Question: FIN 305 Fall 2017 Homework 2 Note: Turn in page 3 only-Thanks! Use the following information for problems 1 and 2: Stock A StockB Average

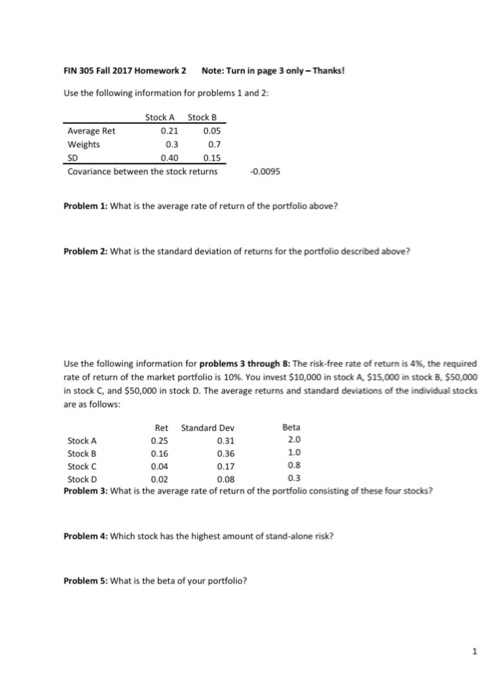

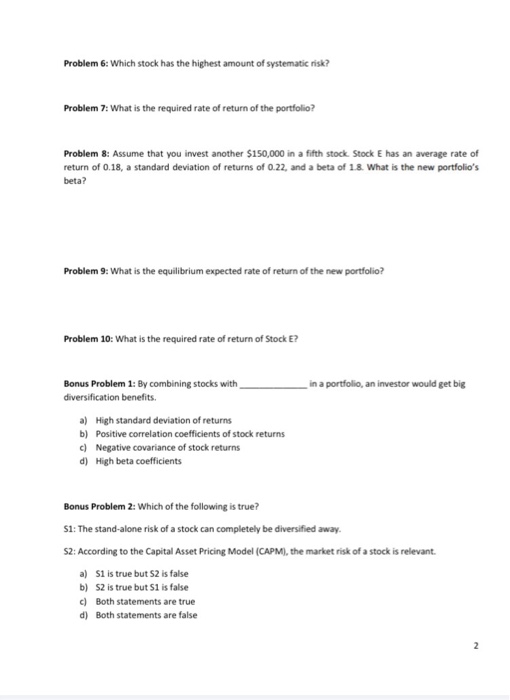

FIN 305 Fall 2017 Homework 2 Note: Turn in page 3 only-Thanks! Use the following information for problems 1 and 2: Stock A StockB Average Ret Weights SD Covariance between the stock returns 0.21 0.3 0.40 0.05 0.7 0.15 0.0095 Problem 1: What is the average rate of return of the portfolio above? Problem 2: What is the standard deviation of returns for the portfolio described above? Use the following information for problems 3 through 8: The risk-free rate of return is 4%, the required rate of return of the market portfolio is 10%. You invest $10,000 in stock A $15,000 in stock B, $50,000 in stock C, and $50,000 in stock D. The average returns and standard deviations of the individual stocks are as follows: Stock A Stock B Stock C Stock D 0.25 0.16 0.04 0.02 Ret Standard Dev 0.31 0.36 0.17 0.08 Beta 2.0 1.0 0.8 0.3 Problem 3: What is the average rate of return of the portfolio consisting of these four stocks? Problem 4: Which stock has the highest amount of stand-alone risk? Problem 5: What is the beta of your portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts