Question: Fill in the missing sections with the information provided. 1. Projected increase in Sales and COGS = 50% 2. Transportation costs are currently $600 per

Fill in the missing sections with the information provided.

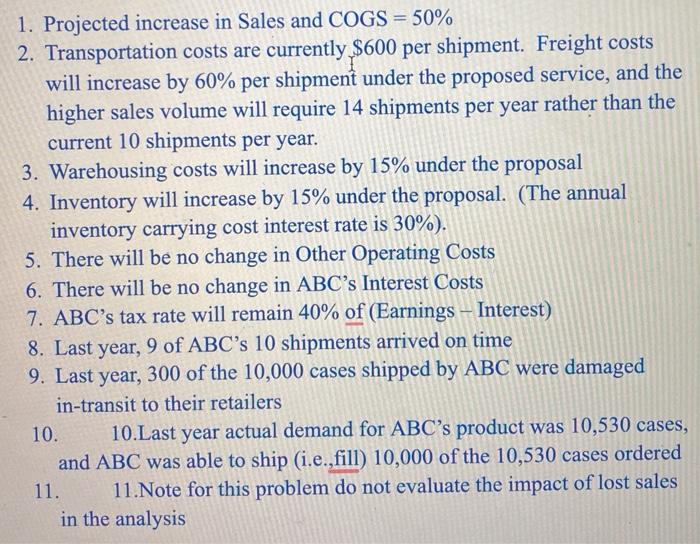

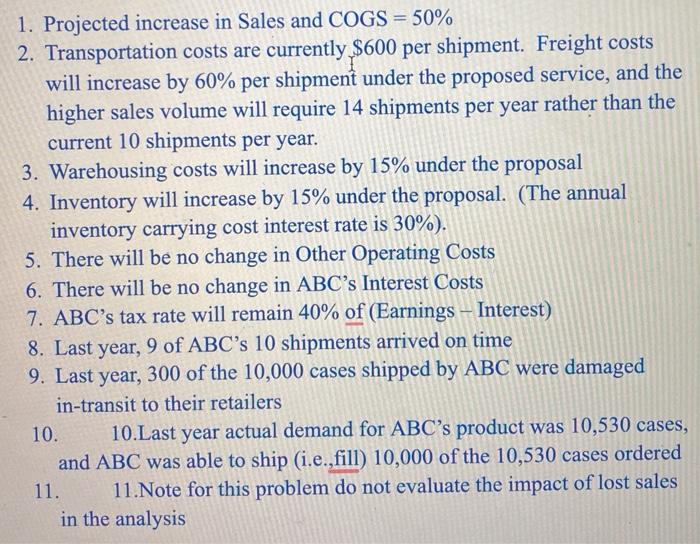

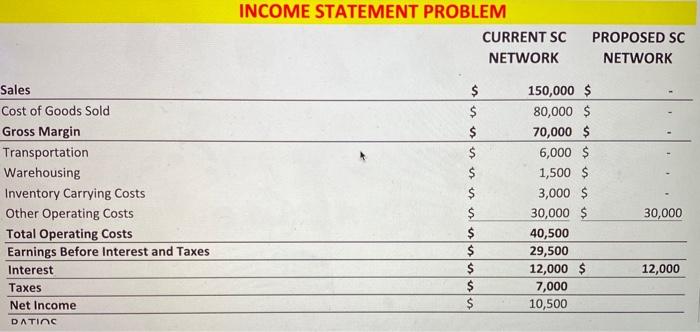

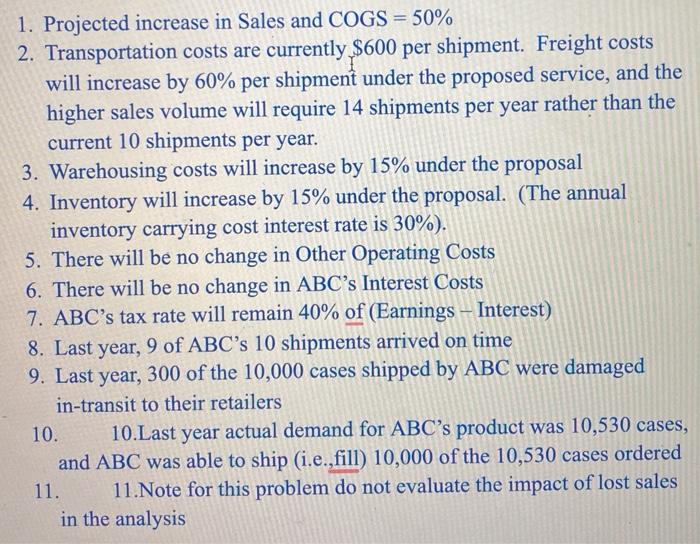

1. Projected increase in Sales and COGS = 50% 2. Transportation costs are currently $600 per shipment. Freight costs will increase by 60% per shipment under the proposed service, and the higher sales volume will require 14 shipments per year rather than the current 10 shipments per year. 3. Warehousing costs will increase by 15% under the proposal 4. Inventory will increase by 15% under the proposal. (The annual inventory carrying cost interest rate is 30%). 5. There will be no change in Other Operating Costs 6. There will be no change in ABC's Interest Costs 7. ABC's tax rate will remain 40% of (Earnings - Interest) 8. Last year, 9 of ABC's 10 shipments arrived on time 9. Last year, 300 of the 10,000 cases shipped by ABC were damaged in-transit to their retailers 10. 10.Last year actual demand for ABC's product was 10,530 cases, and ABC was able to ship (i.e.,fill) 10,000 of the 10,530 cases ordered 11. 11.Note for this problem do not evaluate the impact of lost sales in the analysis INCOME STATEMENT PROBLEM CURRENT SC NETWORK PROPOSED SC NETWORK Sales Cost of Goods Sold Gross Margin Transportation Warehousing Inventory Carrying Costs Other Operating Costs Total Operating costs Earnings Before Interest and Taxes Interest Taxes Net Income DATING $ $ $ $ $ $ $ $ $ $ $ $ 150,000 $ 80,000 $ 70,000 $ 6,000 $ 1,500 $ 3,000 $ 30,000 $ 40,500 29,500 12,000 $ 7,000 10,500 30,000 12,000 $ Net Income 7,000 10,500 4.0% 1.0% 2.0% 7.0% RATIOS Freight Cost as a percent of sales Warehouse Costs as a percent of sales Inventory Carrying Costs as a percent of sales Logistics Costs (frt, whs + invcc) as a percent of sales PERFORMANCE MEASURES On-Time Performance In-Transit Damages Case Fill Rate Inventory Turns per year Warehouse Costs per case Logistics Costs per case MISCELLANEOUS ASSETS Inventory 96% 0.2% 98% 8.0 $ $ 0.150 1.050 $ 10,000 1. Projected increase in Sales and COGS = 50% 2. Transportation costs are currently $600 per shipment. Freight costs will increase by 60% per shipment under the proposed service, and the higher sales volume will require 14 shipments per year rather than the current 10 shipments per year. 3. Warehousing costs will increase by 15% under the proposal 4. Inventory will increase by 15% under the proposal. (The annual inventory carrying cost interest rate is 30%). 5. There will be no change in Other Operating Costs 6. There will be no change in ABC's Interest Costs 7. ABC's tax rate will remain 40% of (Earnings - Interest) 8. Last year, 9 of ABC's 10 shipments arrived on time 9. Last year, 300 of the 10,000 cases shipped by ABC were damaged in-transit to their retailers 10. 10.Last year actual demand for ABC's product was 10,530 cases, and ABC was able to ship (i.e.,fill) 10,000 of the 10,530 cases ordered 11. 11.Note for this problem do not evaluate the impact of lost sales in the analysis INCOME STATEMENT PROBLEM CURRENT SC NETWORK PROPOSED SC NETWORK Sales Cost of Goods Sold Gross Margin Transportation Warehousing Inventory Carrying Costs Other Operating Costs Total Operating costs Earnings Before Interest and Taxes Interest Taxes Net Income DATING $ $ $ $ $ $ $ $ $ $ $ $ 150,000 $ 80,000 $ 70,000 $ 6,000 $ 1,500 $ 3,000 $ 30,000 $ 40,500 29,500 12,000 $ 7,000 10,500 30,000 12,000 $ Net Income 7,000 10,500 4.0% 1.0% 2.0% 7.0% RATIOS Freight Cost as a percent of sales Warehouse Costs as a percent of sales Inventory Carrying Costs as a percent of sales Logistics Costs (frt, whs + invcc) as a percent of sales PERFORMANCE MEASURES On-Time Performance In-Transit Damages Case Fill Rate Inventory Turns per year Warehouse Costs per case Logistics Costs per case MISCELLANEOUS ASSETS Inventory 96% 0.2% 98% 8.0 $ $ 0.150 1.050 $ 10,000