Question: Fill the form Check my work 1 Problem 19-1 Use the financial statements of Heifer Sports Inc. to find the information below for Heifer. (Use

Fill the form

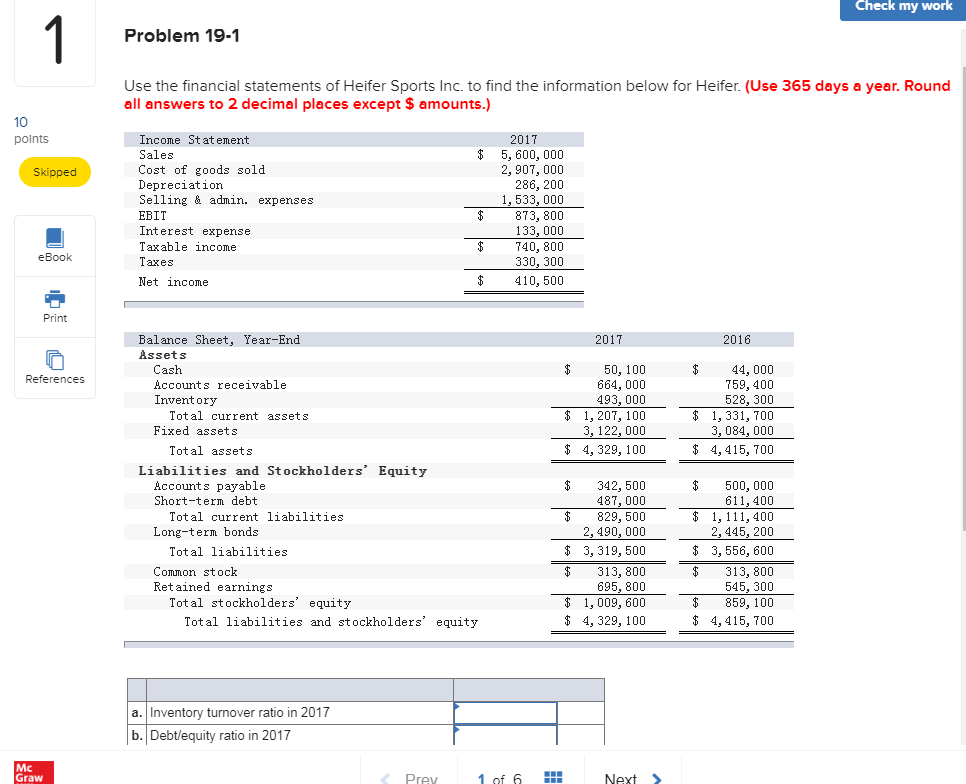

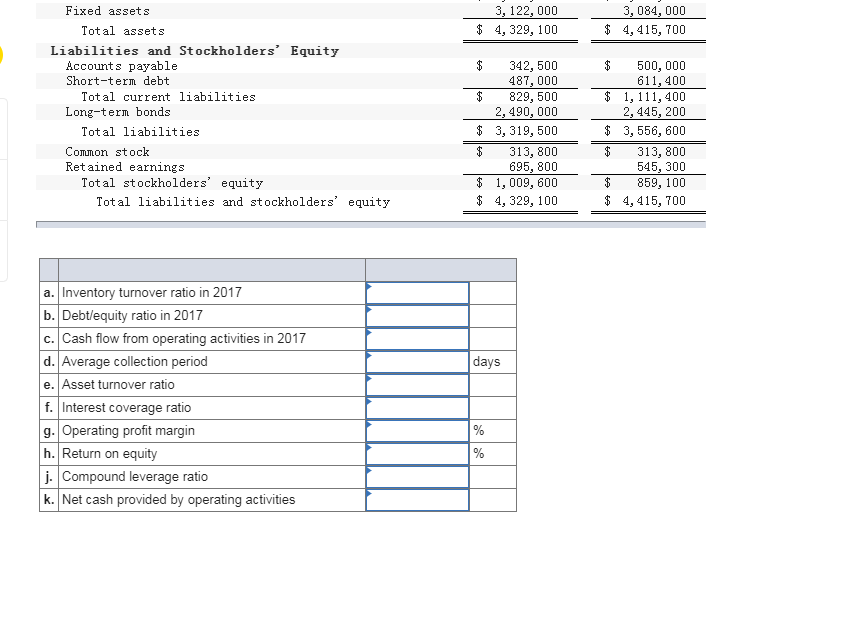

Check my work 1 Problem 19-1 Use the financial statements of Heifer Sports Inc. to find the information below for Heifer. (Use 365 days a year. Round all answers to 2 decimal places except $ amounts.) 10 points Skipped Income Statement Sales Cost of goods sold Depreciation Selling & admin. expenses EBIT Interest expense Taxable income Taxes Net income 2017 $ 5,600,000 2,907,000 286, 200 1, 533,000 $ 873, 800 133,000 $ 740, 800 330, 300 410,500 eBook Print 2017 2016 o. GA es References 50, 100 664,000 493, 000 $ 1,207, 100 3, 122,000 $ 4,329, 100 44,000 759,400 528,300 $ 1,331, 700 3,084,000 $ 4,415, 700 Balance Sheet, Year-End Assets Cash Accounts receivable Inventory Total current assets Fixed assets Total assets Liabilities and Stockholders' Equity Accounts payable Short-term debt Total current liabilities Long-term bonds Total liabilities Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity $ 342,500 487,000 $ 829,500 2,490,000 $ 3,319,500 $ 313, 800 695, 800 $ 1,009, 600 $ 4,329, 100 500,000 611,400 $ 1,111,400 2,445, 200 $ 3,556, 600 313,800 545, 300 $ 859, 100 $ 4,415, 700 $ a. Inventory turnover ratio in 2017 b. Debt/equity ratio in 2017 Mc Graw Prev 1 of 6 HE Next 3, 122,000 $ 4, 329, 100 3,084,000 $ 4,415, 700 Fixed assets Total assets Liabilities and Stockholders' Equity Accounts payable Short-term debt Total current liabilities Long-term bonds Total liabilities Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity $ 342,500 487,000 829, 500 2,490,000 $ 3,319,500 $ 313, 800 695, 800 $ 1,009, 600 $ 4,329, 100 $ 500,000 611,400 $ 1,111,400 2,445, 200 $ 3,556, 600 313, 800 545, 300 $ 859, 100 $ 4,415, 700 $ days a. Inventory turnover ratio in 2017 b. Debt/equity ratio in 2017 C. Cash flow from operating activities in 2017 d. Average collection period e. Asset turnover ratio f. Interest coverage ratio g. Operating profit margin h. Return on equity j. Compound leverage ratio k. Net cash provided by operating activities % %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts