Question: Fin 301 Chapter 14 In-Class Exercise 1. Given the following information for Evernotready Power Co., find the WACC. Assume a 35% tax rate, 5.5% market

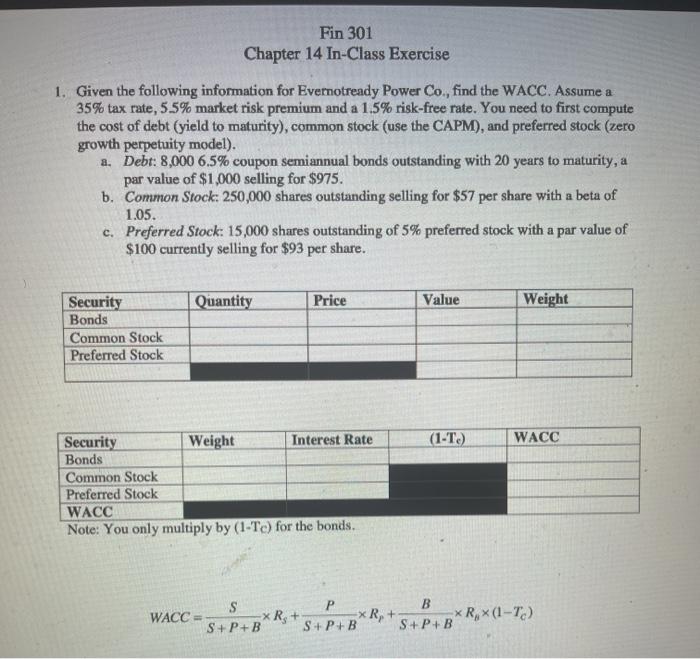

Fin 301 Chapter 14 In-Class Exercise 1. Given the following information for Evernotready Power Co., find the WACC. Assume a 35% tax rate, 5.5% market risk premium and a 1.5% risk-free rate. You need to first compute the cost of debt (yield to maturity), common stock (use the CAPM), and preferred stock (zero growth perpetuity model). a. Debt: 8,000 6.5% coupon semiannual bonds outstanding with 20 years to maturity, a par value of $1,000 selling for $975. b. Common Stock: 250,000 shares outstanding selling for $57 per share with a beta of 1.05. c. Preferred Stock: 15,000 shares outstanding of 5% preferred stock with a par value of $100 currently selling for $93 per share. Quantity Price Value Weight Security Bonds Common Stock Preferred Stock (1-T.) WACC Security Weight Interest Rate Bonds Common Stock Preferred Stock WACC Note: You only multiply by (1-Te) for the bonds. S P B WACC = - x R+ -XR,+ *R,(1-7) S+P+B S+P+B S+P+B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts