Question: FIN 3 5 0 Project Case Study You are a CFP professional and have met with Alix and Eddy Pereira, who have come to you

FIN Project Case Study

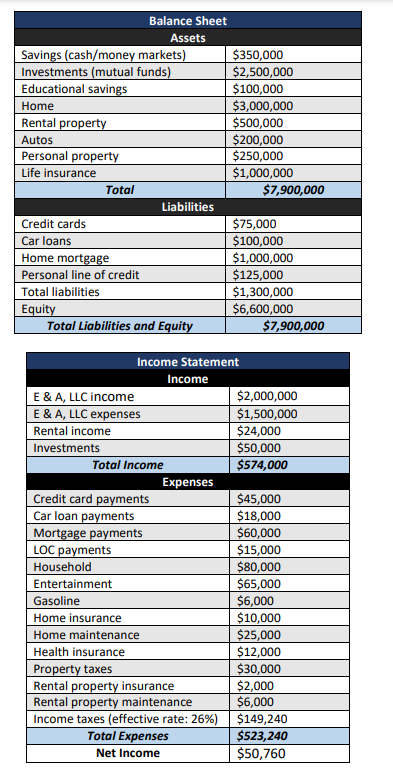

You are a CFP professional and have met with Alix and Eddy Pereira, who have come to you for help with several financial planning goals. Alix and Eddy own a computer software company: E & A LLC Alix is years old, and Eddy is years old. They are happily married and have two children: Tomas age and Maya age All family members are in good health, and the family has no history of serious health issues. Based on these facts, along with their family health histories, Alix and Eddy each expect to live to be years old. Alix and Eddy have completed a risk tolerance questionnaire, which indicates that they have a high tolerance for risk. They would like their portfolio and investment decisions to be based on their expected wealth, their desire for security, the funding levels that they are trying to achieve, and the likelihood of achieving those funding levels.

Retirement Planning Alix and Eddy would like to continue to run their business until Alix turns at which time the couple would like to sell the company and retire. They anticipate that the business will continue to generate the same amount of income each year, that their personal expenses will remain constant until retirement, and that they will net $ million from the sale of the business when they retire. Based on an analysis of current expenses on their income statement along with their expected spending in retirement, Alix and Eddy anticipate that their annual personal expenses in retirement will be of their total annual expenses today. You have mutually agreed to base your retirement planning recommendations on this assumption.

Review the Project Case Study provided above. Then, using your financial calculator, calculate and address each of the following in a minimum of sentences using the template provided. Include an appendix to show your detailed calculations and cite them appropriately. For example, Funding needed is USD see Appendix A

Using the annuity method, perform the time value of money calculations to determine the client's retirement funding needs. Address the following in your response and include any assumptions used in making your recommendations:

A The clients total retirement funding need at retirement age

B The annual savings required to meet the retirement goal

Using the uneven cashflow method for multiple children, perform the time value of money calculations to determine the clients educational funding needs. Address the following in your response and include any assumptions used in making your recommendations:

A Net present value NPV of the total funding need

B The annual savings required to meet the education goal

Propose budget recommendations that fit with the clients financial data that address the opportunities identified. Address the following in your response and include any assumptions used in making your recommendations:

A Financing strategies

B Debt management

C Cashflow management

i Income

ii Expenses

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock