Question: FIN 200 Assignment 2 Spring 2021 Answer the following questions and show mathematical calculations in detail: 1. Bond Valuation and Interest Rate Risk: The Garraty

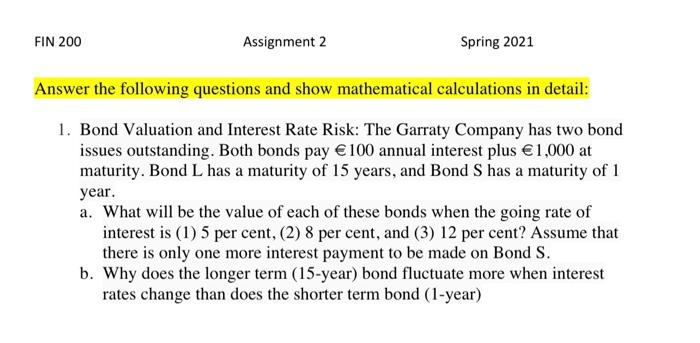

FIN 200 Assignment 2 Spring 2021 Answer the following questions and show mathematical calculations in detail: 1. Bond Valuation and Interest Rate Risk: The Garraty Company has two bond issues outstanding. Both bonds pay 100 annual interest plus 1,000 at maturity. Bond L has a maturity of 15 years, and Bond S has a maturity of 1 year. a. What will be the value of each of these bonds when the going rate of interest is (1) 5 per cent, (2) 8 per cent, and (3) 12 per cent? Assume that there is only one more interest payment to be made on Bond S. b. Why does the longer term (15-year) bond fluctuate more when interest rates change than does the shorter term bond (1-year)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts