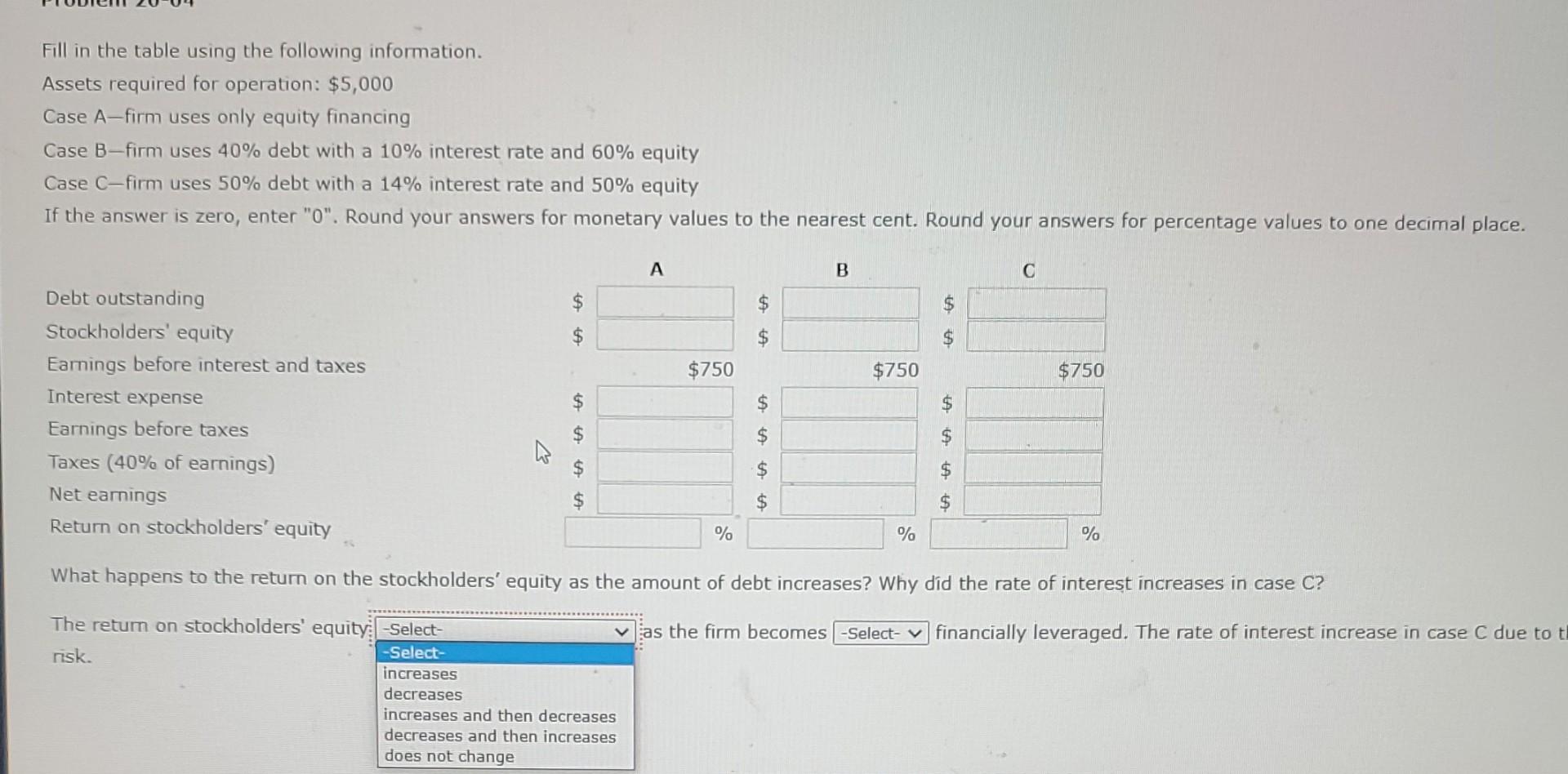

Question: Fill in the table using the following information. Assets required for operation: $5,000 Case A-firm uses only equity financing Case B firm uses 40% debt

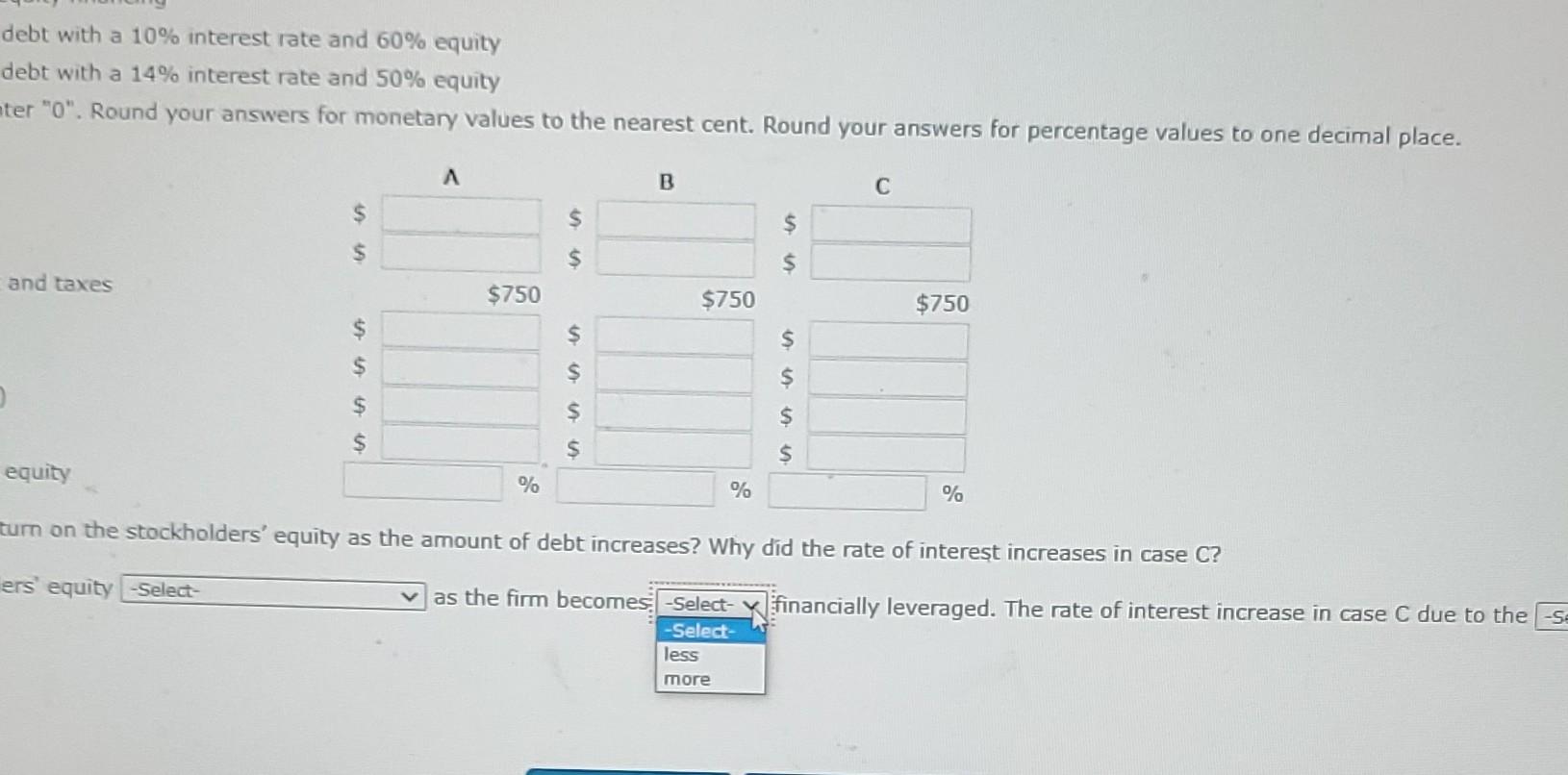

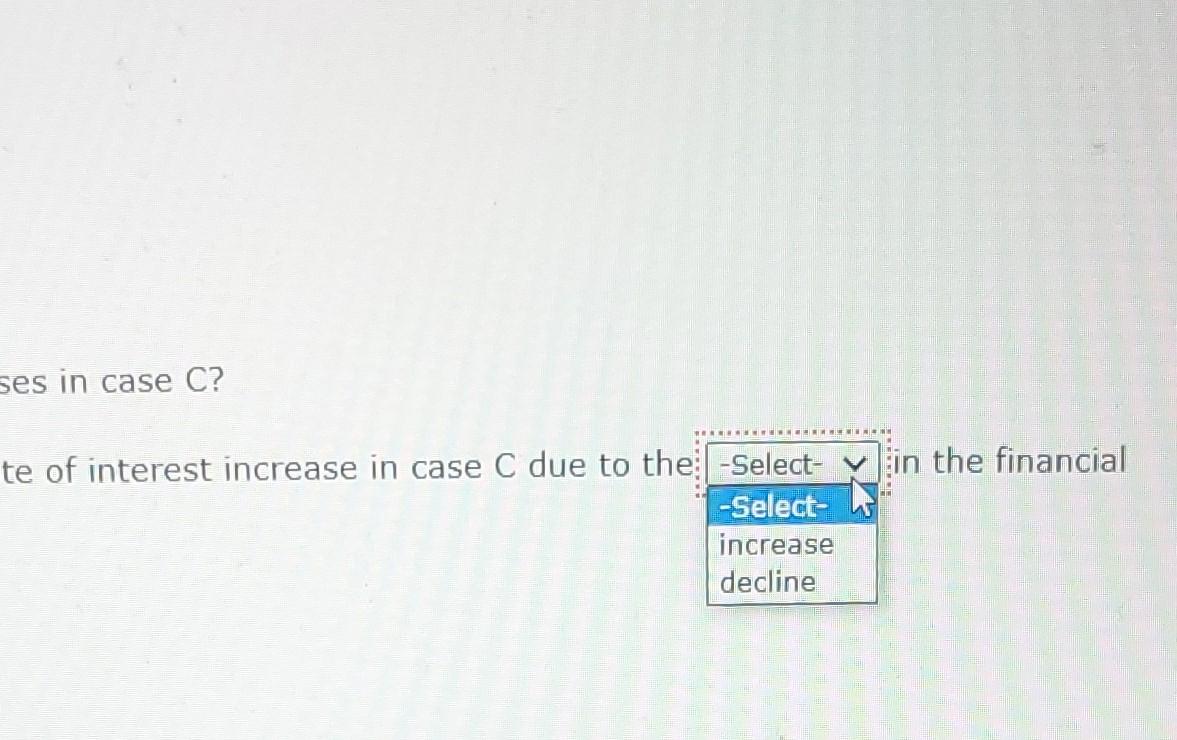

Fill in the table using the following information. Assets required for operation: $5,000 Case A-firm uses only equity financing Case B firm uses 40% debt with a 10% interest rate and 60% equity Case C - firm uses 50% debt with a 14% interest rate and 50% equity If the answer is zero, enter " 0 ". Round your answers for monetary values to the nearest cent. Round your answers for percentage values to one decimal place. What happens to the return on the stockholders' equity as the amount of debt increases? Why dd the rate of interest increases in case C? The return on stockholders' equity: as the firm becomes financially leveraged. The rate of interest increase in case C due to debt with a 10% interest rate and 60% equity debt with a 14% interest rate and 50% equity ter "0". Round your answers for monetary values to the nearest cent. Round your answers for percentage values to one decimal place. turn on the stockholders' equity as the amount of debt increases? Why did the rate of interest increases in case C? ers' equity as the firm becomes financially leveraged. The rate of interest increase in case C due to the in case C? te of interest increase in case C due to the in the financial

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts