Question: FIN 201 Investing Fall 2015 Project 1. Select Asset Allocation (1 point) Refer to the asset allocation table in appendix A. Note the three different

FIN 201 Investing Fall 2015

Project 1. Select Asset Allocation (1 point)

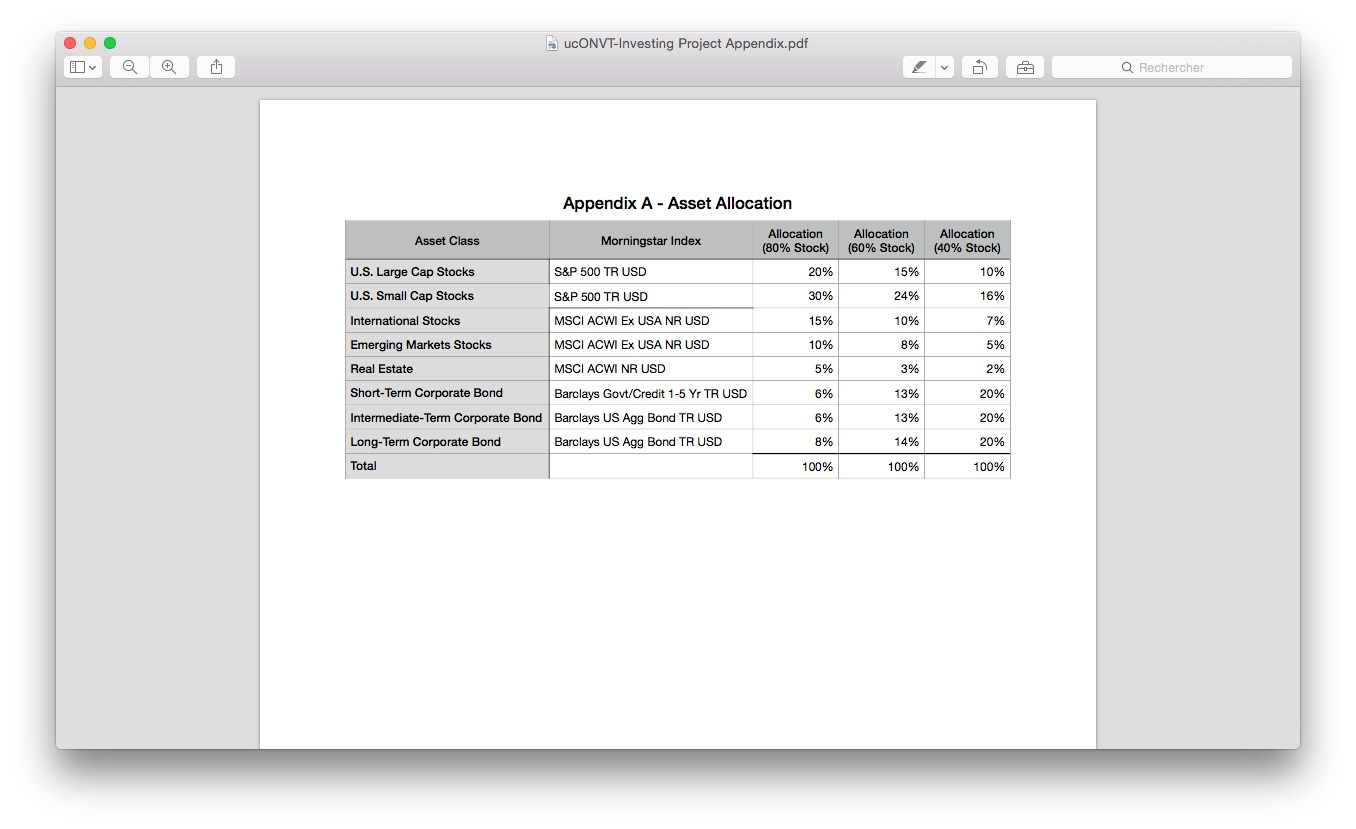

Refer to the asset allocation table in appendix A. Note the three different allocation strategies based on allocations of 80%, 60% and 40% to stocks, with the remainder allocated to bonds (real estate is classified with stocks).

Identify which asset allocation strategy you believe is best for your situation. Explain your answer.

2. Select Mutual Funds or ETFs (1 point)

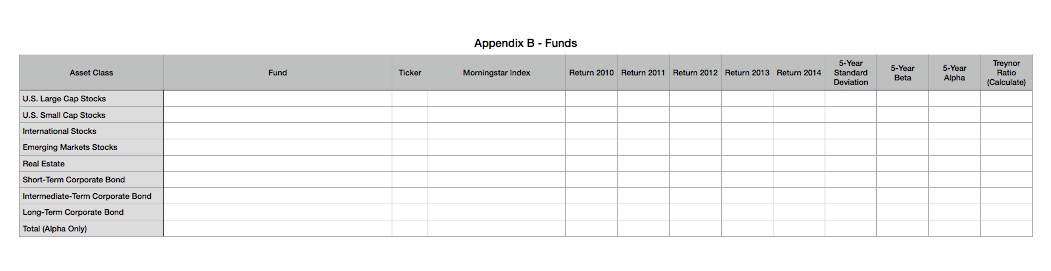

Refer to the Funds table in appendix B. Using any stock picker (consider morningstar.com if you dont know of one), select one mutual fund or ETF for each asset class (no individual stocks or bonds). Note that appendix D - Benchmark Funds, provides an example of the required data.

a) Identify the name of the fund.

b) Identify the ticker symbol.

c) Using morningstar.com, identify returns for 2010 through 2014 for each fund (this

data is on the performance tab). If the fund does not have 5 years of data, select a

different fund.

d) Using morninstar.com, identify the Morningstar comparison index, as well as the 5- Year standard deviation, beta and alpha for each fund (this data is on the Ratings & Risk tab under the MPT Statistics section).

e) Total the alpha column.

f) Calculate the average Treynor ratio for all 5 years for each fund using 0.8% as the

risk-free rate of return. Do not use the Treynor ratios found on Morningstar.

3. Create a Portfolio (1 point)

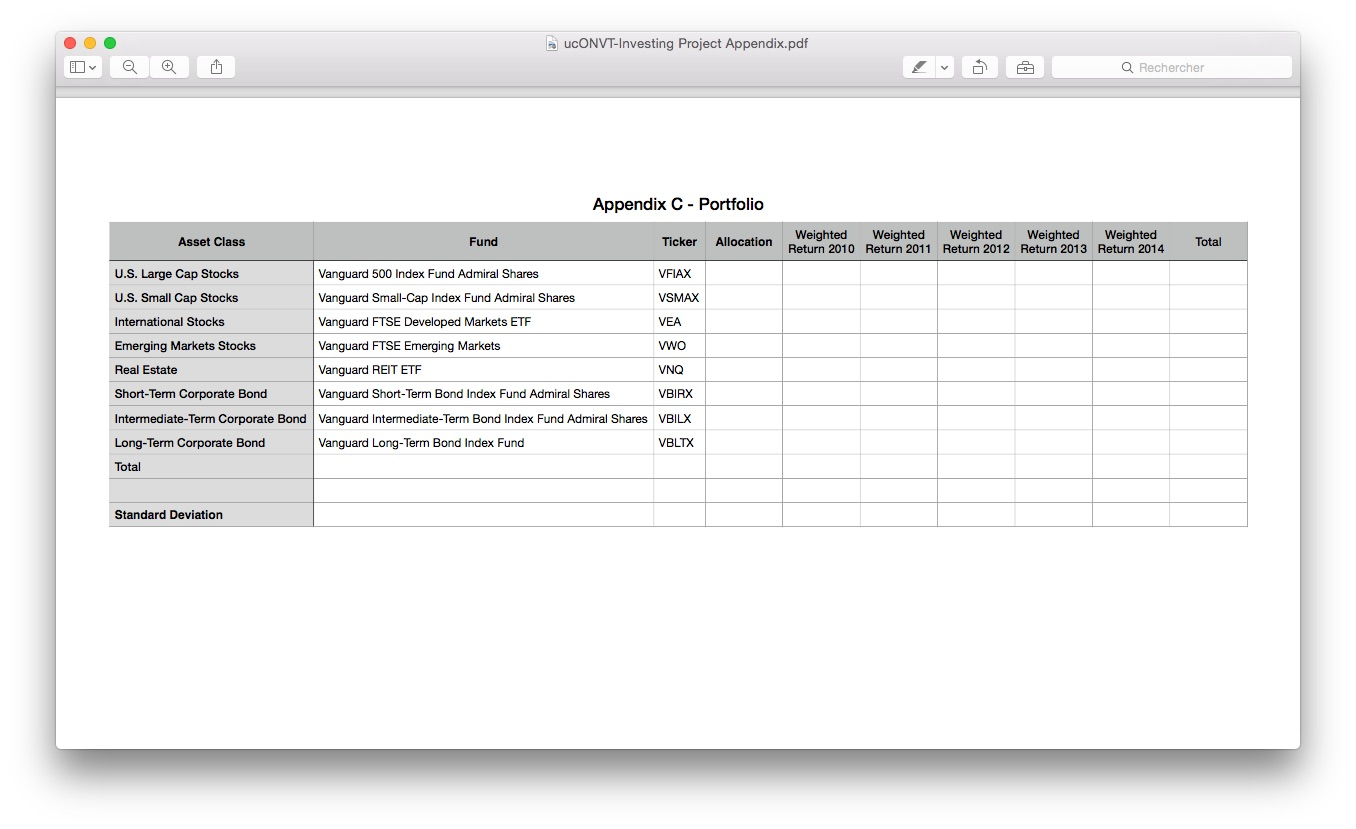

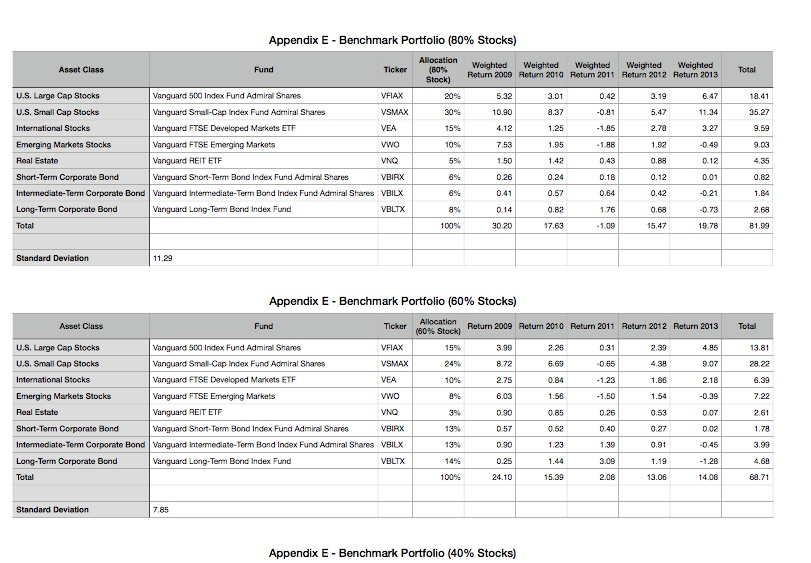

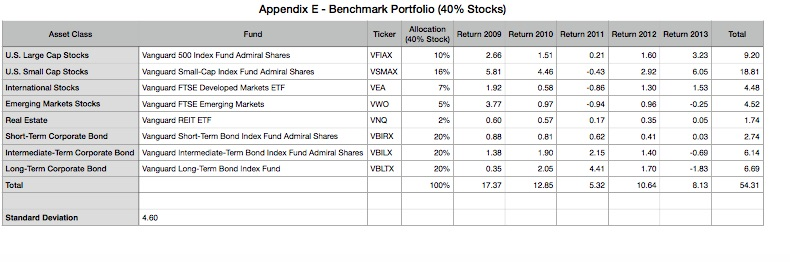

Refer to the Portfolio table in appendix C. Create a portfolio containing (note that appendix E - Benchmark Portfolios provides examples of required data):

a) Identify the name of the fund and ticker from item 2 above.

b) Identify the percent allocation you selected for each asset class/fund from item 1

above.

Page !1 of !2

FIN 201 Investing Fall 2015

c) Calculate the weighted returns for 2010 through 2014 (multiply the percent allocation by the fund performance identified in item 2).

d) Calculate the total return for each year (e.g., the total for 2010, 2011, etc.), as well as the total weighted return for each fund.

e) Calculate the standard deviation of the total returns for 2010 through 2014. You can use the STDEV spreadsheet function, for example =STDEV(E10:I10). Or you can use an online standard deviation calculator such as https:// www.easycalculation.com/statistics/standard-deviation.php.

Extra Credit 4. Analyze Portfolio Performance (4 points)

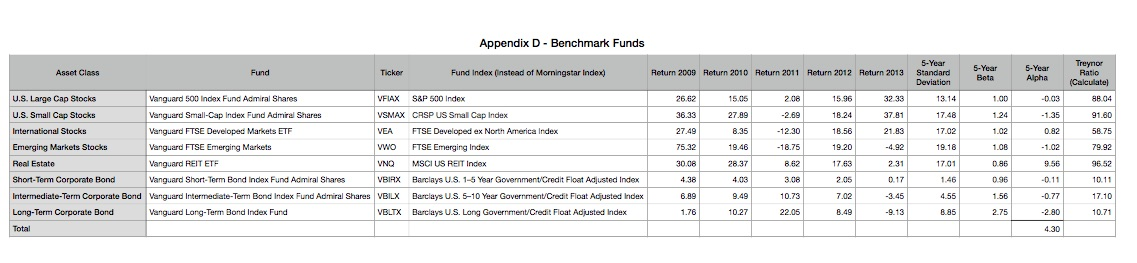

Refer to the Benchmark Fund and Benchmark Portfolios tables in appendix D and E. The funds used in these portfolios are passively managed mutual funds and ETFs by Vanguard. Please do not consider this to be an endorsement of any kind of Vanguard.

Conduct the following analysis:

a) How did the overall returns of your portfolio compare to the returns of the benchmark portfolio? Which funds in your portfolio notably outperformed and underperformed the corresponding funds in the benchmark portfolio?

b) How did the overall risk of your portfolio, as measured by the standard deviation, compare to the benchmark portfolio?

c) Overall, did the fund managers outperform or underperform their benchmarks as measured by alpha? How many outperformed their Morningstar index and how many underperformed their Morningstar index?

d) Comparing the Treynor ratio for each fund in your portfolio to the fund in the benchmark portfolio of the same asset class, which funds in your portfolio had the better risk-adjusted returns? Which funds had the worse risk-adjusted returns?

Page !2 of !2

.ucONVT-Investing Project Appendix.pdf Q Rechercher Appendix A - Asset Allocation Allocation Allocation Allocation (8096 Stock) (60% Stock) (40% Stock) Morningstar Index Asset Class 20% 30% 15% 10% 5% 6% 6% 8% 100% 15% 24% 10% 8% 3% 13% 13% 14% 100% 10% 16% 796 5% 296 | 20% 20% 20% 100% S&P 500 TR USD U.S. Large Cap Stocks U.S. Small Cap Stocks International Stocks Emerging Markets Stocks Real Estate Short-Term Corporate Bond Intermediate-Term Corporate Bond Barclays US Agg Bond TR USD Long-Term Corporate Bond Total S&P 500 TR USD MSCI ACWI Ex USA NR USD MSCI ACWI Ex USA NR USD MSCI ACWI NR USD Barclays Govt/Credit 1-5 Yr TR USD Barclays US Agg Bond TR USD

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts