Question: fill out schedule M-1 and Schedule K using problem 1 Tax Return Phil Williams and Liz Johnson are 60% and 40% shareholders, respectively, in WJ

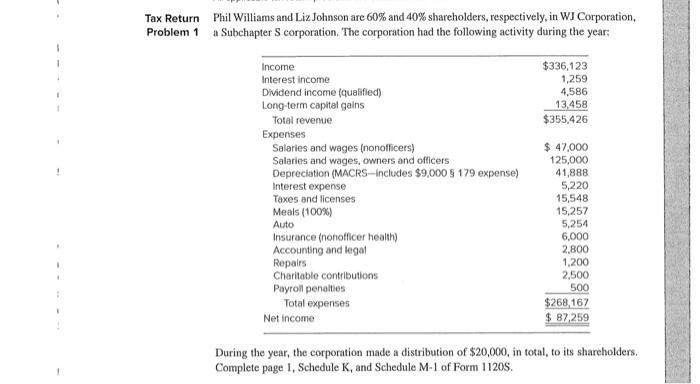

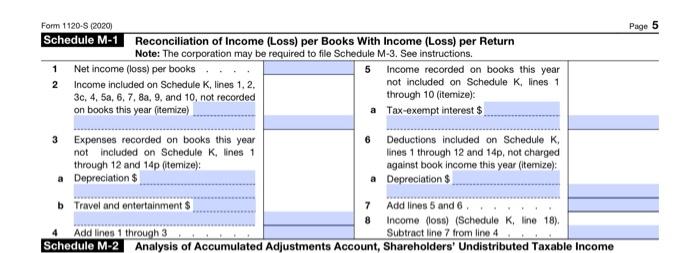

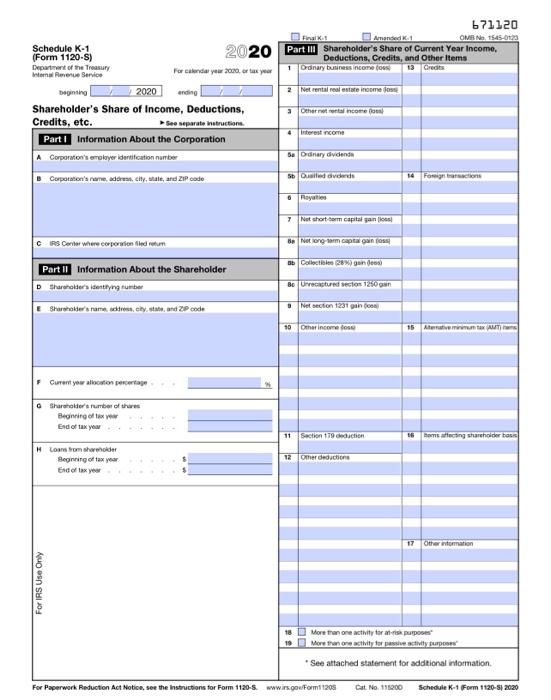

Tax Return Phil Williams and Liz Johnson are 60% and 40% shareholders, respectively, in WJ Corporation, Problem 1 a Subchapter S corporation. The corporation had the following activity during the year: During the year, the corporation made a distribution of $20,000, in total, to its shareholders. Complete page 1, Schedule K, and Schedule M-1 of Form 1120 S. Form 1120-\$ (2020) Page 5 Schedule M-1 Reconciliation of Income (Loss) per Books With Income (Loss) per Return Note: The corporation may be required to file Schedule M-3. See instructions. Schedule M-2 Analysis of Accumulated Adjustments Account, Shareholders' Undistributed Taxable Income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts