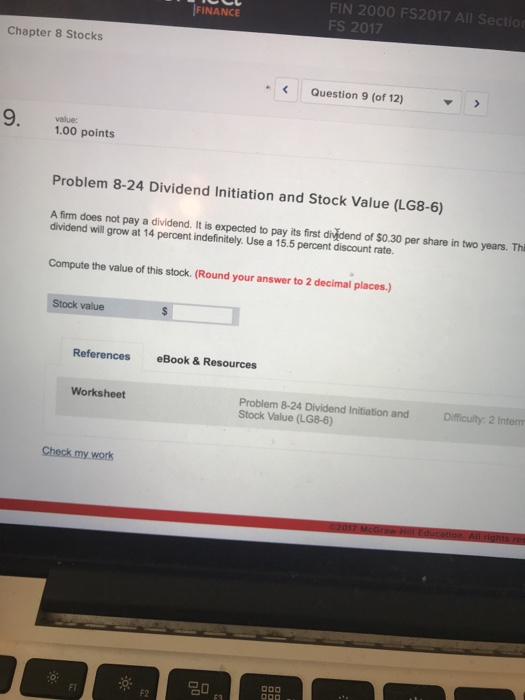

Question: FIN 2000 FS2017 All Section FINANCE 17 Chapter 8 Stocks Question 9 (of 12) 9 value 1.00 points Problem 8-24 Dividend Initiation and Stock Value

FIN 2000 FS2017 All Section FINANCE 17 Chapter 8 Stocks Question 9 (of 12) 9 value 1.00 points Problem 8-24 Dividend Initiation and Stock Value (LG8-6) A firm does not pay a dividend. It is expected to pay its first divjdend of $0.30 per share in two years. Thi dividend will grow at 14 percent indefinitely. Use a 15.5 percent discount rate. Compute the value of this stock. (Round your answer to 2 decimal places.) Stock value References eBook&Resources Worksheet Problem 8-24 Dividend Initiation and Difficulity: 2 Interm Stock Value (LG8-6) : FT F2

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock