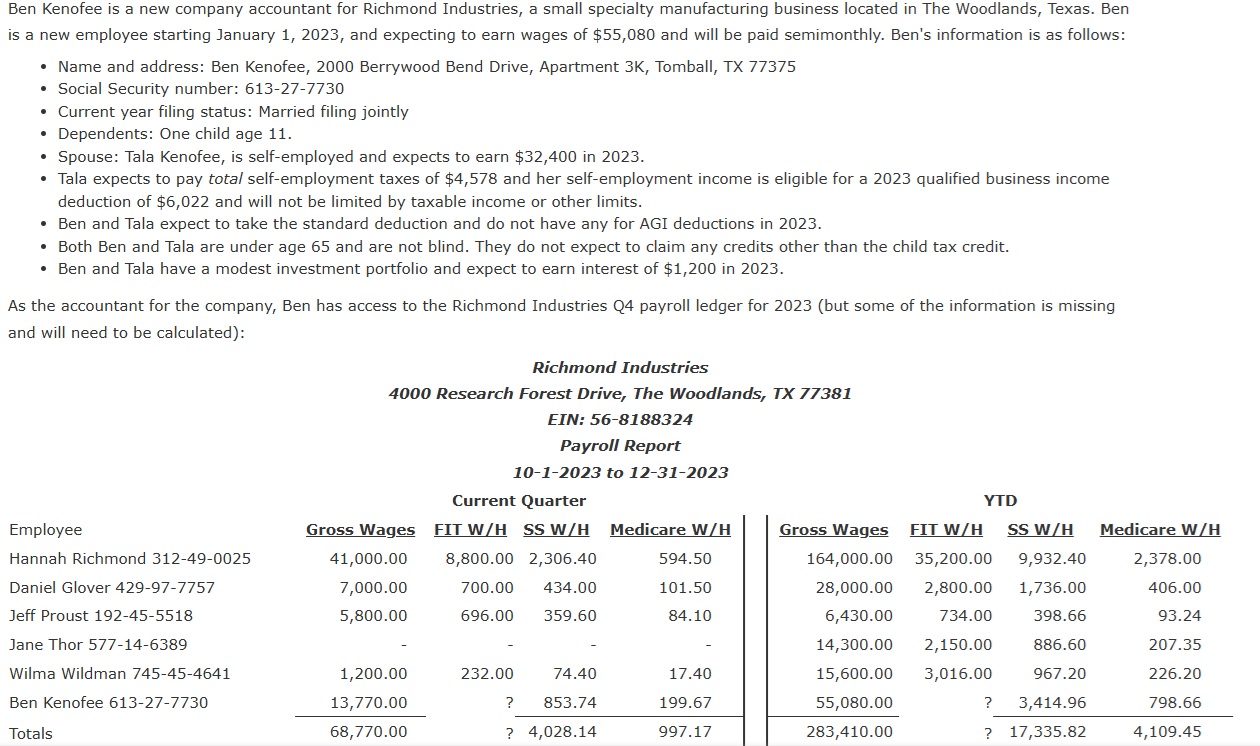

Question: Fill out: the blank, Form W - 4 ( Step 2 - b ) , Form 2 0 2 3 Estimated Tax Worksheet, Form W

Fill out: the blank, Form WStep b Form Estimated Tax Worksheet, Form Wbox : Federal Income Tx withheld Form Form

Step bMultiple Jobs Worksheet Keep for your records.

If you choose the option in Step b on Form W complete this worksheet which calculates the total extra tax for all jobs on only ONE Form W Withholding will be most accurate if you complete the worksheet and enter the result on the Form W for the highest paying job. To be accurate, submit a new Form W for all other jobs if you have not updated your withholding since

Note: If more than one job has annual wages of more than $ or there are more than three jobs, see Pub. for additional tables.

Two jobs. If you have two jobs or you're married filing jointly and you and your spouse each have one job, find the amount from the appropriate table on page Using the "Higher Paying Job" row and the "Lower Paying Job" column, find the value at the intersection of the two household salaries and enter that value on line Then, skip to line

Three jobs. If you andor your spouse have three jobs at the same time, complete lines ab and c below. Otherwise, skip to line

a Find the amount from the appropriate table on page using the annual wages from the highest paying job in the "Higher Paying Job" row and the annual wages for your next highest paying job in the "Lower Paying Job" column. Find the value at the intersection of the two household salaries and enter that value on line a

b Add the annual wages of the two highest paying jobs from line a together and use the total as the wages in the "Higher Paying Job" row and use the annual wages for your third job in the "Lower Paying Job" column to find the amount from the appropriate table on page and enter this amount on line b

c Add the amounts from lines a and b and enter the result on line c

Enter the number of pay periods per year for the highest paying job. For example, if that job pays weekly, enter ; if it pays every other week, enter ; if it pays monthly, enter etc.

Divide the annual amount on line or line c by the number of pay periods on line Enter this amount here and in Step c of Form W for the highest paying job along with any other additional amount you want withheld

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock