Question: fill in the chart with the info provided Exercise 4-6 (Part Level Submission) Greenock Limited has the following information available for accruals for the year

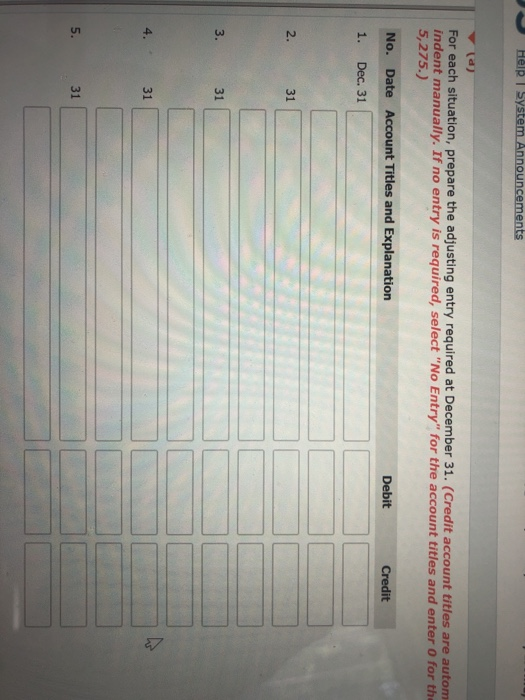

Exercise 4-6 (Part Level Submission) Greenock Limited has the following information available for accruals for the year ended December 31, 2018. The company adjusts its accounts annually. 1. 2. 3. The December utility bill for $590 was unrecorded on December 31. Greenock paid the bill on January 21. Greenock is open seven days a week and employees are paid a total of $3,800 every Monday for a seven-day (Monday-Sunday) workweek. December 31 is a Monday, so employees will have worked one day (Monday, December 31) that they have not been paid for by year end. Employees will be paid next on Monday, January 7. Greenock signed a $45,200, 7% bank loan on November 1, 2017, due in two years. Interest is payable on the first day of each following month and was last paid on December 1. Greenock receives a fee from Pizza Shop next door for all pizzas sold to customers using Greenock's facility. The amount owing for December is $410, which Pizza Shop will pay on January 4. (Hint: Use the Fees Earned account.) Greenock rented some of its unused warehouse space to a client for $6,530 a month, payable the first day of the following month. It received the rent for the month of December on January 2. 4 5. Help System Announcements (d) For each situation, prepare the adjusting entry required at December 31. (Credit account titles are autom indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the 5,275.) No. Date Account Titles and Explanation Debit Credit 1. Dec. 31 2. 31 3. 31 5. 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts