Question: FIN 3 0 0 2 Assignment 2 Problem 1 : Portfolio Analysis ( 5 0 points ) You work for a financial institution that offers

FIN Assignment

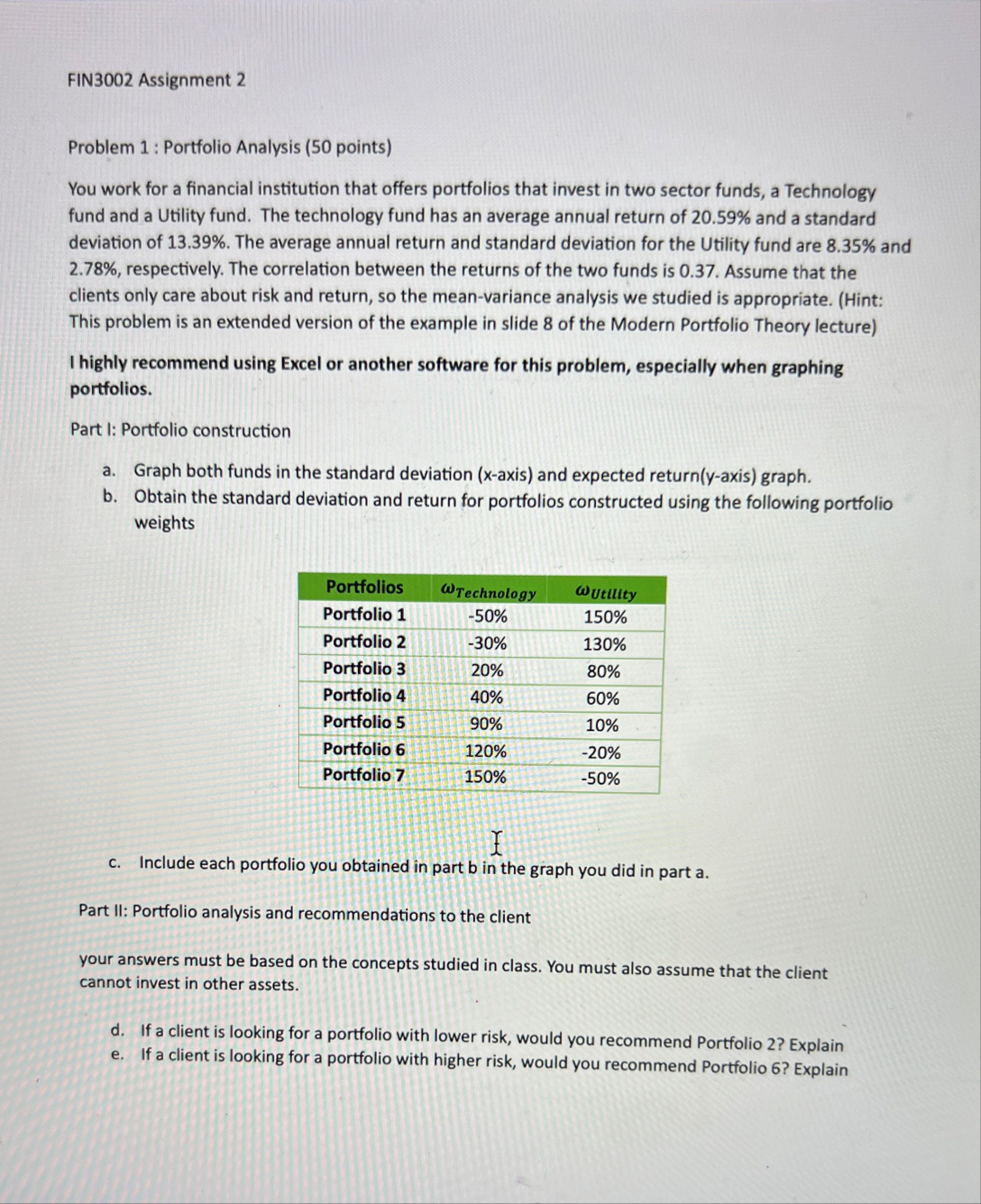

Problem : Portfolio Analysis points

You work for a financial institution that offers portfolios that invest in two sector funds, a Technology fund and a Utility fund. The technology fund has an average annual return of and a standard deviation of The average annual return and standard deviation for the Utility fund are and respectively. The correlation between the returns of the two funds is Assume that the clients only care about risk and return, so the meanvariance analysis we studied is appropriate. Hint: This problem is an extended version of the example in slide of the Modern Portfolio Theory lecture

I highly recommend using Excel or another software for this problem, especially when graphing portfolios.

Part I: Portfolio construction

a Graph both funds in the standard deviation axis and expected returnyaxis graph.

b Obtain the standard deviation and return for portfolios constructed using the following portfolio weights

tablePortfolios

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock