Question: Fill in the blanks. Cell Reference. No hard coding BlockChain Corporation Pro-forma Financials (Key Assumptions in Blue) Assume it is now Jan 1, 2020 2020

Fill in the blanks. Cell Reference. No hard coding

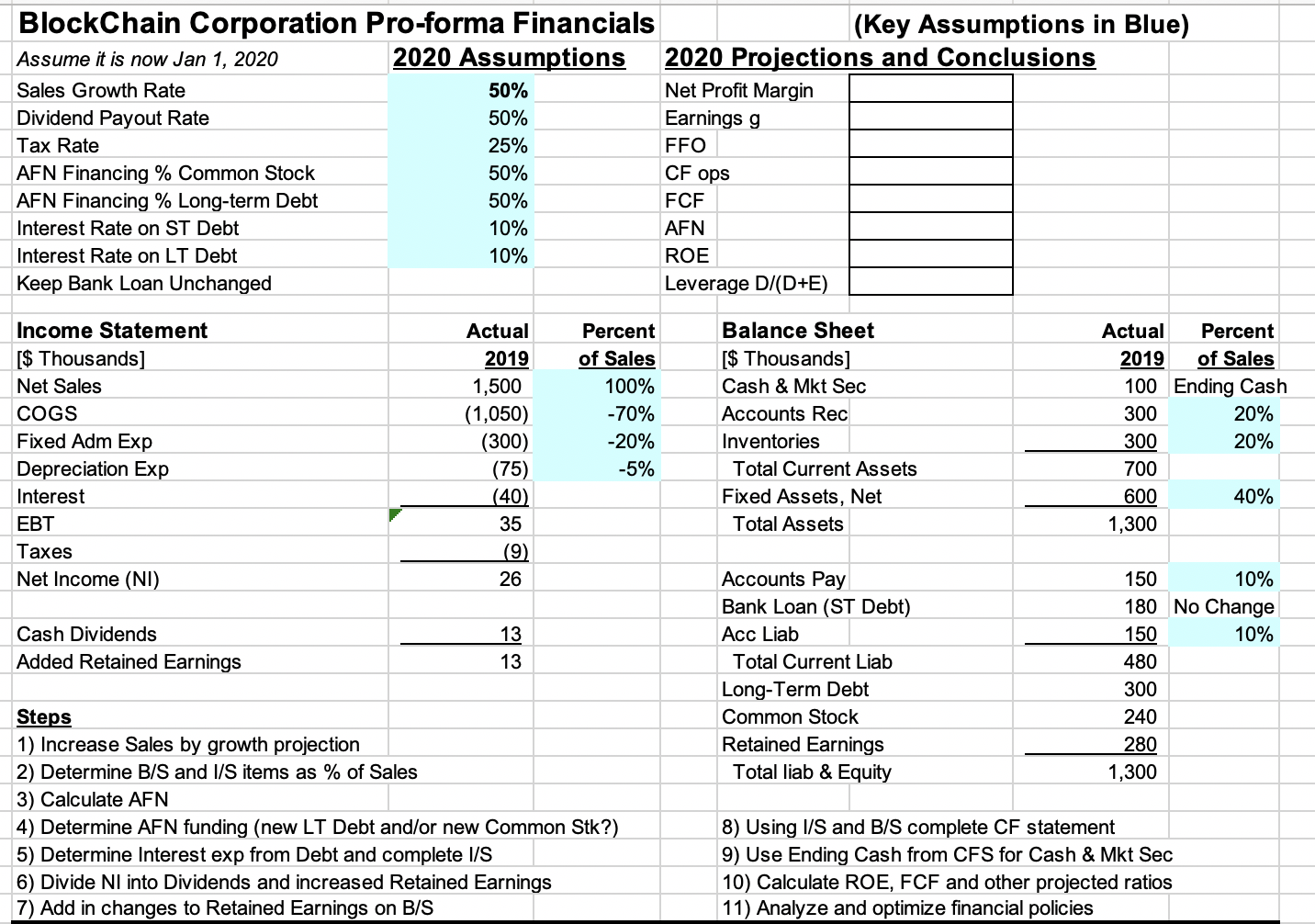

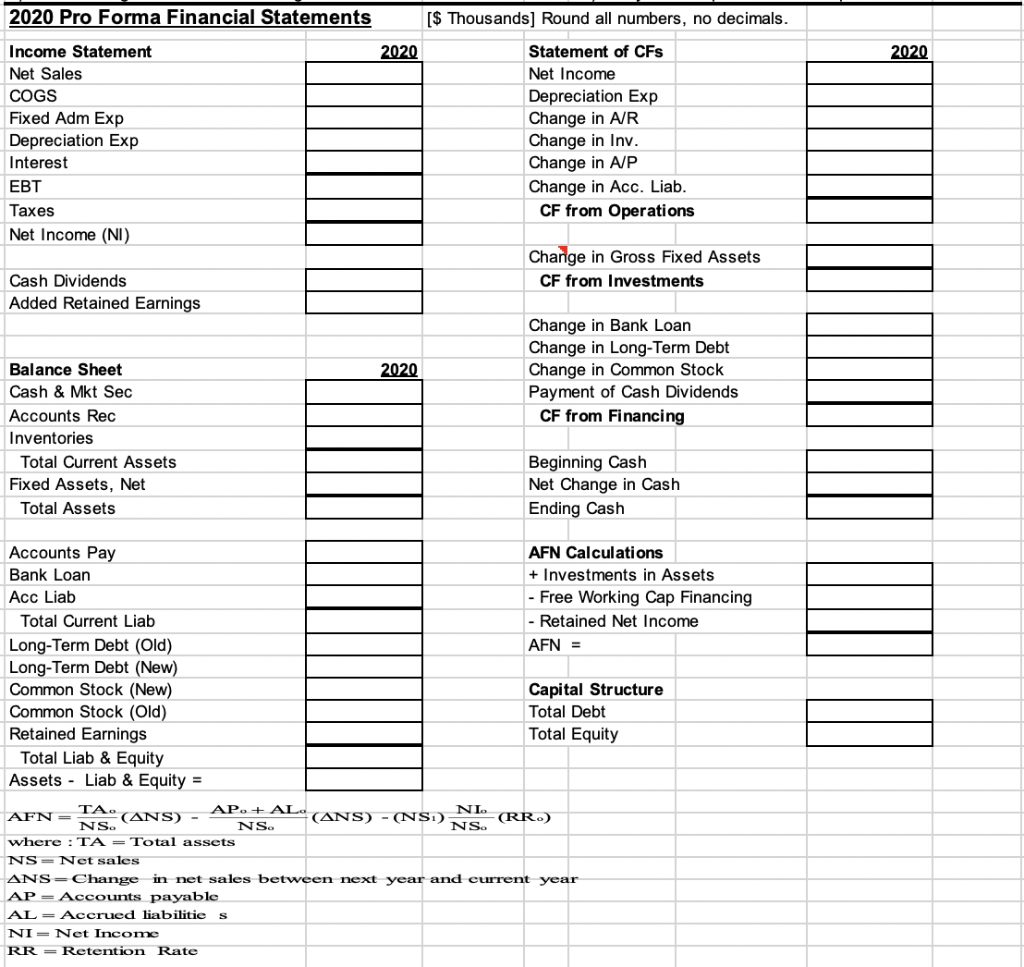

BlockChain Corporation Pro-forma Financials (Key Assumptions in Blue) Assume it is now Jan 1, 2020 2020 Assumptions 2020 Projections and Conclusions Sales Growth Rate 50% Net Profit Margin Dividend Payout Rate 50% Earnings g Tax Rate 25% FFO AFN Financing % Common Stock 50% AFN Financing % Long-term Debt 50% FCF Interest Rate on ST Debt 10% AFN Interest Rate on LT Debt 10% ROE Keep Bank Loan Unchanged Leverage D/(D+E) CF ops Income Statement [$ Thousands] Net Sales COGS Fixed Adm Exp Depreciation Exp Interest EBT Taxes Net Income (NI) Actual 2019 1,500 (1,050) (300) (75) (40) 35 (9) 26 Percent of Sales 100% -70% -20% -5% Balance Sheet [$ Thousands] Cash & Mkt Sec Accounts Rec Inventories Total Current Assets Fixed Assets, Net Total Assets Actual Percent 2019 of Sales 100 Ending Cash 300 20% 300 20% 700 600 40% 1,300 Cash Dividends Added Retained Earnings 13 13 Accounts Pay Bank Loan (ST Debt) Acc Liab Total Current Liab Long-Term Debt Common Stock Retained Earnings Total liab & Equity 150 10% 180 No Change 150 10% 480 300 240 280 1,300 Steps 1) Increase Sales by growth projection 2) Determine B/S and I/S items as % of Sales 3) Calculate AFN 4) Determine AFN funding (new LT Debt and/or new Common Stk?) 5) Determine Interest exp from Debt and complete I/S 6) Divide NI into Dividends and increased Retained Earnings 7) Add in changes to Retained Earnings on B/S 8) Using I/S and B/S complete CF statement 9) Use Ending Cash from CFS for Cash & Mkt Sec 10) Calculate ROE, FCF and other projected ratios 11) Analyze and optimize financial policies 2020 Pro Forma Financial Statements [$ Thousands] Round all numbers, no decimals. 2020 2020 Income Statement Net Sales COGS Fixed Adm Exp Depreciation Exp Interest EBT Taxes Net Income (NI) Statement of CFs Net Income Depreciation Exp Change in AIR Change in Inv. Change in A/P Change in Acc. Liab. CF from Operations Change in Gross Fixed Assets CF from Investments Cash Dividends Added Retained Earnings 2020 Change in Bank Loan Change in Long-Term Debt Change in Common Stock Payment of Cash Dividends CF from Financing Balance Sheet Cash & Mkt Sec Accounts Rec Inventories Total Current Assets Fixed Assets, Net Total Assets Beginning Cash Net Change in Cash Ending Cash AFN Calculations + Investments in Assets Free Working Cap Financing - Retained Net Income AFN = Accounts Pay Bank Loan Acc Liab Total Current Liab Long-Term Debt (Old) Long-Term Debt (New) Common Stock (New) Common Stock (Old) Retained Earnings Total Liab & Equity Assets - Liab & Equity = Capital Structure Total Debt Total Equity AFN= TA. NI. (ANS) AP. + AL (ANS) -(NSi) NS. (RRO) NS. NS. where : TA = Total assets NS-Net sales ANS=Change in net sales between next year and current year AP = Accounts payable AL = Accrued liabilities NI = Net Income RR = Retention Rate BlockChain Corporation Pro-forma Financials (Key Assumptions in Blue) Assume it is now Jan 1, 2020 2020 Assumptions 2020 Projections and Conclusions Sales Growth Rate 50% Net Profit Margin Dividend Payout Rate 50% Earnings g Tax Rate 25% FFO AFN Financing % Common Stock 50% AFN Financing % Long-term Debt 50% FCF Interest Rate on ST Debt 10% AFN Interest Rate on LT Debt 10% ROE Keep Bank Loan Unchanged Leverage D/(D+E) CF ops Income Statement [$ Thousands] Net Sales COGS Fixed Adm Exp Depreciation Exp Interest EBT Taxes Net Income (NI) Actual 2019 1,500 (1,050) (300) (75) (40) 35 (9) 26 Percent of Sales 100% -70% -20% -5% Balance Sheet [$ Thousands] Cash & Mkt Sec Accounts Rec Inventories Total Current Assets Fixed Assets, Net Total Assets Actual Percent 2019 of Sales 100 Ending Cash 300 20% 300 20% 700 600 40% 1,300 Cash Dividends Added Retained Earnings 13 13 Accounts Pay Bank Loan (ST Debt) Acc Liab Total Current Liab Long-Term Debt Common Stock Retained Earnings Total liab & Equity 150 10% 180 No Change 150 10% 480 300 240 280 1,300 Steps 1) Increase Sales by growth projection 2) Determine B/S and I/S items as % of Sales 3) Calculate AFN 4) Determine AFN funding (new LT Debt and/or new Common Stk?) 5) Determine Interest exp from Debt and complete I/S 6) Divide NI into Dividends and increased Retained Earnings 7) Add in changes to Retained Earnings on B/S 8) Using I/S and B/S complete CF statement 9) Use Ending Cash from CFS for Cash & Mkt Sec 10) Calculate ROE, FCF and other projected ratios 11) Analyze and optimize financial policies 2020 Pro Forma Financial Statements [$ Thousands] Round all numbers, no decimals. 2020 2020 Income Statement Net Sales COGS Fixed Adm Exp Depreciation Exp Interest EBT Taxes Net Income (NI) Statement of CFs Net Income Depreciation Exp Change in AIR Change in Inv. Change in A/P Change in Acc. Liab. CF from Operations Change in Gross Fixed Assets CF from Investments Cash Dividends Added Retained Earnings 2020 Change in Bank Loan Change in Long-Term Debt Change in Common Stock Payment of Cash Dividends CF from Financing Balance Sheet Cash & Mkt Sec Accounts Rec Inventories Total Current Assets Fixed Assets, Net Total Assets Beginning Cash Net Change in Cash Ending Cash AFN Calculations + Investments in Assets Free Working Cap Financing - Retained Net Income AFN = Accounts Pay Bank Loan Acc Liab Total Current Liab Long-Term Debt (Old) Long-Term Debt (New) Common Stock (New) Common Stock (Old) Retained Earnings Total Liab & Equity Assets - Liab & Equity = Capital Structure Total Debt Total Equity AFN= TA. NI. (ANS) AP. + AL (ANS) -(NSi) NS. (RRO) NS. NS. where : TA = Total assets NS-Net sales ANS=Change in net sales between next year and current year AP = Accounts payable AL = Accrued liabilities NI = Net Income RR = Retention Rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts