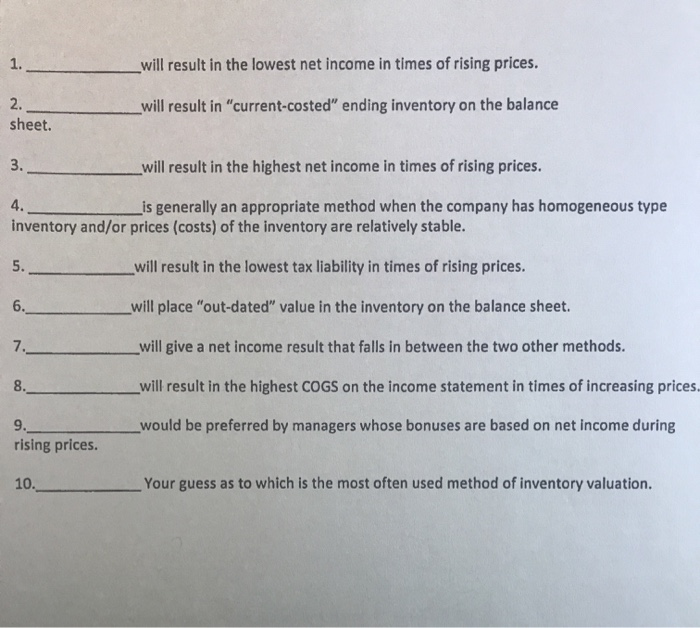

Question: Fill in the blanks with the correct inventory method: FIFO, LIFO, WAC will result in the lowest net income in times of rising prices. 1.

will result in the lowest net income in times of rising prices. 1. 2. will result in "current-costed" ending inventory on the balance sheet. 3. will result in the highest net income in times of rising prices. 4. is generally an appropriate method when the company has homogeneous type inventory and/or prices (costs) of the inventory are relatively stable. 5. will result in the lowest tax liability in times of rising prices. 6. will place "out-dated" value in the inventory on the balance sheet. 7. will give a net income result that falls in between the two other methods. 8. will result in the highest COGS on the income statement in times of increasing prices. 9 rising prices. would be preferred by managers whose bonuses are based on net income during 10. Your guess as to which is the most often used method of inventory valuation. un

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts