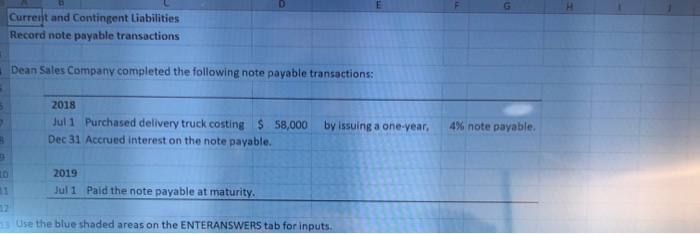

Question: Fill in the cells with the missing information. Show steps and calculations. H Currerit and Contingent Liabilities Record note payable transactions Dean Sales Company completed

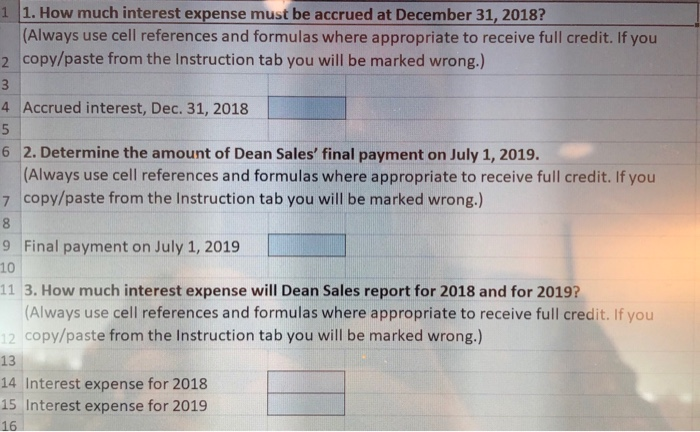

H Currerit and Contingent Liabilities Record note payable transactions Dean Sales Company completed the following note payable transactions: 2018 Jul 1 Purchased delivery truck costing $ 58,000 by issuing a one-year, 4% note payable. Dec 31 Accrued interest on the note payable. 2019 10 Jul 1 Paid the note payable at maturity. 11 2 3Use the blue shaded areas on the ENTERANSWERS tab for inputs. 1 1. How much interest expense must be accrued at December 31, 2018? use cell references and formulas where appropriate to receive full credit. If you (Always 2 copy/paste from the Instruction tab you will be marked wrong.) 3 4 Accrued interest, Dec. 31, 2018 6 2. Determine the amount of Dean Sales' final payment on July 1, 2019. (Always use cell references and formulas where appropriate to receive full credit. If you 7 copy/paste from the Instruction tab you will be marked wrong.) 9 Final payment on July 1, 2019 10 11 3. How much interest expense will Dean Sales report for 2018 and for 2019? (Always use cell references and formulas where appropriate to receive full credit. If you 12 copy/paste from the Instruction tab you will be marked wrong.) 13 14 Interest expense for 2018 15 Interest expense for 2019 16

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts