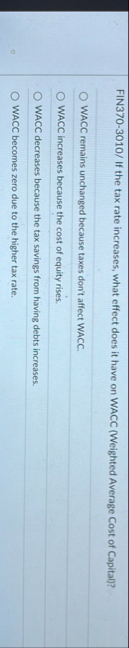

Question: FIN 3 7 0 - 3 0 1 0 / If the tax rate increases, what effect does it have on WACC ( Weighted Average

FIN If the tax rate increases, what effect does it have on WACC Weighted Average Cost of Capital

WACC remains unchanged because taxes don't affect WACC.

WACC increases because the cost of equity rises.

WACC decreases because the tax savings from having debts increases.

WACC becomes zero due to the higher tax rate.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock