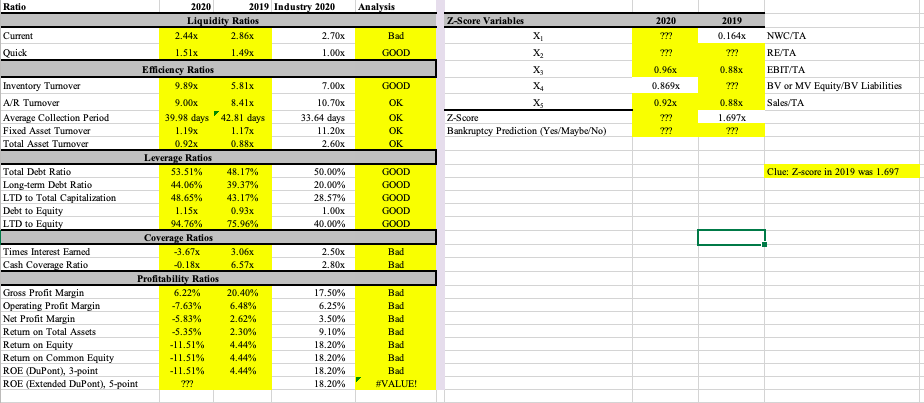

Question: fill up yellow cells that has question mark using formulas. Rocker Farms Income Statements For the Years 2019 and 2020 2020 Sales $370,000 Cost of

fill up yellow cells that has question mark using formulas.

fill up yellow cells that has question mark using formulas.

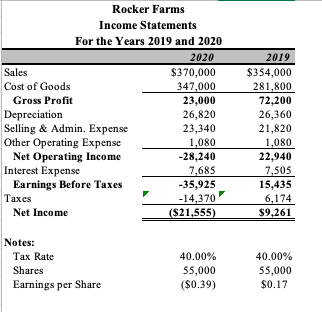

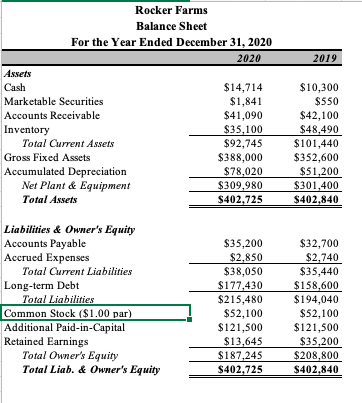

Rocker Farms Income Statements For the Years 2019 and 2020 2020 Sales $370,000 Cost of Goods 347,000 Gross Profit 23,000 Depreciation 26,820 Selling & Admin. Expense 23,340 Other Operating Expense 1,080 Net Operating Income -28,240 Interest Expense 7,685 Earnings Before Taxes -35,925 Taxes -14,370 Net Income ($21,555) 2019 $354,000 281,800 72,200 26,360 21,820 1,080 22,940 7,505 15,435 6,174 $9,261 Notes: Tax Rate Shares Earnings per Share 40.00% 55,000 ($0.39) 40.00% 55,000 $0.17 2019 Rocker Farms Balance Sheet For the Year Ended December 31, 2020 2020 Assets Cash $14,714 Marketable Securities $1,841 Accounts Receivable $41,090 Inventory $35,100 Total Current Assets $92,745 Gross Fixed Assets $388,000 Accumulated Depreciation $78,020 Net Plant & Equipment $309,980 Total Assets $402,725 $10,300 $550 $42,100 $48,490 $101,440 $352,600 $51,200 $301,400 $402,840 Liabilities & Owner's Equity Accounts Payable Accrued Expenses Total Current Liabilities Long-term Debt Total Liabilities Common Stock ($1.00 par) Additional Paid-in-Capital Retained Earnings Total Owner's Equity Total Liab. & Owner's Equity $35,200 $2,850 $38,050 $177,430 $215,480 $52,100 $121,500 $13,645 $187,245 $402,725 $32,700 $2,740 $35,440 $158,600 $194,040 $52,100 $121,500 $35,200 $208,800 $402,840 Analysis Z-Score Variables 2019 0.164x Bad 2020 ?!? ?!? X GOOD 0.88x 0.96x 0.869x NWC/TA RETA EBIT/TA BV or MV Equity/BV Liabilities Sales/TA GOOD OK OK OK X X z Score Bankruptcy Prediction (Yes/Maybe/No) 0.92x ??? 0.88x 1.697x ??? OK Clue: Z-score in 2019 was 1.697 Ratio 2020 2019 Industry 2020 Liquidity Ratios Current 2.44x 2.86% 2.70x Quick 1.51x 1.49x 1.00 Efficiency Ratios Inventory Tumover 9.89% 5.81x 7.00x A/R Tumover 9.00x 8.41x 10.70x Average Collection Period 39.98 days 42.81 days 33.64 days Fixed Asset Tumover 1.19x 1.17x 11.20x Total Asset Tumover 0.92% 0.88 2.60% Leverage Ratios Total Debt Ratio 53.51% 48.17% 50.00% Long-term Debt Ratio 44.06% 39.37% 20.00% LTD to Total Capitalization 48.65% 43.17% 28.57% Debt to Equity 1.15x 0.93x 1.00x LTD to Equity 94.76% 75.96% 40.00% Coverage Ratios Times Interest Earned -3.67x 3.06x 2.S0x Cash Coverage Ratio -0.18x 6.57x 2.80x Profitability Ratios Gross Profit Margin 6.22% 20.40% 17.50% Operating Profit Margin -7.63% 6.48% 6.25% Net Profit Margin -5.83% 2.62% 3.50% Return on Total Assets -5.35% 2.30% 9.10% Retum on Equity -11.51% 4.44% 18.20% Return on Common Equity -11.51% 4.44% 18.20% ROE (DuPont), 3-point -11.51% 4.44% 18.20% ROE (Extended DuPont), 5-point ??? 18.20% GOOD GOOD GOOD GOOD GOOD Bad Bad Bad Bad Bad Bad Bad Bad Bad #VALUE! Rocker Farms Income Statements For the Years 2019 and 2020 2020 Sales $370,000 Cost of Goods 347,000 Gross Profit 23,000 Depreciation 26,820 Selling & Admin. Expense 23,340 Other Operating Expense 1,080 Net Operating Income -28,240 Interest Expense 7,685 Earnings Before Taxes -35,925 Taxes -14,370 Net Income ($21,555) 2019 $354,000 281,800 72,200 26,360 21,820 1,080 22,940 7,505 15,435 6,174 $9,261 Notes: Tax Rate Shares Earnings per Share 40.00% 55,000 ($0.39) 40.00% 55,000 $0.17 2019 Rocker Farms Balance Sheet For the Year Ended December 31, 2020 2020 Assets Cash $14,714 Marketable Securities $1,841 Accounts Receivable $41,090 Inventory $35,100 Total Current Assets $92,745 Gross Fixed Assets $388,000 Accumulated Depreciation $78,020 Net Plant & Equipment $309,980 Total Assets $402,725 $10,300 $550 $42,100 $48,490 $101,440 $352,600 $51,200 $301,400 $402,840 Liabilities & Owner's Equity Accounts Payable Accrued Expenses Total Current Liabilities Long-term Debt Total Liabilities Common Stock ($1.00 par) Additional Paid-in-Capital Retained Earnings Total Owner's Equity Total Liab. & Owner's Equity $35,200 $2,850 $38,050 $177,430 $215,480 $52,100 $121,500 $13,645 $187,245 $402,725 $32,700 $2,740 $35,440 $158,600 $194,040 $52,100 $121,500 $35,200 $208,800 $402,840 Analysis Z-Score Variables 2019 0.164x Bad 2020 ?!? ?!? X GOOD 0.88x 0.96x 0.869x NWC/TA RETA EBIT/TA BV or MV Equity/BV Liabilities Sales/TA GOOD OK OK OK X X z Score Bankruptcy Prediction (Yes/Maybe/No) 0.92x ??? 0.88x 1.697x ??? OK Clue: Z-score in 2019 was 1.697 Ratio 2020 2019 Industry 2020 Liquidity Ratios Current 2.44x 2.86% 2.70x Quick 1.51x 1.49x 1.00 Efficiency Ratios Inventory Tumover 9.89% 5.81x 7.00x A/R Tumover 9.00x 8.41x 10.70x Average Collection Period 39.98 days 42.81 days 33.64 days Fixed Asset Tumover 1.19x 1.17x 11.20x Total Asset Tumover 0.92% 0.88 2.60% Leverage Ratios Total Debt Ratio 53.51% 48.17% 50.00% Long-term Debt Ratio 44.06% 39.37% 20.00% LTD to Total Capitalization 48.65% 43.17% 28.57% Debt to Equity 1.15x 0.93x 1.00x LTD to Equity 94.76% 75.96% 40.00% Coverage Ratios Times Interest Earned -3.67x 3.06x 2.S0x Cash Coverage Ratio -0.18x 6.57x 2.80x Profitability Ratios Gross Profit Margin 6.22% 20.40% 17.50% Operating Profit Margin -7.63% 6.48% 6.25% Net Profit Margin -5.83% 2.62% 3.50% Return on Total Assets -5.35% 2.30% 9.10% Retum on Equity -11.51% 4.44% 18.20% Return on Common Equity -11.51% 4.44% 18.20% ROE (DuPont), 3-point -11.51% 4.44% 18.20% ROE (Extended DuPont), 5-point ??? 18.20% GOOD GOOD GOOD GOOD GOOD Bad Bad Bad Bad Bad Bad Bad Bad Bad #VALUE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts