Question: Fill out using the same format as the table below. I will also post an example at the bottom of the page for added reference.

Fill out using the same format as the table below. I will also post an example at the bottom of the page for added reference.

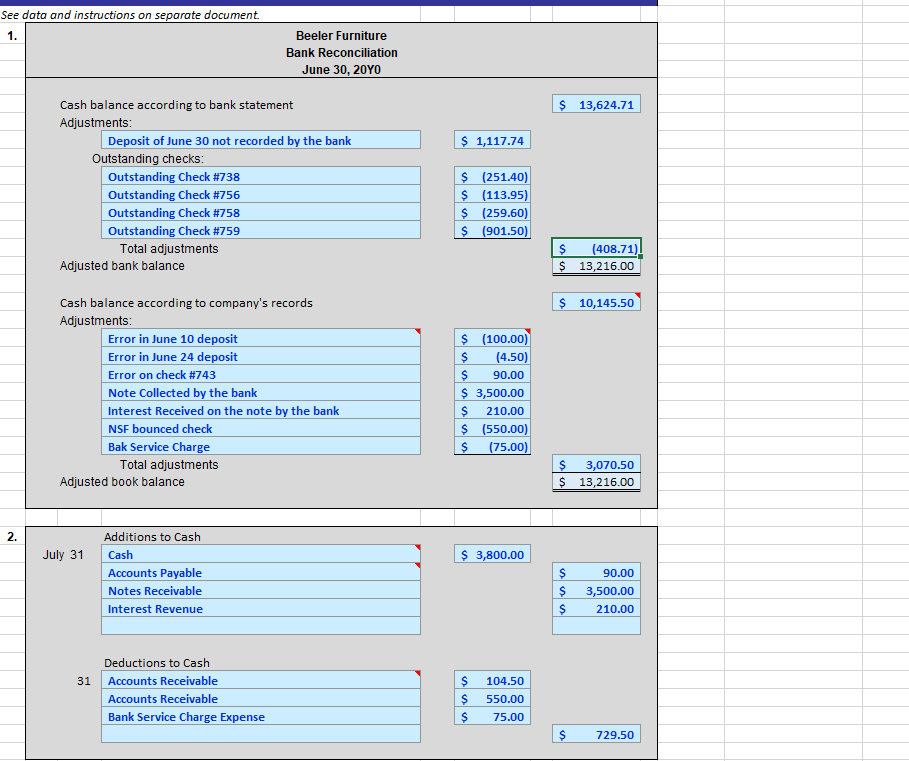

Example:

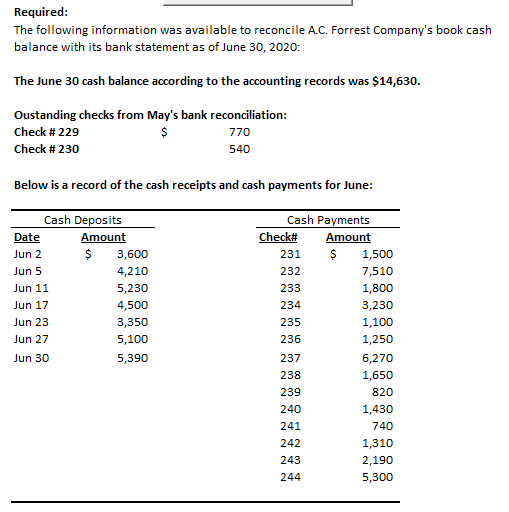

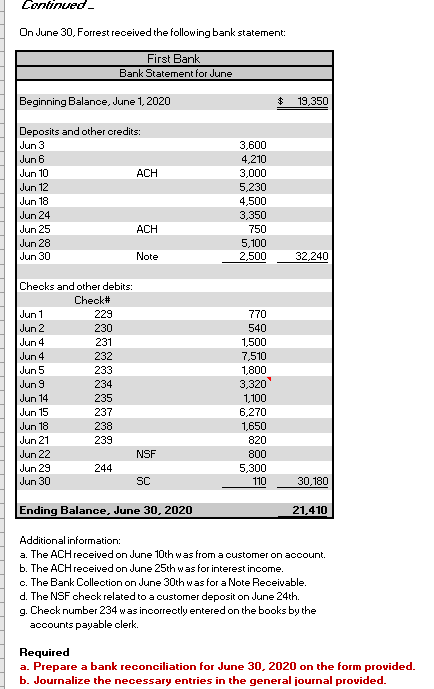

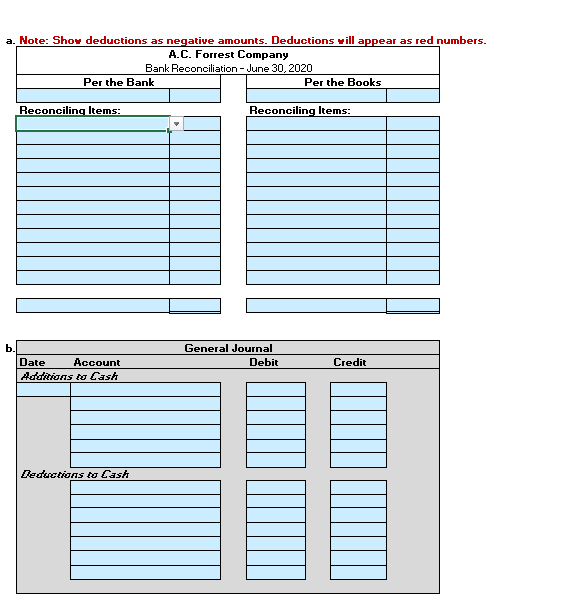

The following information was available to reconcile A.C. Forrest Company's book cash balance with its bank statement as of June 30, 2020: The June 30 cash balance according to the accounting records was $14,630. Below is a record of the cash receipts and cash payments for June: Dn June 30 . Forrest received the followina bank statement: dditional information: a. The ACH received on June 10th was from a customer on account. b. The ACH received on June 25 th was for interest income. c. The Bank Collection on June 30th was for a Note Receivable. d. The NSF oheok related to a oustomer deposit on June 24 th. g. Check number 234 was incorrectly entered on the books by the acoounts payable olerk. Required a. Prepare a bank reconciliation for June 30,2020 on the form prouided. b. Journalize the necessary entries in the general journal prouided. a. Mote: Show deductions as negative amounts. Deductions will appear as red numbers. \begin{tabular}{|l|l|} \hline \multicolumn{2}{|c|}{ A.C. Forres } \\ \hline \multicolumn{2}{|c|}{ Bank Reconciliztion- } \\ \hline Peconciling ltems: & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline \end{tabular} Reconciling Items: \begin{tabular}{|l|l|} \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline \end{tabular} b. See data and instructions on separate document. $13,624.71 \begin{tabular}{|lc|} \hline$ & (408.71) \\ \hline \hline & 13,216.00 \\ \hline \hline \end{tabular} Total adjustments \begin{tabular}{|lr|} \hline$(75.00) & $3,070.50 \\ \hline$13,216.00 \\ \hline \hline \end{tabular} Adjusted book balance \begin{tabular}{|l|l|} \hline \multirow{4}{*}{ July 31} & Additions to Cash \\ & Cash \\ \hline & Accounts Payable \\ \hline & Notes Receivable \\ \hline & Interest Revenue \\ \hline & \\ \hline \end{tabular} $10,145.50 Deductions to Cash \begin{tabular}{|l|l|lr|} \hline Accounts Receivable & $ & 104.50 \\ \hline Accounts Receivable & $550.00 \\ \hline Bank Service Charge Expense & $ & 75.00 \\ \hline \end{tabular} \begin{tabular}{|lr|} \hline$ & 90.00 \\ \hline$ & 3,500.00 \\ \hline$ & 210.00 \\ \hline & \\ \hline$ & 729.50 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts