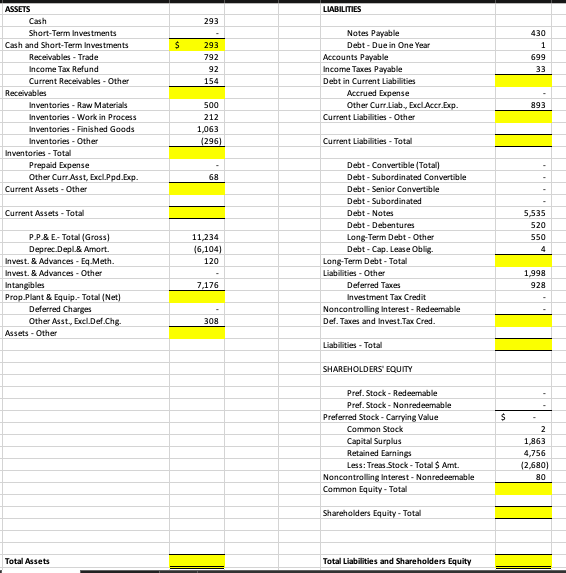

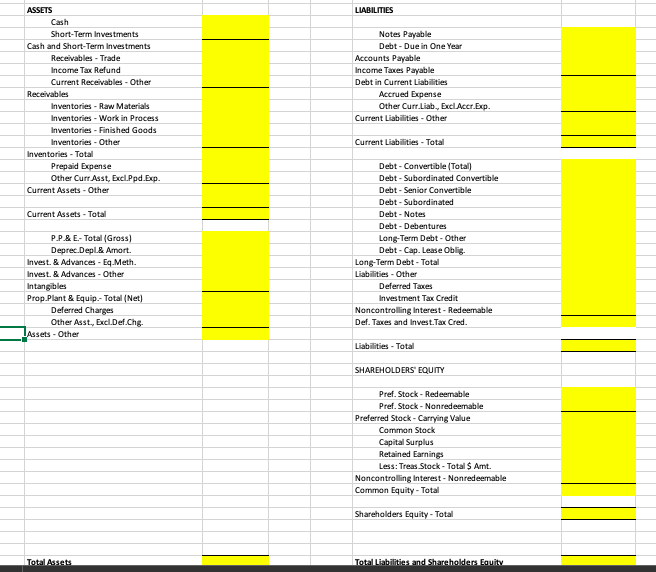

Question: Fill out highlighted boxes by using formulas for both the original balance sheet and pro forma balance sheet. Use the percentage of sales approach assuming

Fill out highlighted boxes by using formulas for both the original balance sheet and pro forma balance sheet. Use the percentage of sales approach assuming a growth rate of 6%.

ASSETS Cash Short-Term Investments Cash and Short-Term Investments Receivables - Trade Income Tax Refund Current Receivables - Other Receivables Inventories - Raw Materials Inventories - Work in Process Inventories - Finished Goods Inventories - Other Prepaid Expense Other Curr Asst, Excl.Ppd.Exp. Inventories - Total Current Assets - Other Current Assets - Total P.P.& E.- Total (Gross) Deprec.Depl.& Amort. Invest. & Advances - Eq.Meth. Invest. & Advances - Other Intangibles Prop.Plant & Equip.- Total (Net) Deferred Charges Other Asst., Excl.Def.Chg. Assets - Other Total Assets $ 293 293 792 92 154 500 212 1,063 (296) 68 11,234 (6,104) 120 7,176 308 LIABILITIES Accounts Payable Income Taxes Payable Debt in Current Liabilities Accrued Expense Other Curr.Liab, Excl.Accr.Exp. Current Liabilities - Other Current Liabilities - Total Debt-Convertible (Total) Debt-Subordinated Convertible Debt - Senior Convertible Debt-Subordinated Debt-Notes Debt-Debentures Long-Term Debt-Other Debt-Cap. Lease Oblig. Long-Term Debt-Total Liabilities - Other Deferred Taxes Investment Tax Credit Noncontrolling Interest - Redeemable Def. Taxes and Invest.Tax Cred. Liabilities - Total SHAREHOLDERS' EQUITY Preferred Stock-Carrying Value Common Stock Capital Surplus Retained Earnings Less: Treas Stock - Total $ Amt. Noncontrolling Interest - Nonredeemable Common Equity - Total Shareholders Equity - Total Total Liabilities and Shareholders Equity Notes Payable Debt-Due in One Year Pref. Stock-Redeemable Pref. Stock-Nonredeemable $ 430 1 699 33 893 5,535 520 550 4 1,998 928 2 1,863 4,756 (2,680) 80 ASSETS Cash Short-Term Investments Cash and Short-Term Investments Receivables - Trade Income Tax Refund Current Receivables - Other Receivables Inventories - Raw Materials Inventories - Work in Process Inventories - Finished Goods Inventories - Other Inventories - Total Prepaid Expense Other Curr Asst, Excl.Ppd.Exp. Current Assets - Other Current Assets - Total P.P.& E.- Total (Gross) Deprec.Depl.& Amort. Invest. & Advances - Eq.Meth. Invest. & Advances - Other Intangibles Prop.Plant & Equip.- Total (Net) Deferred Charges Other Asst., Excl.Def.Chg. LAssets - Other Total Assets LIABILITIES Accounts Payable Income Taxes Payable Debt in Current Liabilities Accrued Expense Other Curr.Liab., Excl.Accr.Exp. Current Liabilities - Other Current Liabilities - Total Debt-Convertible (Total) Debt-Subordinated Convertible Debt - Senior Convertible Debt-Subordinated Debt-Notes Debt-Debentures Long-Term Debt-Other Debt-Cap. Lease Oblig. Long-Term Debt-Total Liabilities - Other Deferred Taxes Investment Tax Credit Noncontrolling Interest - Redeemable Def. Taxes and Invest.Tax Cred. Liabilities - Total SHAREHOLDERS' EQUITY Pref. Stock - Redeemable Pref. Stock - Nonredeemable Preferred Stock-Carrying Value Common Stock Capital Surplus Retained Earnings Less: Treas Stock - Total $ Amt. Noncontrolling Interest - Nonredeemable Common Equity - Total Shareholders Equity - Total Total Liabilities and Shareholders Equity Notes Payable Debt-Due in One Year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts