Question: FILL IN THE BLANKS Here is some information: Help me Fill these blanks out: Assume the following data for Sunland Care Dry Cleaning for the

FILL IN THE BLANKS

Here is some information:

Help me Fill these blanks out:

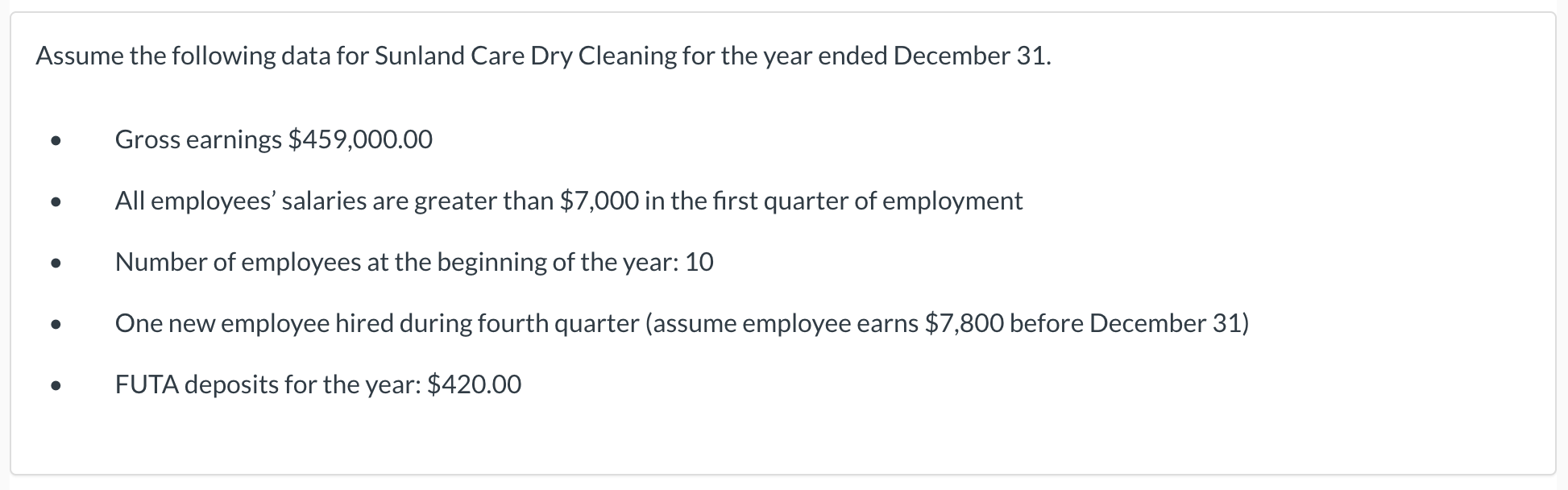

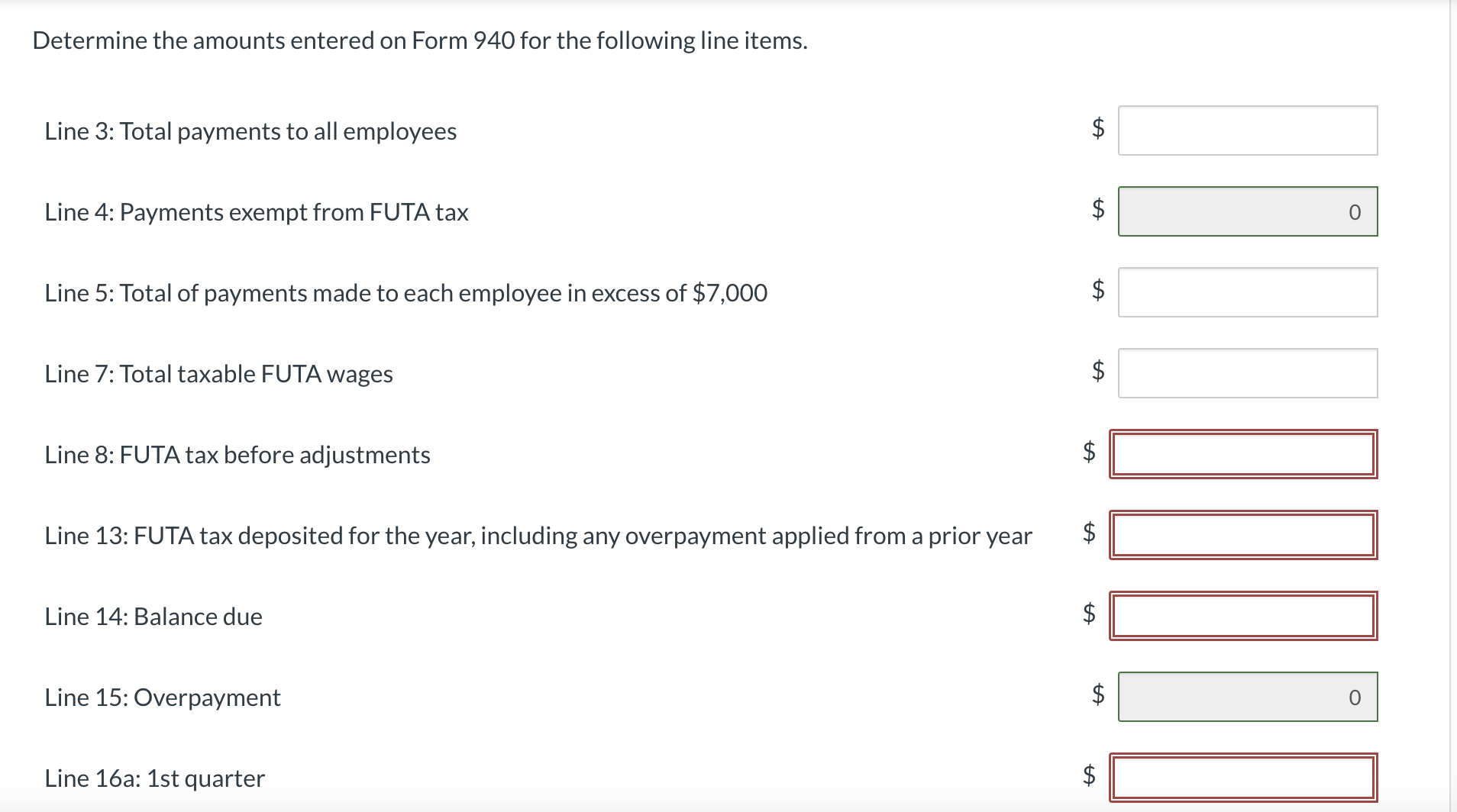

Assume the following data for Sunland Care Dry Cleaning for the year ended December 31. - Gross earnings $459,000.00 - All employees' salaries are greater than $7,000 in the first quarter of employment - Number of employees at the beginning of the year: 10 - One new employee hired during fourth quarter (assume employee earns \$7,800 before December 31) - FUTA deposits for the year: $420.00 Determine the amounts entered on Form 940 for the following line items. Line 3: Total payments to all employees $ Line 4: Payments exempt from FUTA tax $ Line 5: Total of payments made to each employee in excess of $7,000 $ Line 7: Total taxable FUTA wages Line 8: FUTA tax before adjustments Line 13: FUTA tax deposited for the year, including any overpayment applied from a prior year Line 14: Balance due Line 15: Overpayment $ Line 16a: 1st quarter $ Line 16a: 1st quarter Line 16b: 2nd quarter Line 16c: 3rd quarter Line 16d: 4th quarter Line 17: Total tax liability for the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts