Question: FIN 3113 Engagement Assignment # 5 Fall 2019 This assignment is worth a total of 15 points. You may work in groups of two to

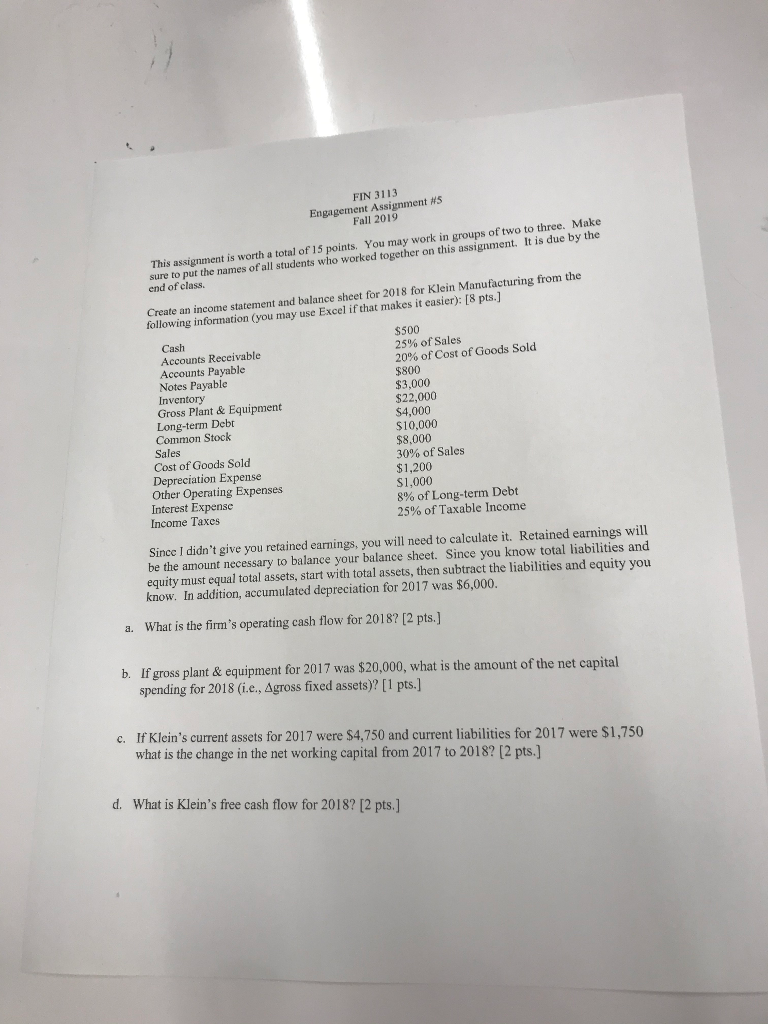

FIN 3113 Engagement Assignment # 5 Fall 2019 This assignment is worth a total of 15 points. You may work in groups of two to three. Make sure to put the names of all students who worked together on this assignment. It is due by the end of class. Create an income statement and balance sheet for 2018 for Klein Manufacturing from the following information (you may use Excel if that makes it easier): [8 pts.] $500 25% of Sales 20% of Cost of Goods Sold $800 $3,000 $22,000 $4,000 $10,000 $8,000 30% of Sales $1,200 S1,000 Cash Accounts Receivable Accounts Payable Notes Payable Inventory Gross Plant& Equipment Long-term Debt Common Stock Sales Cost of Goods Sold Depreciation Expense Other Operating Expenses Interest Expense Income Taxes 8% of Long-term Debt 25% of Taxable Income Since I didn't give you retained earnings, you will need to calculate it. Retained earnings will be the amount necessary to balance your balance sheet. Since you know total liabilities and equity must equal total assets, start with total assets, then subtract the liabilities and equity you know. In addition, accumulated depreciation for 2017 was $6,000. What is the firm's operating cash flow for 2018? [2 pts.] a. b. If gross plant & equipment for 2017 was $20,000, what is the amount of the net capital spending for 2018 (i.e., Agross fixed assets)? [1 pts.] c. If Klein's current assets for 2017 were $4,750 and current liabilities for 2017 were $1,750 what is the change in the net working capital from 2017 to 2018? [2 pts.] What is Klein's free cash flow for 2018? [2 pts.] d. FIN 3113 Engagement Assignment # 5 Fall 2019 This assignment is worth a total of 15 points. You may work in groups of two to three. Make sure to put the names of all students who worked together on this assignment. It is due by the end of class. Create an income statement and balance sheet for 2018 for Klein Manufacturing from the following information (you may use Excel if that makes it easier): [8 pts.] $500 25% of Sales 20% of Cost of Goods Sold $800 $3,000 $22,000 $4,000 $10,000 $8,000 30% of Sales $1,200 S1,000 Cash Accounts Receivable Accounts Payable Notes Payable Inventory Gross Plant& Equipment Long-term Debt Common Stock Sales Cost of Goods Sold Depreciation Expense Other Operating Expenses Interest Expense Income Taxes 8% of Long-term Debt 25% of Taxable Income Since I didn't give you retained earnings, you will need to calculate it. Retained earnings will be the amount necessary to balance your balance sheet. Since you know total liabilities and equity must equal total assets, start with total assets, then subtract the liabilities and equity you know. In addition, accumulated depreciation for 2017 was $6,000. What is the firm's operating cash flow for 2018? [2 pts.] a. b. If gross plant & equipment for 2017 was $20,000, what is the amount of the net capital spending for 2018 (i.e., Agross fixed assets)? [1 pts.] c. If Klein's current assets for 2017 were $4,750 and current liabilities for 2017 were $1,750 what is the change in the net working capital from 2017 to 2018? [2 pts.] What is Klein's free cash flow for 2018? [2 pts.] d

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts