Question: fill out the 1040 based on the information given, and please show worK Kevin Connor (age 66 as of December 31, 2020) lives at 101

fill out the 1040 based on the information given, and please show worK

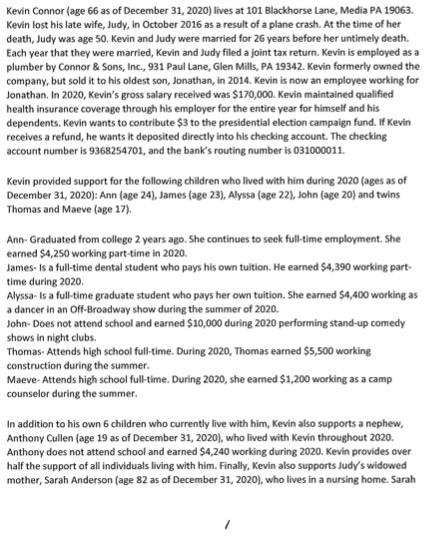

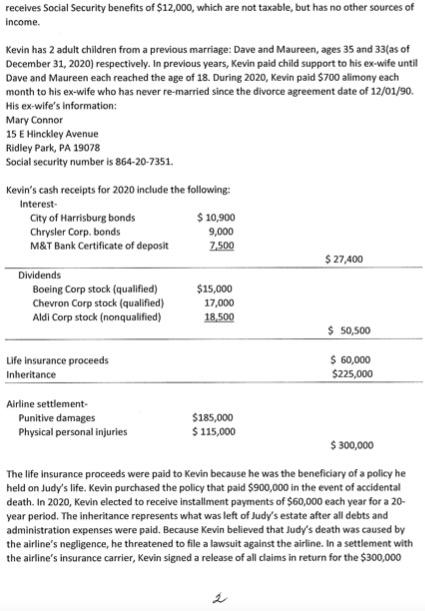

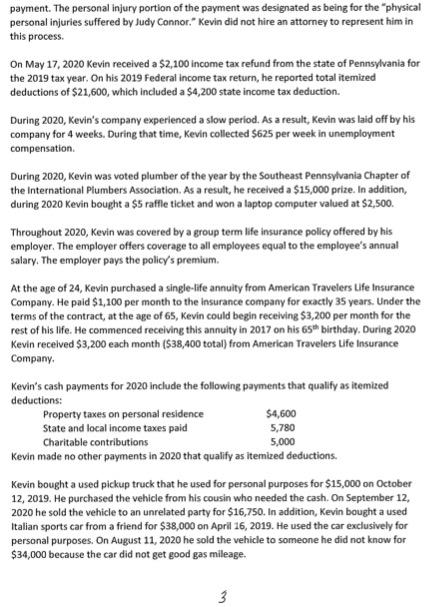

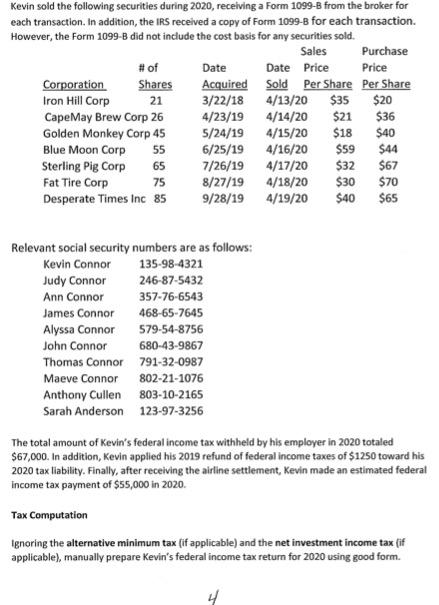

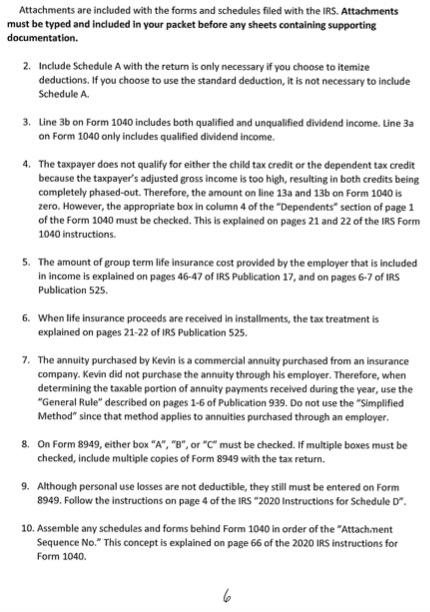

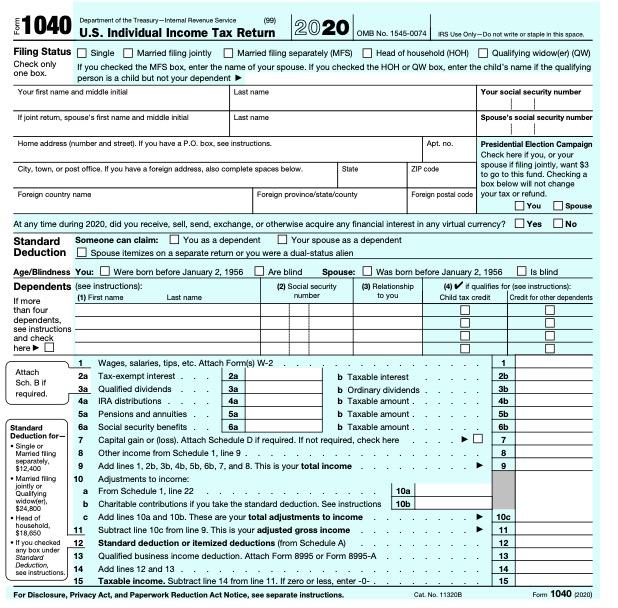

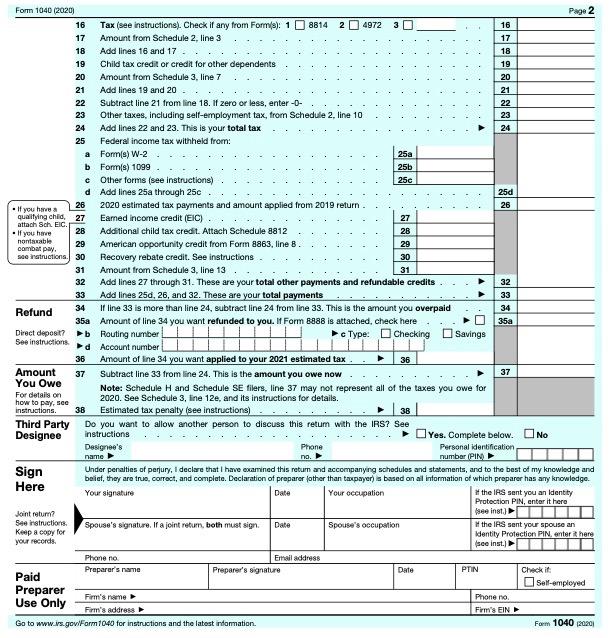

Kevin Connor (age 66 as of December 31, 2020) lives at 101 Blackhorse Lane, Media PA 19063. Kevin lost his late wife, Judy, in October 2016 as a result of a plane crash. At the time of her death, Judy was age 50. Kevin and Judy were married for 26 years before her untimely death. Each year that they were married, Kevin and Judy filed a joint tax return. Kevin is employed as a plumber by Connor & Sons, Inc., 931 Paul Lane, Glen Mills, PA 19342. Kevin formerly owned the company, but sold it to his oldest son, Jonathan, in 2014. Kevin is now an employee working for Jonathan. In 2020, Kevin's gross salary received was $170,000. Kevin maintained qualified health insurance coverage through his employer for the entire year for himself and his dependents, Kevin wants to contribute $3 to the presidential election campaign fund. If Kevin receives a refund, he wants it deposited directly into his checking account. The checking account number is 9368254701, and the bank's routing number is 031000011. Kevin provided support for the following children who lived with him during 2020 (ages as of December 31, 2020): Ann (age 24), James (age 23), Alyssa (age 22), John (age 20) and twins Thomas and Maeve (age 17). Ann-Graduated from college 2 years ago. She continues to seek full-time employment. She earned $4,250 working part-time in 2020, James- Is a full-time dental student who pays his own tuition. He earned $4,390 working part- time during 2020 Alyssa- Is a full-time graduate student who pays her own tuition. She earned $4,400 working as a dancer in an Off-Broadway show during the summer of 2020. John-Does not attend school and earned $10,000 during 2020 performing stand-up comedy shows in night clubs Thomas-Attends high school full-time. During 2020, Thomas earned $5,500 working construction during the summer. Maeve- Attends high school full-time. During 2020, she earned $1.200 working as a camp counselor during the summer. In addition to his own 6 children who currently live with him, Kevin also supports a nephew, Anthony Cullen (age 19 as of December 31, 2020), who lived with Kevin throughout 2020. Anthony does not attend school and earned $4,240 working during 2020, Kevin provides over half the support of all individuals living with him. Finally, Kevin also supports Judy's widowed mother, Sarah Anderson (age 82 as of December 31, 2020), who lives in a nursing home. Sarah receives Social Security benefits of $12,000, which are not taxable, but has no other sources of income. Kevin has 2 adult children from a previous marriage: Dave and Maureen, ages 35 and 33(as of December 31, 2020) respectively. In previous years, Kevin paid child support to his ex-wife until Dave and Maureen each reached the age of 18. During 2020, Kevin paid $700 alimony each month to his ex-wife who has never re-married since the divorce agreement date of 12/01/90. His ex-wife's information: Mary Connor 15 E Hinckley Avenue Ridley Park, PA 19078 Social security number is 864-20-7351. Kevin's cash receipts for 2020 include the following: Interest City of Harrisburg bonds $ 10,900 Chrysler Corp, bonds 9,000 M&T Bank Certificate of deposit 2.500 $ 27,400 Dividends Boeing Corp stock (qualified) $15,000 Chevron Corp stock (qualified) 17,000 Aldi Corp stock (nonqualified) 18.500 $ 50,500 Life Insurance proceeds Inheritance $ 60,000 $225,000 Airline settlement Punitive damages Physical personal injuries $185,000 $ 115,000 $ 300,000 The life insurance proceeds were paid to Kevin because he was the beneficiary of a policy he held on Judy's life. Kevin purchased the policy that paid $900,000 in the event of accidental death. In 2020, Kevin elected to receive installment payments of $60,000 each year for a 20- year period. The inheritance represents what was left of Judy's estate after all debts and administration expenses were paid. Because Kevin believed that Judy's death was caused by the airline's negligence, he threatened to file a lawsuit against the airline. In a settlement with the airline's insurance carrier, Kevin signed a release of all daims in return for the $300,000 payment. The personal injury portion of the payment was designated as being for the physical personal injuries suffered by Judy Connor." Kevin did not hire an attorney to represent him in this process On May 17, 2020 Kevin received a $2,100 income tax refund from the state of Pennsylvania for the 2019 tax year. On his 2019 Federal income tax return, he reported total itemized deductions of $21,600, which included a $4,200 state income tax deduction During 2020, Kevin's company experienced a slow period. As a result, Kevin was laid off by his company for 4 weeks. During that time, Kevin collected $625 per week in unemployment compensation During 2020, Kevin was voted plumber of the year by the Southeast Pennsylvania Chapter of the International Plumbers Association. As a result, he received a $15,000 prize. In addition, during 2020 Kevin bought a $5 raffle ticket and won a laptop computer valued at $2,500. Throughout 2020, Kevin was covered by a group term life insurance policy offered by his employer. The employer offers coverage to all employees equal to the employee's annual salary. The employer pays the policy's premium At the age of 24, Kevin purchased a single-life annuity from American Travelers Life Insurance Company. He paid $1,100 per month to the insurance company for exactly 35 years. Under the terms of the contract, at the age of 65, Kevin could begin receiving $3,200 per month for the rest of his life. He commenced receiving this annuity in 2017 on his birthday. During 2020 Kevin received $3,200 each month ($38,400 total) from American Travelers Life Insurance Company Kevin's cash payments for 2020 Include the following payments that qualify as itemized deductions: Property taxes on personal residence $4,600 State and local income taxes paid 5,780 Charitable contributions 5,000 Kevin made no other payments in 2020 that qualify as itemized deductions Kevin bought a used pickup truck that he used for personal purposes for $15,000 on October 12, 2019. He purchased the vehicle from his cousin who needed the cash. On September 12, 2020 he sold the vehicle to an unrelated party for $16,750. In addition, Kevin bought a used Italian sports car from a friend for $38,000 on April 16, 2019. He used the car exclusively for personal purposes. On August 11, 2020 he sold the vehicle to someone he did not know for $34,000 because the car did not get good gas mileage. 3 Kevin sold the following securities during 2020, receiving a Form 1099-B from the broker for each transaction. In addition, the IRS received a copy of Form 1099-B for each transaction. However, the Form 1099-B did not include the cost basis for any securities sold. Sales Purchase # of Date Date Price Price Corporation Shares Acquired Sold Per Share Per Share Iron Hill Corp 21 3/22/18 4/13/20 $35 $20 CapeMay Brew Corp 26 4/23/19 4/14/20 536 Golden Monkey Corp 45 5/24/19 4/15/20 $18 $40 Blue Moon Corp 55 6/25/19 4/16/20 $59 $44 Sterling Pig Corp 65 7/26/19 4/17/20 $32 Fat Tire Corp 75 8/27/19 4/18/20 $30 $70 Desperate Times Inc 85 9/28/19 4/19/20 $40 $65 $21 $67 Relevant social security numbers are as follows: Kevin Connor 135-98-4321 Judy Connor 246-87-5432 Ann Connor 357-76-6543 James Connor 468-65-7645 Alyssa Connor 579-54-8756 John Connor 680-43-9867 Thomas Connor 791-32-0987 Maeve Connor 802-21-1076 Anthony Cullen 803-10-2165 Sarah Anderson 123-97-3256 The total amount of Kevin's federal income tax withheld by his employer in 2020 totaled $67,000. In addition, Kevin applied his 2019 refund of federal income taxes of $1250 toward his 2020 tax liability. Finally, after receiving the airline settlement, Kevin made an estimated federal Income tax payment of $55,000 in 2020. Tax Computation Ignoring the alternative minimum tax (if applicable) and the net investment income tax (if applicable), manually prepare Kevin's federal income tax return for 2020 using good form. 4 (Using tax preparation software is prohibited). Consider including the following forms and schedules with your return: Form 1040 Schedule 1 Schedule A (only necessary if taxpayer chooses to itemize deductions) Schedule B Schedule D Form 8949 Remember, you are to assume that you are a paid tax practitioner preparing the tax return for client(s). Therefore, in addition to including the clients' occupation(s), be sure to complete the "Paid Preparer Use Only" section of page 12 of the Form 1040. It is okay to make-up a fictitious firm name and address for this section. Be sure to sign your name where the form says, "Preparer's signature". Supporting computations should be attached behind the return. Using good form, include the supporting computation for the tax liability; Form 1040, Line 12(a). The solution shows that Kevin will be owed a refund of $1026. (Note that the instructor has prepared the federal income tax return and feels confident that this check figure is correct but does not guarantee the accuracy of this amount.) Your answer could be a few dollars different due to either rounding or using the tax rate schedule instead of the tax table (or vice-versa) to compute the tax liability. No points will be deducted for difference due to either one of these two reasons. Hints and Additional Instructions 1. If the information requested by the IRS does not fit in the allotted space on the IRS tax form for IRS tax schedule), include the required information on a separate sheet of paper attached to the back of the return. Be sure to reference the attachment on the form by writing something like "See Attached Schedule". Make sure the attachment: Includes the information that is required on the form; Specifically states the line number on the form for which it is providing the requested information, and Ties into the IRS form or schedule 5 Attachments are included with the forms and schedules filled with the IRS. Attachments must be typed and included in your packet before any sheets containing supporting documentation. 2. Include Schedule A with the return is only necessary if you choose to itemize deductions. If you choose to use the standard deduction, it is not necessary to include Schedule A 3. Line 3b on Form 1040 includes both qualified and unqualified dividend income. Line 3a on Form 1040 only includes qualified dividend income. 4. The taxpayer does not qualify for either the child tax credit or the dependent tax credit because the taxpayer's adjusted gross income is too high, resulting in both credits being completely phased-out. Therefore, the amount on line 13a and 13b on Form 1040 is zero. However, the appropriate box in column 4 of the "Dependents" section of page 1 of the Form 1000 must be checked. This is explained on pages 21 and 22 of the IRS Form 1040 instructions 5. The amount of group term life insurance cost provided by the employer that is included in income is explained on pages 46-47 of IRS Publication 17, and on pages 6-7 of IRS Publication 525. 6. When life insurance proceeds are received in installments, the tax treatment is explained on pages 21-22 of IRS Publication 525. 7. The annuity purchased by Kevin is a commercial annuity purchased from an insurance company. Kevin did not purchase the annuity through his employer. Therefore, when determining the taxable portion of annuity payments received during the year, use the "General Rule" described on pages 1-6 of Publication 939. Do not use the "Simplified Method" since that method applies to annuities purchased through an employer, 8. On Form 8949, either box "A", "B", or "C" must be checked. If multiple boxes must be checked, include multiple copies of Form 8949 with the tax return. 9. Although personal use losses are not deductible, they still must be entered on Form 8949. Follow the instructions on page 4 of the IRS -2020 Instructions for Schedule D". 10. Assemble any schedules and forms behind Form 1040 in order of the "Attachment Sequence No." This concept is explained on page 66 of the 2020 IRS instructions for Form 1040 Department of the Treasury--Internal Revenue Service 1040 (se) U.S. Individual Income Tax Return 2020 OMB No. 1545-0074 IRS U Only-Do not write or simple in his space Filing Status Single Married filing jointly Married filing separately (MFS) Head of household (HOH) Qualifying widower) (ow Check only If you checked the MFS box, enter the name of your spouse. If you checked the HOH or GW box, enter the child's name if the qualifying one box. person is a child but not your dependent Your first name and middle initial Last name Your social security number It joint retum, spouse's first name and middle initial Last name Spouse's social security number Home address number and street). If you have a P.O. bor, see instructions. Apt. no. Presidential Election Campaign Check here if you, or your City, town, or post office. If you have a foreign address, also complete spaces below. State ZIP code spouse if filing jointly, want $3 to go to this fund. Checking a box below will not change Foreign country name Foreign province/stata/county Foreign postal code your tax or refund. You Spouse At any time during 2020, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency? Yes No Standard Someone can claim: You as a dependent Your spouse as a dependent Deduction Spouse itemizes on a separate return or you were a dual-status alien Age/Blindness You: Were born before January 2, 1956 Are blind Spouse: Was bom before January 2, 1956 is blind Dependents (see instructions: (2) Social security (3) Relationship (4) # qualities for so instructions If more (1) First name Last name number to you Child tax credit Credit for other dependents than four dependents, see instructions and check here 1 Wages, salaries, tips, etc. Attach Forms) W-2 1 Attach 2a Tax-exempt interest 2a b Taxable interest 2b Sch. Bit 3a Qualified dividends 3a required. 3b b Ordinary dividends 4a IRA distributions 4a b Taxable amount. 4b 5a Pensions and annuities 5a b Taxable amount 5b Standard 6a Social security benefits b Taxable amount 6b Deduction for 7 Capital gain or loss). Attach Schedule D it required. If not required, check here 7 - Single or Married fling 8 Other income from Schedule 1, line 9. 8 separately. $12.400 9 Add lines 1, 2b, 3b, 4b, 5b, 6b, 7. and B. This is your total income 9 - Married ning 10 Adjustments to income: Quallying a From Schedule 1. line 22 10a $24,800 Charitable contributions if you take the standard deduction. See instructions 10b Head of c Add lines 10a and 10b. These are your total adjustments to income 10c household $18.650 11 Subtract line 10c from line 9. This is your adjusted gross income 11 . If you checked 12 Standard deduction or itemized deductions (from Schedule A) 12 any box under Standard 13 Qualified business income deduction. Attach Form 8995 or Form 8995-A 13 Deduction 14 see instructions. Add lines 12 and 13. 14 15 Taxable income. Subtract line 14 fromn line 11. If zero or less, enter-O- 15 For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions Cat No. 113200 Form 1040 2020) lol. Jointly or widower A 18 4 AA Form 1040 (2020) Page 2 16 Tax (see instructions). Check if any from Forms): 1 8814 2 4972 3 16 17 Amount from Schedule 2, line 3 17 18 Add lines 16 and 17 19 Child tax credit or credit for other dependents 19 20 Amount from Schedule 3. line 7 20 21 Add lines 19 and 20 21 22 Subtract line 21 from line 18. If zero or less, enter-O- 22 23 Other taxes, including self-employment tax, from Schedule 2, line 10 23 24 Add lines 22 and 23. This is your total tax 24 25 Federal income tax withheld from: a Form(s) W-2 25a b Fom's) 1099 25b Other forms (see instructions) 25c dAdd lines 25a through 250 25d 26 . If you have 2020 estimated tax payments and amount applied from 2019 return 26 qualifying child. 27 Earned Income credit (EIC). 27 attach Sch. LIC. 28 - If you have Additional child tax credit. Attach Schedule 8812 28 nonsable 29 combat pay. 29 American opportunity credit from Form 8863, line B. see natructions. 30 Recovery rebate credit. See Instructions. 30 31 Amount from Schedule 3. line 13 31 32 Add lines 27 through 31. These are your total other payments and refundable credits 32 33 Add lines 25d, 26, and 32. These are your total payments 33 Refund 34 If line 33 is more than line 24, subtract line 24 from line 33. This is the amount you overpaid 34 35a Amount of line 34 you want refunded to you. If Form 8888 is attached, check here 35a Direct depost? b Routing number See instructions Account number Type: Checking Savings 36 Amount of line 34 you want applied to your 2021 estimated tax 36 Amount 37 Subtract line 33 from line 24. This is the amount you owe now 37 You Owe For details on Note: Schedule H and Schedule SE filers, line 37 may not represent all of the taxes you owe for how to pay, sce 2020. See Schedule 3, line 12e, and its instructions for details. instructions. 38 Estimated tax penalty (see Instructions) 38 Third Party Do you want to allow another person to discuss this retum with the IRS? See Designee Instructions Yes. Complete below. ONO Designeo's Phone Personal identification name number (PIN Sign Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete. Declaration of preparer other than taxpayer) is based on all information of which preparer has any knowledge. Here Your signature Date Your occupation the IRS sent you an identity Protection PIN, enter it here Joint return se insl.) See instructions. Spouse's signature. If a joint return, both must sign Date Spouse's occupation the IRS sent your spouse an Keep a copy for Identity Protection PIN, enter here your records. see inst. Phone no Email address Preparer's name Date Preparer's signature PTIN Paid Check it Self-employed Preparer Firm's name Phone no Use Only Firm's address Firm's EIN Go to www.rs.gov/Form 1040 for instructions and the latest indommation. Form 1040 2020 U no. Kevin Connor (age 66 as of December 31, 2020) lives at 101 Blackhorse Lane, Media PA 19063. Kevin lost his late wife, Judy, in October 2016 as a result of a plane crash. At the time of her death, Judy was age 50. Kevin and Judy were married for 26 years before her untimely death. Each year that they were married, Kevin and Judy filed a joint tax return. Kevin is employed as a plumber by Connor & Sons, Inc., 931 Paul Lane, Glen Mills, PA 19342. Kevin formerly owned the company, but sold it to his oldest son, Jonathan, in 2014. Kevin is now an employee working for Jonathan. In 2020, Kevin's gross salary received was $170,000. Kevin maintained qualified health insurance coverage through his employer for the entire year for himself and his dependents, Kevin wants to contribute $3 to the presidential election campaign fund. If Kevin receives a refund, he wants it deposited directly into his checking account. The checking account number is 9368254701, and the bank's routing number is 031000011. Kevin provided support for the following children who lived with him during 2020 (ages as of December 31, 2020): Ann (age 24), James (age 23), Alyssa (age 22), John (age 20) and twins Thomas and Maeve (age 17). Ann-Graduated from college 2 years ago. She continues to seek full-time employment. She earned $4,250 working part-time in 2020, James- Is a full-time dental student who pays his own tuition. He earned $4,390 working part- time during 2020 Alyssa- Is a full-time graduate student who pays her own tuition. She earned $4,400 working as a dancer in an Off-Broadway show during the summer of 2020. John-Does not attend school and earned $10,000 during 2020 performing stand-up comedy shows in night clubs Thomas-Attends high school full-time. During 2020, Thomas earned $5,500 working construction during the summer. Maeve- Attends high school full-time. During 2020, she earned $1.200 working as a camp counselor during the summer. In addition to his own 6 children who currently live with him, Kevin also supports a nephew, Anthony Cullen (age 19 as of December 31, 2020), who lived with Kevin throughout 2020. Anthony does not attend school and earned $4,240 working during 2020, Kevin provides over half the support of all individuals living with him. Finally, Kevin also supports Judy's widowed mother, Sarah Anderson (age 82 as of December 31, 2020), who lives in a nursing home. Sarah receives Social Security benefits of $12,000, which are not taxable, but has no other sources of income. Kevin has 2 adult children from a previous marriage: Dave and Maureen, ages 35 and 33(as of December 31, 2020) respectively. In previous years, Kevin paid child support to his ex-wife until Dave and Maureen each reached the age of 18. During 2020, Kevin paid $700 alimony each month to his ex-wife who has never re-married since the divorce agreement date of 12/01/90. His ex-wife's information: Mary Connor 15 E Hinckley Avenue Ridley Park, PA 19078 Social security number is 864-20-7351. Kevin's cash receipts for 2020 include the following: Interest City of Harrisburg bonds $ 10,900 Chrysler Corp, bonds 9,000 M&T Bank Certificate of deposit 2.500 $ 27,400 Dividends Boeing Corp stock (qualified) $15,000 Chevron Corp stock (qualified) 17,000 Aldi Corp stock (nonqualified) 18.500 $ 50,500 Life Insurance proceeds Inheritance $ 60,000 $225,000 Airline settlement Punitive damages Physical personal injuries $185,000 $ 115,000 $ 300,000 The life insurance proceeds were paid to Kevin because he was the beneficiary of a policy he held on Judy's life. Kevin purchased the policy that paid $900,000 in the event of accidental death. In 2020, Kevin elected to receive installment payments of $60,000 each year for a 20- year period. The inheritance represents what was left of Judy's estate after all debts and administration expenses were paid. Because Kevin believed that Judy's death was caused by the airline's negligence, he threatened to file a lawsuit against the airline. In a settlement with the airline's insurance carrier, Kevin signed a release of all daims in return for the $300,000 payment. The personal injury portion of the payment was designated as being for the physical personal injuries suffered by Judy Connor." Kevin did not hire an attorney to represent him in this process On May 17, 2020 Kevin received a $2,100 income tax refund from the state of Pennsylvania for the 2019 tax year. On his 2019 Federal income tax return, he reported total itemized deductions of $21,600, which included a $4,200 state income tax deduction During 2020, Kevin's company experienced a slow period. As a result, Kevin was laid off by his company for 4 weeks. During that time, Kevin collected $625 per week in unemployment compensation During 2020, Kevin was voted plumber of the year by the Southeast Pennsylvania Chapter of the International Plumbers Association. As a result, he received a $15,000 prize. In addition, during 2020 Kevin bought a $5 raffle ticket and won a laptop computer valued at $2,500. Throughout 2020, Kevin was covered by a group term life insurance policy offered by his employer. The employer offers coverage to all employees equal to the employee's annual salary. The employer pays the policy's premium At the age of 24, Kevin purchased a single-life annuity from American Travelers Life Insurance Company. He paid $1,100 per month to the insurance company for exactly 35 years. Under the terms of the contract, at the age of 65, Kevin could begin receiving $3,200 per month for the rest of his life. He commenced receiving this annuity in 2017 on his birthday. During 2020 Kevin received $3,200 each month ($38,400 total) from American Travelers Life Insurance Company Kevin's cash payments for 2020 Include the following payments that qualify as itemized deductions: Property taxes on personal residence $4,600 State and local income taxes paid 5,780 Charitable contributions 5,000 Kevin made no other payments in 2020 that qualify as itemized deductions Kevin bought a used pickup truck that he used for personal purposes for $15,000 on October 12, 2019. He purchased the vehicle from his cousin who needed the cash. On September 12, 2020 he sold the vehicle to an unrelated party for $16,750. In addition, Kevin bought a used Italian sports car from a friend for $38,000 on April 16, 2019. He used the car exclusively for personal purposes. On August 11, 2020 he sold the vehicle to someone he did not know for $34,000 because the car did not get good gas mileage. 3 Kevin sold the following securities during 2020, receiving a Form 1099-B from the broker for each transaction. In addition, the IRS received a copy of Form 1099-B for each transaction. However, the Form 1099-B did not include the cost basis for any securities sold. Sales Purchase # of Date Date Price Price Corporation Shares Acquired Sold Per Share Per Share Iron Hill Corp 21 3/22/18 4/13/20 $35 $20 CapeMay Brew Corp 26 4/23/19 4/14/20 536 Golden Monkey Corp 45 5/24/19 4/15/20 $18 $40 Blue Moon Corp 55 6/25/19 4/16/20 $59 $44 Sterling Pig Corp 65 7/26/19 4/17/20 $32 Fat Tire Corp 75 8/27/19 4/18/20 $30 $70 Desperate Times Inc 85 9/28/19 4/19/20 $40 $65 $21 $67 Relevant social security numbers are as follows: Kevin Connor 135-98-4321 Judy Connor 246-87-5432 Ann Connor 357-76-6543 James Connor 468-65-7645 Alyssa Connor 579-54-8756 John Connor 680-43-9867 Thomas Connor 791-32-0987 Maeve Connor 802-21-1076 Anthony Cullen 803-10-2165 Sarah Anderson 123-97-3256 The total amount of Kevin's federal income tax withheld by his employer in 2020 totaled $67,000. In addition, Kevin applied his 2019 refund of federal income taxes of $1250 toward his 2020 tax liability. Finally, after receiving the airline settlement, Kevin made an estimated federal Income tax payment of $55,000 in 2020. Tax Computation Ignoring the alternative minimum tax (if applicable) and the net investment income tax (if applicable), manually prepare Kevin's federal income tax return for 2020 using good form. 4 (Using tax preparation software is prohibited). Consider including the following forms and schedules with your return: Form 1040 Schedule 1 Schedule A (only necessary if taxpayer chooses to itemize deductions) Schedule B Schedule D Form 8949 Remember, you are to assume that you are a paid tax practitioner preparing the tax return for client(s). Therefore, in addition to including the clients' occupation(s), be sure to complete the "Paid Preparer Use Only" section of page 12 of the Form 1040. It is okay to make-up a fictitious firm name and address for this section. Be sure to sign your name where the form says, "Preparer's signature". Supporting computations should be attached behind the return. Using good form, include the supporting computation for the tax liability; Form 1040, Line 12(a). The solution shows that Kevin will be owed a refund of $1026. (Note that the instructor has prepared the federal income tax return and feels confident that this check figure is correct but does not guarantee the accuracy of this amount.) Your answer could be a few dollars different due to either rounding or using the tax rate schedule instead of the tax table (or vice-versa) to compute the tax liability. No points will be deducted for difference due to either one of these two reasons. Hints and Additional Instructions 1. If the information requested by the IRS does not fit in the allotted space on the IRS tax form for IRS tax schedule), include the required information on a separate sheet of paper attached to the back of the return. Be sure to reference the attachment on the form by writing something like "See Attached Schedule". Make sure the attachment: Includes the information that is required on the form; Specifically states the line number on the form for which it is providing the requested information, and Ties into the IRS form or schedule 5 Attachments are included with the forms and schedules filled with the IRS. Attachments must be typed and included in your packet before any sheets containing supporting documentation. 2. Include Schedule A with the return is only necessary if you choose to itemize deductions. If you choose to use the standard deduction, it is not necessary to include Schedule A 3. Line 3b on Form 1040 includes both qualified and unqualified dividend income. Line 3a on Form 1040 only includes qualified dividend income. 4. The taxpayer does not qualify for either the child tax credit or the dependent tax credit because the taxpayer's adjusted gross income is too high, resulting in both credits being completely phased-out. Therefore, the amount on line 13a and 13b on Form 1040 is zero. However, the appropriate box in column 4 of the "Dependents" section of page 1 of the Form 1000 must be checked. This is explained on pages 21 and 22 of the IRS Form 1040 instructions 5. The amount of group term life insurance cost provided by the employer that is included in income is explained on pages 46-47 of IRS Publication 17, and on pages 6-7 of IRS Publication 525. 6. When life insurance proceeds are received in installments, the tax treatment is explained on pages 21-22 of IRS Publication 525. 7. The annuity purchased by Kevin is a commercial annuity purchased from an insurance company. Kevin did not purchase the annuity through his employer. Therefore, when determining the taxable portion of annuity payments received during the year, use the "General Rule" described on pages 1-6 of Publication 939. Do not use the "Simplified Method" since that method applies to annuities purchased through an employer, 8. On Form 8949, either box "A", "B", or "C" must be checked. If multiple boxes must be checked, include multiple copies of Form 8949 with the tax return. 9. Although personal use losses are not deductible, they still must be entered on Form 8949. Follow the instructions on page 4 of the IRS -2020 Instructions for Schedule D". 10. Assemble any schedules and forms behind Form 1040 in order of the "Attachment Sequence No." This concept is explained on page 66 of the 2020 IRS instructions for Form 1040 Department of the Treasury--Internal Revenue Service 1040 (se) U.S. Individual Income Tax Return 2020 OMB No. 1545-0074 IRS U Only-Do not write or simple in his space Filing Status Single Married filing jointly Married filing separately (MFS) Head of household (HOH) Qualifying widower) (ow Check only If you checked the MFS box, enter the name of your spouse. If you checked the HOH or GW box, enter the child's name if the qualifying one box. person is a child but not your dependent Your first name and middle initial Last name Your social security number It joint retum, spouse's first name and middle initial Last name Spouse's social security number Home address number and street). If you have a P.O. bor, see instructions. Apt. no. Presidential Election Campaign Check here if you, or your City, town, or post office. If you have a foreign address, also complete spaces below. State ZIP code spouse if filing jointly, want $3 to go to this fund. Checking a box below will not change Foreign country name Foreign province/stata/county Foreign postal code your tax or refund. You Spouse At any time during 2020, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency? Yes No Standard Someone can claim: You as a dependent Your spouse as a dependent Deduction Spouse itemizes on a separate return or you were a dual-status alien Age/Blindness You: Were born before January 2, 1956 Are blind Spouse: Was bom before January 2, 1956 is blind Dependents (see instructions: (2) Social security (3) Relationship (4) # qualities for so instructions If more (1) First name Last name number to you Child tax credit Credit for other dependents than four dependents, see instructions and check here 1 Wages, salaries, tips, etc. Attach Forms) W-2 1 Attach 2a Tax-exempt interest 2a b Taxable interest 2b Sch. Bit 3a Qualified dividends 3a required. 3b b Ordinary dividends 4a IRA distributions 4a b Taxable amount. 4b 5a Pensions and annuities 5a b Taxable amount 5b Standard 6a Social security benefits b Taxable amount 6b Deduction for 7 Capital gain or loss). Attach Schedule D it required. If not required, check here 7 - Single or Married fling 8 Other income from Schedule 1, line 9. 8 separately. $12.400 9 Add lines 1, 2b, 3b, 4b, 5b, 6b, 7. and B. This is your total income 9 - Married ning 10 Adjustments to income: Quallying a From Schedule 1. line 22 10a $24,800 Charitable contributions if you take the standard deduction. See instructions 10b Head of c Add lines 10a and 10b. These are your total adjustments to income 10c household $18.650 11 Subtract line 10c from line 9. This is your adjusted gross income 11 . If you checked 12 Standard deduction or itemized deductions (from Schedule A) 12 any box under Standard 13 Qualified business income deduction. Attach Form 8995 or Form 8995-A 13 Deduction 14 see instructions. Add lines 12 and 13. 14 15 Taxable income. Subtract line 14 fromn line 11. If zero or less, enter-O- 15 For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions Cat No. 113200 Form 1040 2020) lol. Jointly or widower A 18 4 AA Form 1040 (2020) Page 2 16 Tax (see instructions). Check if any from Forms): 1 8814 2 4972 3 16 17 Amount from Schedule 2, line 3 17 18 Add lines 16 and 17 19 Child tax credit or credit for other dependents 19 20 Amount from Schedule 3. line 7 20 21 Add lines 19 and 20 21 22 Subtract line 21 from line 18. If zero or less, enter-O- 22 23 Other taxes, including self-employment tax, from Schedule 2, line 10 23 24 Add lines 22 and 23. This is your total tax 24 25 Federal income tax withheld from: a Form(s) W-2 25a b Fom's) 1099 25b Other forms (see instructions) 25c dAdd lines 25a through 250 25d 26 . If you have 2020 estimated tax payments and amount applied from 2019 return 26 qualifying child. 27 Earned Income credit (EIC). 27 attach Sch. LIC. 28 - If you have Additional child tax credit. Attach Schedule 8812 28 nonsable 29 combat pay. 29 American opportunity credit from Form 8863, line B. see natructions. 30 Recovery rebate credit. See Instructions. 30 31 Amount from Schedule 3. line 13 31 32 Add lines 27 through 31. These are your total other payments and refundable credits 32 33 Add lines 25d, 26, and 32. These are your total payments 33 Refund 34 If line 33 is more than line 24, subtract line 24 from line 33. This is the amount you overpaid 34 35a Amount of line 34 you want refunded to you. If Form 8888 is attached, check here 35a Direct depost? b Routing number See instructions Account number Type: Checking Savings 36 Amount of line 34 you want applied to your 2021 estimated tax 36 Amount 37 Subtract line 33 from line 24. This is the amount you owe now 37 You Owe For details on Note: Schedule H and Schedule SE filers, line 37 may not represent all of the taxes you owe for how to pay, sce 2020. See Schedule 3, line 12e, and its instructions for details. instructions. 38 Estimated tax penalty (see Instructions) 38 Third Party Do you want to allow another person to discuss this retum with the IRS? See Designee Instructions Yes. Complete below. ONO Designeo's Phone Personal identification name number (PIN Sign Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete. Declaration of preparer other than taxpayer) is based on all information of which preparer has any knowledge. Here Your signature Date Your occupation the IRS sent you an identity Protection PIN, enter it here Joint return se insl.) See instructions. Spouse's signature. If a joint return, both must sign Date Spouse's occupation the IRS sent your spouse an Keep a copy for Identity Protection PIN, enter here your records. see inst. Phone no Email address Preparer's name Date Preparer's signature PTIN Paid Check it Self-employed Preparer Firm's name Phone no Use Only Firm's address Firm's EIN Go to www.rs.gov/Form 1040 for instructions and the latest indommation. Form 1040 2020 U no

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts