Question: Fin 315 Practice Problems: Stock Splits Adobe Systems (ADBE) had their IPO in 1986. Suppose that you purchased 100 shares of Adobe Systems common stock

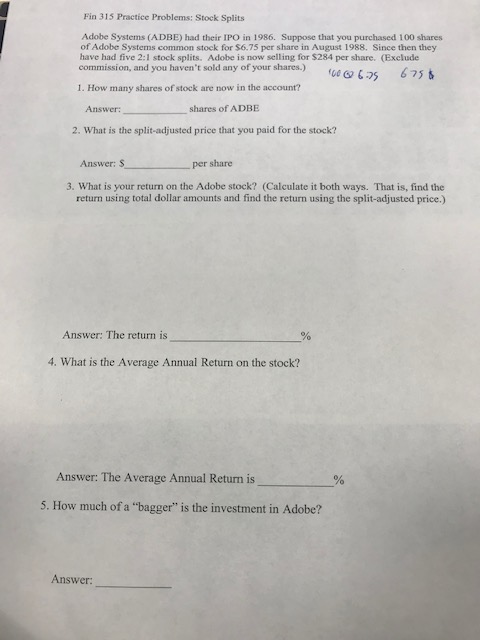

Fin 315 Practice Problems: Stock Splits Adobe Systems (ADBE) had their IPO in 1986. Suppose that you purchased 100 shares of Adobe Systems common stock for $6.75 per share in August 1988. Since then they have had five 2:1 stock splits. Adobe is now selling for $284 per share. (Exclude commission, and you haven't sold any of your shares.) 675 6 1. How many shares of stock are now in the account? Answer: shares of ADBE 2. What is the split-adjusted price that you paid for the stock? Answer: $ per share 3. What is your return on the Adobe stock? (Calculate it both ways. That is, find the return using total dollar amounts and find the return using the split-adjusted price.) Answer: The return is 4. What is the Average Annual Return on the stock? Answer: The Average Annual Return is 5. How much of a "bagger" is the investment in Adobe

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts