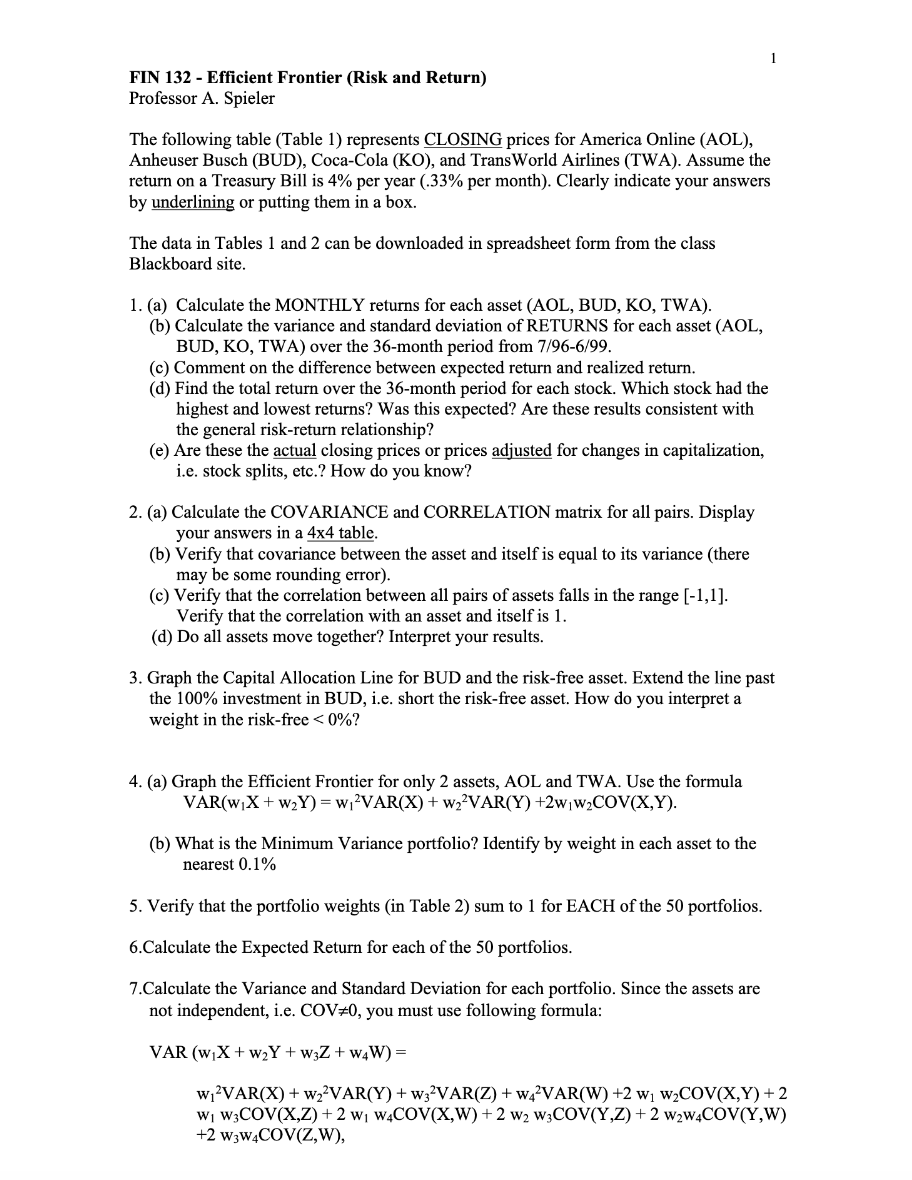

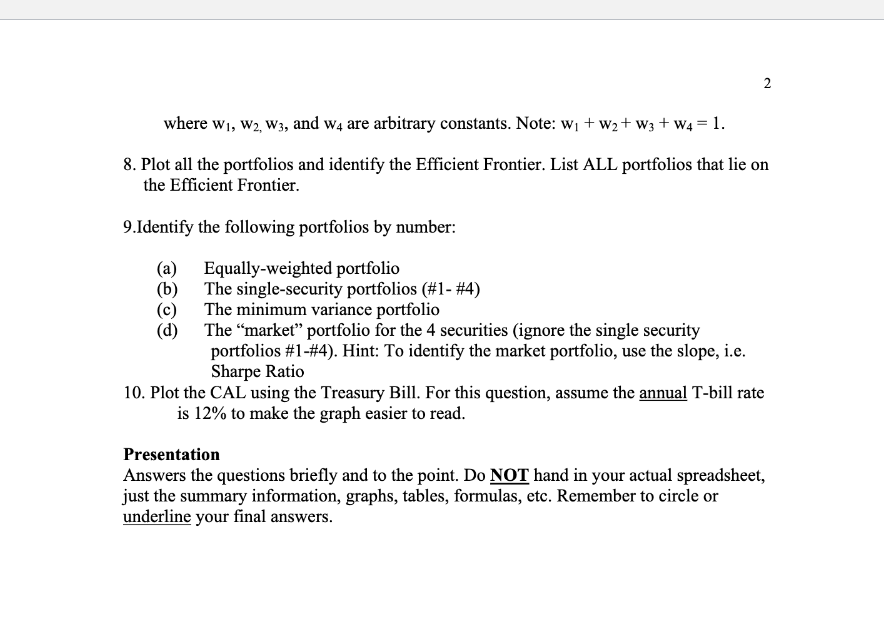

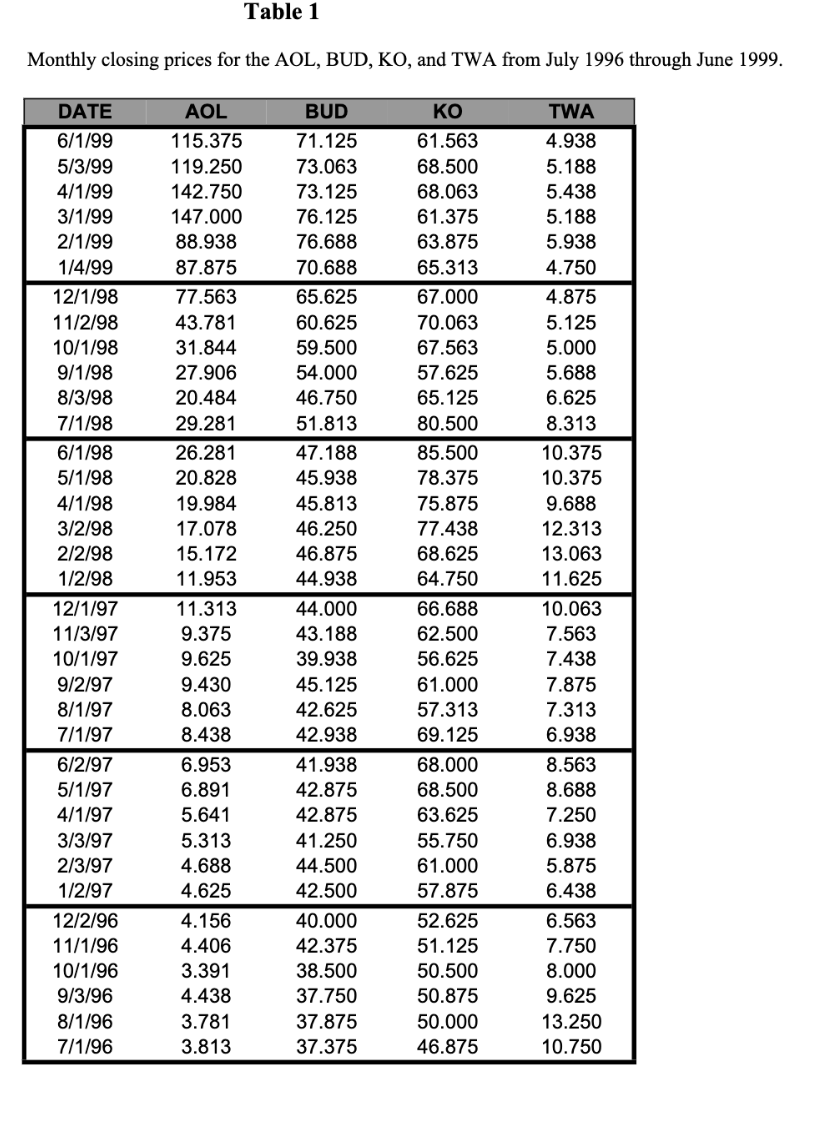

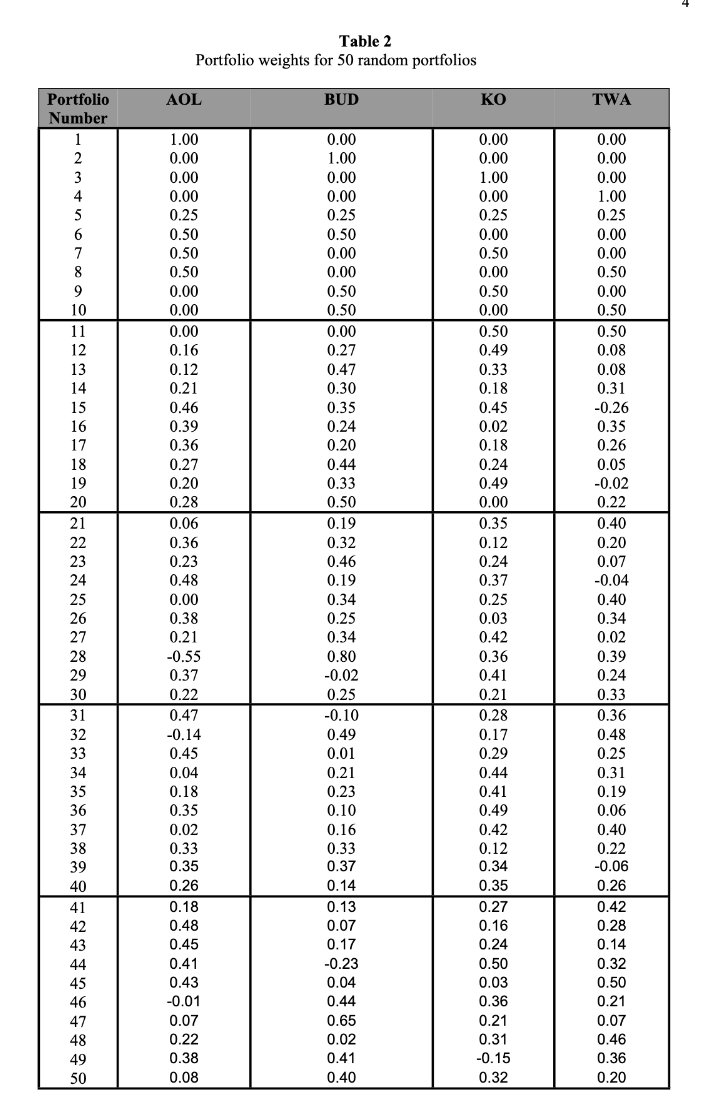

Question: FIN 132 - Efficient Frontier (Risk and Return) Professor A. Spieler The following table (Table 1) represents CLOSING prices for America Online (AOL), Anheuser Busch

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts