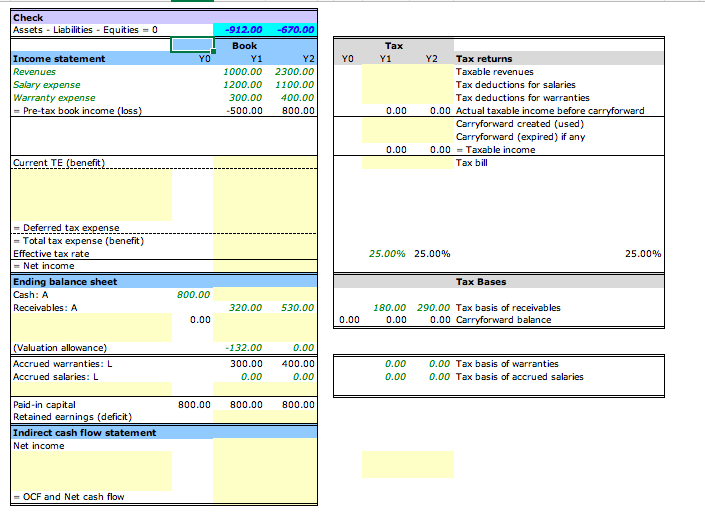

Question: Fill out the excel below: Check Assets - Liabilities - Equities = 0 -670.00 Tax Y1 YO YO Income statement Revenues Salary expense Warranty expense

Fill out the excel below:

Check Assets - Liabilities - Equities = 0 -670.00 Tax Y1 YO YO Income statement Revenues Salary expense Warranty expense | = Pre-tax book income (loss) -912.00 Book Y1 1000.00 1200.00 300.00 -500.00 Y2 2300.00 1100.00 400.00 800.00 0.00 Y2 Tax returns Taxable revenues Tax deductions for salaries Tax deductions for warranties 0.00 Actual taxable income before carryforward Carryforward created (used) Carryforward (expired) if any 0.00 - Taxable income Tax bill 0.00 Current TE (benefit) 25.00% 25.00% 25.00% - Deferred tax expense - Total tax expense (benefit) Effective tax rate = Net income Ending balance sheet Cash: A Receivables: A Tax Bases 800.00 320.00 530.00 180.00 290.00 Tax basis of receivables 0.00 0.00 Carryforward balance 0.00 0.00 (Valuation allowance) Accrued warranties: L Accrued salaries: L -132.00 300.00 0.00 0.00 400.00 0.00 0.00 0.00 0.00 Tax basis of warranties 0.00 Tax basis of accrued salaries 800.00 800.00 800.00 Paid-in capital Retained earnings (deficit) Indirect cash flow statement Net income OCF and Net cash flow Check Assets - Liabilities - Equities = 0 -670.00 Tax Y1 YO YO Income statement Revenues Salary expense Warranty expense | = Pre-tax book income (loss) -912.00 Book Y1 1000.00 1200.00 300.00 -500.00 Y2 2300.00 1100.00 400.00 800.00 0.00 Y2 Tax returns Taxable revenues Tax deductions for salaries Tax deductions for warranties 0.00 Actual taxable income before carryforward Carryforward created (used) Carryforward (expired) if any 0.00 - Taxable income Tax bill 0.00 Current TE (benefit) 25.00% 25.00% 25.00% - Deferred tax expense - Total tax expense (benefit) Effective tax rate = Net income Ending balance sheet Cash: A Receivables: A Tax Bases 800.00 320.00 530.00 180.00 290.00 Tax basis of receivables 0.00 0.00 Carryforward balance 0.00 0.00 (Valuation allowance) Accrued warranties: L Accrued salaries: L -132.00 300.00 0.00 0.00 400.00 0.00 0.00 0.00 0.00 Tax basis of warranties 0.00 Tax basis of accrued salaries 800.00 800.00 800.00 Paid-in capital Retained earnings (deficit) Indirect cash flow statement Net income OCF and Net cash flow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts