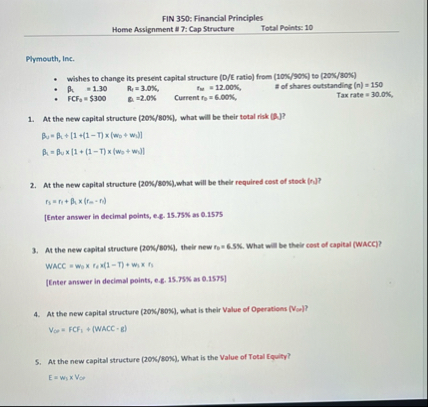

Question: FIN 3 5 0 : Financial Principles Home Assignment II 7 : Cap Structure Total Points: 1 0 Plymouth, Inc. wishes to change its present

FIN : Financial Principles

Home Assignment II : Cap Structure

Total Points:

Plymouth, Inc.

wishes to change its present capital structure DE ratio from to

zof shares outitanding

$

Current

Tax rate

At the new capital structure what will be their total riak BUN

At the new capital structure what will be their required cost of stock n

Enter answer in decimal points, ef as

At the new capital structure their new What will be their cost of capital WACC

WACC

Enter answer in decimal points, es as

At the new capital structure what is their Value of Operations

At the new capital structure What is the Value of Total Equily?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock