense 5 522 51 52 53 10 10 10 10 10 10,310 10,310 Must be 0 Must be 0 Must be 0 54 55 56 Must be o General Journal General Ledger Submission_1_July_Schedule Submission_2_August_Schedule Submission_3_Sept_Schedule Submission_4_Trial_ ... + G H 1 J K L M N o P Q R S T U V w Y Z AA AB AC - A B C D E F The Hoya Bakery 2 Calculation of Depreciation Amortization for the months of July, August and September. amino July August September #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! 8 Baking Equipment Cost 10 Life (months) 11 Monthly Deprn. #DIV/0! 12 13 Depreciation Exp. 14 Accum. Deprn. 15 16 17 Oven Equipment 18 Cost 19 Life (months) 20 Monthly Deprn. #DIV/0! 21 22 Depreciation Exp. 23 Accum. Deprn. 24 25 Totals 26 Depreciation Exp. 27 Accum. Deprn. 28 29 #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! 30 31 32 33 34 35 36 General Journal General_Ledger Submission_1_July_Schedule Submission_2 August Schedule Submission_3_Sept_Schedule Submission_4_Trial_ ... +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts