Question: Fill in the table below, using the information on the handout, based on what is best for the client. Assume tax laws in 2021 are

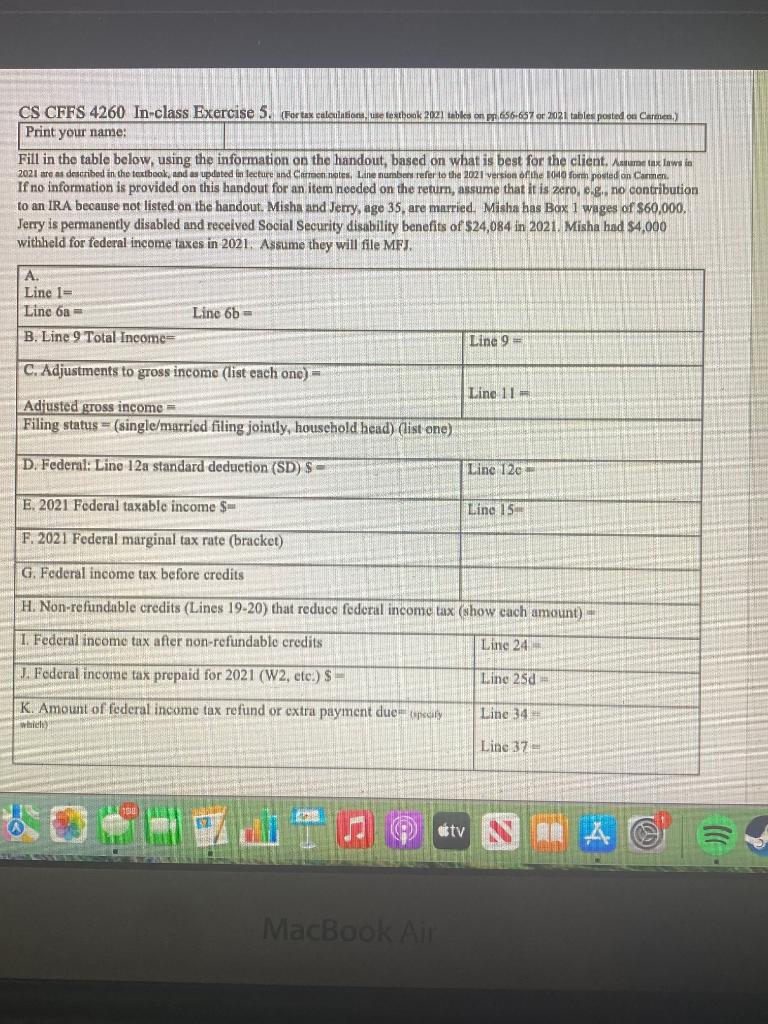

Fill in the table below, using the information on the handout, based on what is best for the client. Assume tax laws in 2021 are as described in the textbook, and as updated in lecture and Carmen notes. Line numbers refer to the 2021 version of the 1040 form posted on Carmen. If no information is provided on this handout for an item needed on the return, assume that it is zero, e.g., no contribution to an IRA because not listed on the handout. Misha and Jerry, age 35, are married. Misha has Box 1 wages of $60,000. Jerry is permanently disabled and received Social Security disability benefits of $24,084 in 2021. Misha had $4,000 withheld for federal income taxes in 2021. Assume they will file MFJ.

CS CFFS 4260 In-class Exercise 5. (For tax calculations, wise textbook 21 table on pr 656-657 or 2021 tables posted on Carmen Print your name: Fill in the table below, using the information on the handout, based on what is best for the client. Malume tax laws in 2021 are as described in the textbook, and as updated in lecture and Carennotes, Laine numbent refer to the 2021 version of the 1040 form posted on Carmen If no information is provided on this handout for an item needed on the return, assume that it is zero, eg, no contribution to an IRA because not listed on the handout. Misha and Jerry, age 35 are married. Misha has Box 1 wages of $60,000, Jerry is permanently disabled and received Social Security disability benefits of $24,084 in 2021. Misha had $4,000 withheld for federal income taxes in 2021. Assume they will file MFL. A. Line I= Line 6 = B. Line 9 Total Income. Line 6b Line 9 C. Adjustments to gross income (list each one) Line 11 - Adjusted gross income = Filing status = (single/married filing jointly, household head) (list one) D. Federai: Lino 12a standard deduction (SD) $ - Line T20 E. 2021 Federal taxable income $ Line 15 F. 2021 Federal marginal tax rate (bracket) G. Federal income tax before credits H. Non-refundable credits (Lines 19-20) that reduce federal income tax (show cach amount) 1. Federal income tax after non-refundable credits Line 24 J. Federal income tax prepaid for 2021 (W2, etc.) S- Line 2sd K. Amount of federal income tax refund or extra payment due pecity Line 34 Line 37 etv N A MacBook Air CS CFFS 4260 In-class Exercise 5. (For tax calculations, wise textbook 21 table on pr 656-657 or 2021 tables posted on Carmen Print your name: Fill in the table below, using the information on the handout, based on what is best for the client. Malume tax laws in 2021 are as described in the textbook, and as updated in lecture and Carennotes, Laine numbent refer to the 2021 version of the 1040 form posted on Carmen If no information is provided on this handout for an item needed on the return, assume that it is zero, eg, no contribution to an IRA because not listed on the handout. Misha and Jerry, age 35 are married. Misha has Box 1 wages of $60,000, Jerry is permanently disabled and received Social Security disability benefits of $24,084 in 2021. Misha had $4,000 withheld for federal income taxes in 2021. Assume they will file MFL. A. Line I= Line 6 = B. Line 9 Total Income. Line 6b Line 9 C. Adjustments to gross income (list each one) Line 11 - Adjusted gross income = Filing status = (single/married filing jointly, household head) (list one) D. Federai: Lino 12a standard deduction (SD) $ - Line T20 E. 2021 Federal taxable income $ Line 15 F. 2021 Federal marginal tax rate (bracket) G. Federal income tax before credits H. Non-refundable credits (Lines 19-20) that reduce federal income tax (show cach amount) 1. Federal income tax after non-refundable credits Line 24 J. Federal income tax prepaid for 2021 (W2, etc.) S- Line 2sd K. Amount of federal income tax refund or extra payment due pecity Line 34 Line 37 etv N A MacBook Air

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts