Question: Fill out this table based on the following information: Instructions: You are a Manager of Accounting, with six employees reporting to you: Employee Position Jessica

Fill out this table based on the following information:

Instructions: You are a Manager of Accounting, with six employees reporting to you: Employee Position Jessica Senior Financial Analyst Mike Senior Financial Analyst Russ Financial Analyst Bob Financial Analyst Megan Associate Financial Analyst Joyce Sr. Admin Associate You are working on your salary plan for the upcoming year. Assume that the years merit guideline is 4.0%, with an additional 2.5% for other adjustments. Attached are brief profiles of Jessica, Mike, Russ, Bob, Megan, and Joyce. Please read the profiles, and then answer the three questions on the worksheet that follows the case.

Jessica - Senior Financial Analyst

Jessica has been in her position for 3 years, and with the company for 9. This year she completed her MBA/Finance. Jessica has maintained a high level of productivity in the department. The Sales and Marketing divisions, which she supports, have frequently commented on her outstanding contributions. Within the department, she is often called upon as a problem-solver. Your evaluation of Jessicas performance might have been Outstanding except for her occasional reluctance to contribute in meetings. You have decided to rate her as Exceeding Job Standards, and if her participation in meetings improves, will recommend her for promotion to Accounting Manager in the coming year. Market Data: $55,000 - $72,500 - $90,000 Current Salary: $70,500 (5th decile) Time in Position: 3 years Performance Rating: 8 Potential Rating: 3

Mike - Senior Financial Analyst

Mike is a long-service employee. He has been in his current position for 17 years and with the company for 25. He is productive and well thought of in the department. Because of his experience, everyone relies on him, especially at year-end closing time. Mike is a stabilizing influence and is frequently called upon to train new employees. The divisions he supports regard him favorably and often comment on his ability to get things done. He willingly learned the new computer programs, and even though he has a heavy workload, he takes on additional tasks when requested. Mike is content in his position and has told you that he is not interested in assuming any managerial responsibilities. You have evaluated Mikes performance as Meeting Job Standards. Market Data: $55,000 - $72,500 - $90,000 Current Salary: $82,000 (8th decile) Time in Position: 17 years Performance Rating: 6 Potential Rating: 2

Russ - Financial Analyst

You hired Russ in July. He arrived just in time to become involved in the budget preparation review. Russ worked for four years with a smaller company in a non-related industry; he needs to become familiar with the jobs requirements and expectations. He has, however, already mastered the computer programs, made suggestions for improvements, and demonstrated solid knowledge of accounting principles. You have evaluated his performance to date as Meeting Job Standards. Market Data: $44,000 - $57,500 - $71,000 Current Salary: $52,000 (4th decile) Time in Position: 5 months Performance Rating: 4 Potential Rating: Too New to Rate

Bob Financial Analyst

Bob has been in his current position for three years. He came to the company six years ago directly from college. Bob has had ongoing performance problems. You hoped that after last years discussion, a performance evaluation of (barely) Meeting Expectations, and ongoing coaching and feedback throughout the year, he would improve. This has not happened; rather, his performance has deteriorated further. The problem is not insufficient technical ability. Bob has a good understanding of the departments processes. You have observed, however, that he does not seem willing to take responsibility for the accuracy and timeliness of his work. When corrected or confronted, he becomes defensive -- usually blaming a co-worker for providing insufficient or wrong data. This has not been found to be factual. In your most recent evaluation, you rated Bobs performance as Needs Improvement. You now need to decide what to do about a merit salary increase. You are aware that Bobs salary is low in the market data. Market Data: $44,000 - $57,500 - $71,000 Current Salary: $48,000 (2nd decile) Time in Position: 3 years Performance Rating: 3 Potential Rating: 1

Megan - Associate Financial Analyst

Megan was promoted into her present position a year ago from a position as a Senior Accounting Clerk. This year, she completed her undergraduate degree in Accounting. Megans work is always accurate, and she completes many assignments prior to the deadlines. Her willingness to help others is very much appreciated, as is her desire to take on new responsibilities. You believe she has excellent potential and want to encourage her, as well as assist in her development. In your estimation, she has progressed favorably and is beginning to demonstrate a solid understanding of the basics of financial analysis. You have evaluated Megans performance as Meeting Job Expectations. Market Data: $37,000 - $48,000 - $59,000 Current Salary: $42,000 (3rd decile) Time in Position: 1.5 years Performance Rating: 5 Potential Rating: 2

Joyce Sr. Admin Associate

Joyce has been in her position for 7 years, and with the company for 30 years. She has graduated from a professional school. She maintains a high level of productivity in overall coordination and administration of functions for the department. She generally supports all of the associates in the department and knows where to go for information or materials on short notice. Your evaluation of Joyces performance would have been higher, but she still has not learned the latest software that has been set as a standard for the Corporation. You have decided to rate her at a mid level of Meeting Job Standards. Market Data: $33,000 - $42,500 - $52,000 Current Salary: $48,000 (8th decile) Time in Position: 7 years Performance Rating: 5 Potential Rating: n/a

Fill out this table based on the following information:

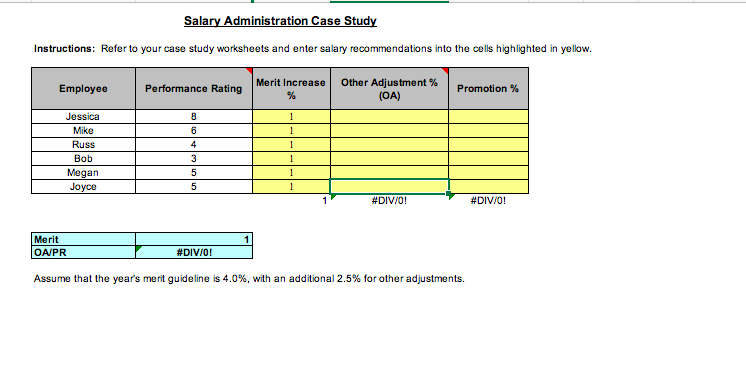

Salary Administration Case Study Instructions: Refer to your case study worksheets and enter salary recommendations into the cells highlighted in yellow. Assume that the year's merit guideline is 4.0%, with an additional 2.5% for other adjustments. Salary Administration Case Study Instructions: Refer to your case study worksheets and enter salary recommendations into the cells highlighted in yellow. Assume that the year's merit guideline is 4.0%, with an additional 2.5% for other adjustments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts