Question: Fill in the missing words by dragging and dropping from the options below. Multiple empirical studies have documented a negative correlation between returns over consecutive

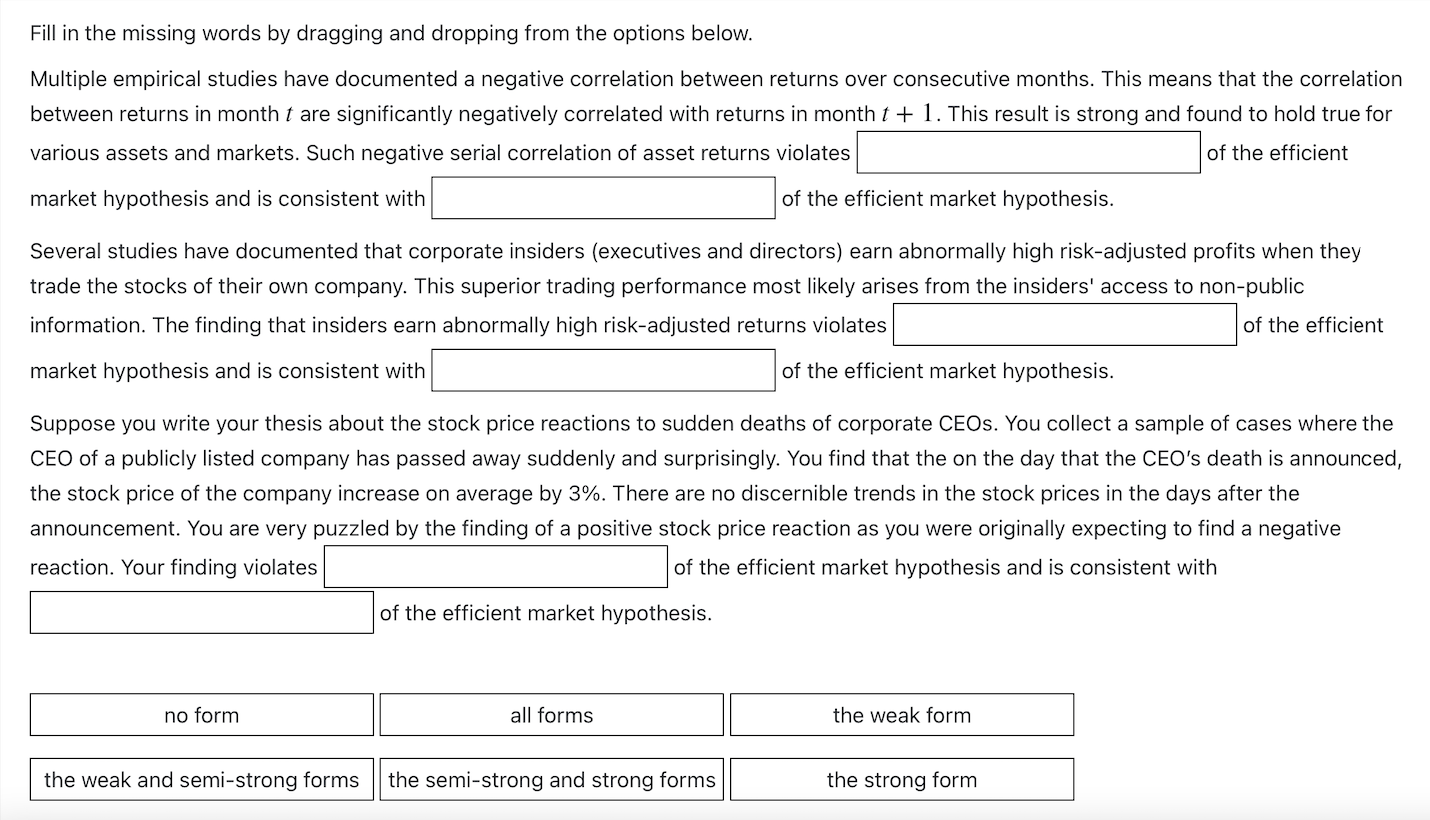

Fill in the missing words by dragging and dropping from the options below. Multiple empirical studies have documented a negative correlation between returns over consecutive months. This means that the correlation between returns in month t are significantly negatively correlated with returns in month t+1. This result is strong and found to hold true for various assets and markets. Such negative serial correlation of asset returns violates of the efficient market hypothesis and is consistent with of the efficient market hypothesis. Several studies have documented that corporate insiders (executives and directors) earn abnormally high risk-adjusted profits when they trade the stocks of their own company. This superior trading performance most likely arises from the insiders' access to non-public information. The finding that insiders earn abnormally high risk-adjusted returns violates of the efficient market hypothesis and is consistent with of the efficient market hypothesis. Suppose you write your thesis about the stock price reactions to sudden deaths of corporate CEOs. You collect a sample of cases where the CEO of a publicly listed company has passed away suddenly and surprisingly. You find that the on the day that the CEO's death is announced, the stock price of the company increase on average by 3%. There are no discernible trends in the stock prices in the days after the announcement. You are very puzzled by the finding of a positive stock price reaction as you were originally expecting to find a negative reaction. Your finding violates of the efficient market hypothesis and is consistent with of the efficient market hypothesis. ][[ Fill in the missing words by dragging and dropping from the options below. Multiple empirical studies have documented a negative correlation between returns over consecutive months. This means that the correlation between returns in month t are significantly negatively correlated with returns in month t+1. This result is strong and found to hold true for various assets and markets. Such negative serial correlation of asset returns violates of the efficient market hypothesis and is consistent with of the efficient market hypothesis. Several studies have documented that corporate insiders (executives and directors) earn abnormally high risk-adjusted profits when they trade the stocks of their own company. This superior trading performance most likely arises from the insiders' access to non-public information. The finding that insiders earn abnormally high risk-adjusted returns violates of the efficient market hypothesis and is consistent with of the efficient market hypothesis. Suppose you write your thesis about the stock price reactions to sudden deaths of corporate CEOs. You collect a sample of cases where the CEO of a publicly listed company has passed away suddenly and surprisingly. You find that the on the day that the CEO's death is announced, the stock price of the company increase on average by 3%. There are no discernible trends in the stock prices in the days after the announcement. You are very puzzled by the finding of a positive stock price reaction as you were originally expecting to find a negative reaction. Your finding violates of the efficient market hypothesis and is consistent with of the efficient market hypothesis. ][[

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts