Question: Fill out Forms listed on page 3. Form 1040, Schedules 1&2, Schedule A,B,C. Form 8959, Form 4562, 8995-A, with the information given. Form 4562 -

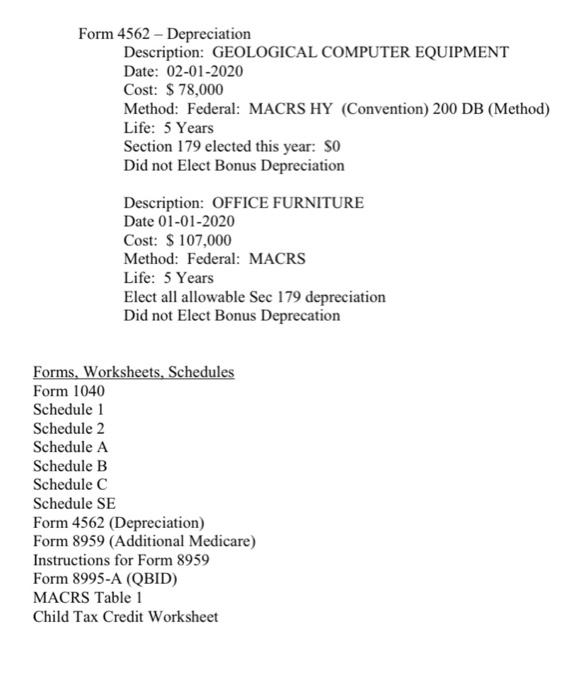

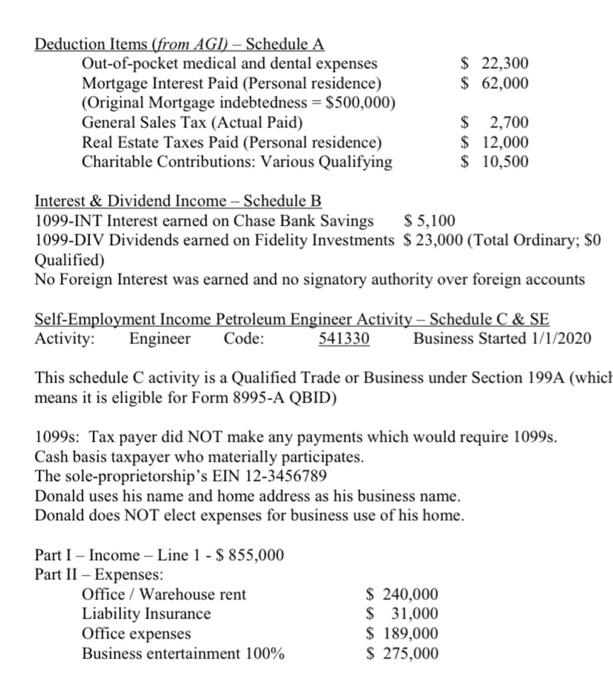

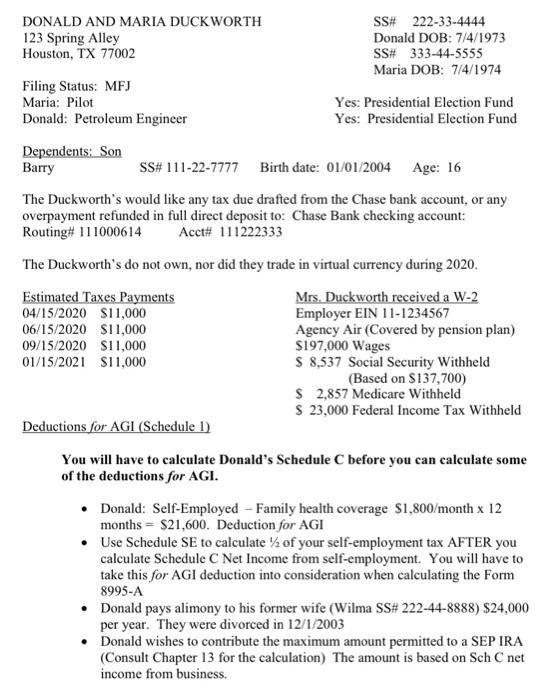

Form 4562 - Depreciation Description: GEOLOGICAL COMPUTER EQUIPMENT Date: 02-01-2020 Cost: $ 78,000 Method: Federal: MACRS HY (Convention) 200 DB (Method) Life: 5 Years Section 179 elected this year: $0 Did not Elect Bonus Depreciation Description: OFFICE FURNITURE Date 01-01-2020 Cost: $ 107,000 Method: Federal: MACRS Life: 5 Years Elect all allowable Sec 179 depreciation Did not Elect Bonus Deprecation Forms. Worksheets, Schedules Form 1040 Schedule 1 Schedule 2 Schedule A Schedule B Schedule C Schedule SE Form 4562 (Depreciation) Form 8959 (Additional Medicare) Instructions for Form 8959 Form 8995-A (QBID) MACRS Table 1 Child Tax Credit Worksheet Deduction Items (from AGI) - Schedule A Out-of-pocket medical and dental expenses $ 22,300 Mortgage Interest Paid (Personal residence) $ 62,000 (Original Mortgage indebtedness = $500,000) General Sales Tax (Actual Paid) $ 2,700 Real Estate Taxes Paid (Personal residence) $ 12,000 Charitable Contributions: Various Qualifying $ 10,500 Interest & Dividend Income - Schedule B 1099-INT Interest earned on Chase Bank Savings $ 5,100 1099-DIV Dividends earned on Fidelity Investments $ 23,000 (Total Ordinary; $0 Qualified) No Foreign Interest was earned and no signatory authority over foreign accounts Self-Employment Income Petroleum Engineer Activity - Schedule C & SE Activity: Engineer Code: 541330 Business Started 1/1/2020 This schedule C activity is a Qualified Trade or Business under Section 199A (which means it is eligible for Form 8995-A QBID) 1099s: Tax payer did NOT make any payments which would require 1099s. Cash basis taxpayer who materially participates. The sole proprietorship's EIN 12-3456789 Donald uses his name and home address as his business name. Donald does NOT elect expenses for business use of his home. Part I - Income - Line 1 - $ 855,000 Part II - Expenses: Office/Warehouse rent Liability Insurance Office expenses Business entertainment 100% $ 240,000 $ 31,000 $ 189,000 $ 275,000 DONALD AND MARIA DUCK WORTH SS# 222-33-4444 123 Spring Alley Donald DOB: 7/4/1973 Houston, TX 77002 SS# 333-44-5555 Maria DOB: 7/4/1974 Filing Status: MFJ Maria: Pilot Yes: Presidential Election Fund Donald: Petroleum Engineer Yes: Presidential Election Fund Dependents: Son Barry SS# 111-22-7777 Birth date: 01/01/2004 Age: 16 The Duckworth's would like any tax due drafted from the Chase bank account, or any overpayment refunded in full direct deposit to: Chase Bank checking account: Routing# 111000614 Acct# 111222333 The Duckworth's do not own, nor did they trade in virtual currency during 2020. Estimated Taxes Payments Mrs. Duckworth received a W-2 04/15/2020 $11,000 Employer EIN 11-1234567 06/15/2020 $11,000 Agency Air (Covered by pension plan) 09/15/2020 $11,000 $197,000 Wages 01/15/2021 $11,000 $ 8,537 Social Security Withheld (Based on $137,700) $ 2,857 Medicare Withheld $ 23,000 Federal Income Tax Withheld Deductions for AGI (Schedule 1) You will have to calculate Donald's Schedule C before you can calculate some of the deductions for AGI. Donald: Self-Employed - Family health coverage $1,800/month x 12 months = $21,600. Deduction for AGI Use Schedule SE to calculate y of your self-employment tax AFTER you calculate Schedule C Net Income from self-employment. You will have to take this for AGI deduction into consideration when calculating the Form 8995-A Donald pays alimony to his former wife (Wilma SS# 222-44-8888) $24,000 per year. They were divorced in 12/1/2003 Donald wishes to contribute the maximum amount permitted to a SEP IRA (Consult Chapter 13 for the calculation) The amount is based on Sch C net income from business. Form 4562 - Depreciation Description: GEOLOGICAL COMPUTER EQUIPMENT Date: 02-01-2020 Cost: $ 78,000 Method: Federal: MACRS HY (Convention) 200 DB (Method) Life: 5 Years Section 179 elected this year: $0 Did not Elect Bonus Depreciation Description: OFFICE FURNITURE Date 01-01-2020 Cost: $ 107,000 Method: Federal: MACRS Life: 5 Years Elect all allowable Sec 179 depreciation Did not Elect Bonus Deprecation Forms. Worksheets, Schedules Form 1040 Schedule 1 Schedule 2 Schedule A Schedule B Schedule C Schedule SE Form 4562 (Depreciation) Form 8959 (Additional Medicare) Instructions for Form 8959 Form 8995-A (QBID) MACRS Table 1 Child Tax Credit Worksheet Deduction Items (from AGI) - Schedule A Out-of-pocket medical and dental expenses $ 22,300 Mortgage Interest Paid (Personal residence) $ 62,000 (Original Mortgage indebtedness = $500,000) General Sales Tax (Actual Paid) $ 2,700 Real Estate Taxes Paid (Personal residence) $ 12,000 Charitable Contributions: Various Qualifying $ 10,500 Interest & Dividend Income - Schedule B 1099-INT Interest earned on Chase Bank Savings $ 5,100 1099-DIV Dividends earned on Fidelity Investments $ 23,000 (Total Ordinary; $0 Qualified) No Foreign Interest was earned and no signatory authority over foreign accounts Self-Employment Income Petroleum Engineer Activity - Schedule C & SE Activity: Engineer Code: 541330 Business Started 1/1/2020 This schedule C activity is a Qualified Trade or Business under Section 199A (which means it is eligible for Form 8995-A QBID) 1099s: Tax payer did NOT make any payments which would require 1099s. Cash basis taxpayer who materially participates. The sole proprietorship's EIN 12-3456789 Donald uses his name and home address as his business name. Donald does NOT elect expenses for business use of his home. Part I - Income - Line 1 - $ 855,000 Part II - Expenses: Office/Warehouse rent Liability Insurance Office expenses Business entertainment 100% $ 240,000 $ 31,000 $ 189,000 $ 275,000 DONALD AND MARIA DUCK WORTH SS# 222-33-4444 123 Spring Alley Donald DOB: 7/4/1973 Houston, TX 77002 SS# 333-44-5555 Maria DOB: 7/4/1974 Filing Status: MFJ Maria: Pilot Yes: Presidential Election Fund Donald: Petroleum Engineer Yes: Presidential Election Fund Dependents: Son Barry SS# 111-22-7777 Birth date: 01/01/2004 Age: 16 The Duckworth's would like any tax due drafted from the Chase bank account, or any overpayment refunded in full direct deposit to: Chase Bank checking account: Routing# 111000614 Acct# 111222333 The Duckworth's do not own, nor did they trade in virtual currency during 2020. Estimated Taxes Payments Mrs. Duckworth received a W-2 04/15/2020 $11,000 Employer EIN 11-1234567 06/15/2020 $11,000 Agency Air (Covered by pension plan) 09/15/2020 $11,000 $197,000 Wages 01/15/2021 $11,000 $ 8,537 Social Security Withheld (Based on $137,700) $ 2,857 Medicare Withheld $ 23,000 Federal Income Tax Withheld Deductions for AGI (Schedule 1) You will have to calculate Donald's Schedule C before you can calculate some of the deductions for AGI. Donald: Self-Employed - Family health coverage $1,800/month x 12 months = $21,600. Deduction for AGI Use Schedule SE to calculate y of your self-employment tax AFTER you calculate Schedule C Net Income from self-employment. You will have to take this for AGI deduction into consideration when calculating the Form 8995-A Donald pays alimony to his former wife (Wilma SS# 222-44-8888) $24,000 per year. They were divorced in 12/1/2003 Donald wishes to contribute the maximum amount permitted to a SEP IRA (Consult Chapter 13 for the calculation) The amount is based on Sch C net income from business

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts