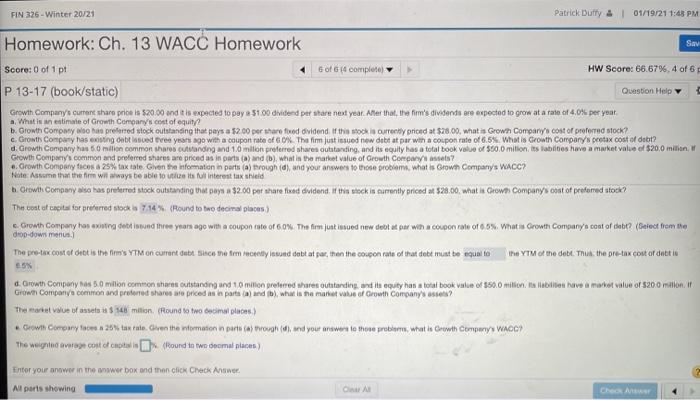

Question: FIN 326 - Winter 20/21 Patrick Duffy & 01/19/211:45 PM Homework: Ch. 13 WACC Homework Sav Score: 0 of 1 pt 6 of 6 (complete

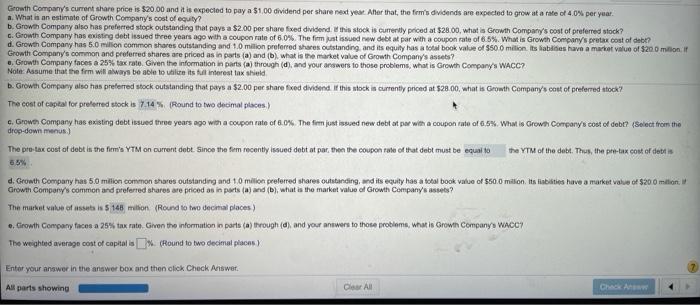

FIN 326 - Winter 20/21 Patrick Duffy & 01/19/211:45 PM Homework: Ch. 13 WACC Homework Sav Score: 0 of 1 pt 6 of 6 (complete HW Score: 66.67%. 4 of 6 P 13-17 (book/static) Question Help Growth Company's current share price is $20.00 and the expected to pay a 51.00 dividend per stare next year. Anar that the firm's dividends are expected to grow at a rate of 4.0% per year a. What is an estimate of Growth Company's cost of equity b. Growth Company has preferred stock outstanding that pays a $2.00 per share fred dividend if the stock is currently priced at $28.00, what is Grown Company's cost of proferred stock? c Growts Company has existing onbesoed tree years ago with a coupon rate of GX The firm just issued new debt at par win a coupon rate of 6.5% What is Growth Company's pretax cost of debt? d. Growth Company has 5 milion common shares outstanding and 10 milion preferred shares outstanding, and its equity has a total book of $50,0 milion Islabies have a market value of $200 million Growth Company's common and preferred shares are priced as in partea) and (b), what is the market value of Growth Courses Growth Company to a 25% tax tote Given the information in parts (a) through (d), and your answers to those problema. What is Grown Company's WACC? Note: Asumin that the firm wil wways be able to its full interest tak held b. Orowth company also has proferred stock outstanding that pays a $2.00 per share fired dividend. If thin slock in currently priced at $28.00. What is Crowns Company's coat of preferred stock? The cost of capital for preferred stock is 714% (Round to two decimal places) Growth Company hasta det sund three years ago with a coupon rate of 60%. The firm just inued now det et par won a coupon role of 65% What is Growth Company's cost of debt? (Select from the The pro-tax cost of it is the firm's YTM on current dubte femei debita par, then the coupon rate of that dete must be equal to the YTM of the debt. Thus the pre-tax cost of debti 65% Growth Company is 50 million common than outstanding and 10 million profered share outstanding and its equity has a total book value of $50.0 millon, Italien have a market value of $200 million, Grow Company common and proferred share are priced len parts a) and (b), what is the market value of Growth Company's essen? The more value of 548 milion (Round to two decimale Gown Company to 25% taw talo. Glven the formation parte a rough (d), and your answers to these problem, what he Growth Companys WACC) The weighted average contact (ound to loooomal places) Enter your answer in the answer box and then click Check Answer Al ports showing CREA Growth Company's current share price is $20.00 and it is expected to pay a $1.00 dividend per share next year. Alter that, the firm's dividends are expected to grow at a rate of 4.0% per year. What is an estimate of Growth Company's cost of equity? b. Growth Company also has preferred stock outstanding that pays a $2.00 per share fixed dividend this stock is currently priced at $28.00, what is Growth Company's cost of preferred stock? c. Growth Company has existing debt issued three years ago with a coupon rate of 6.0%. The first issued new debeat par with a coupon rate of 6.5%. What is Growth Company's pretax cost of debt? d. Growth Company has 5.0 million common shares outstanding and 10 million preferred shares outstanding and its equity has a total book value of 500 milion Its habilities have a market value of $200 milioni Growth Company's common and preferred shares are priced as in parts(a) and (b). what is the market value of Growth Company's assets? .. Growth Company faces a 25% tax rate. Given the information in parts (a) through (d), and your answers to those problems, what is Growth Company's WACC? Not: Assume that the firm will always be able to its interest lax shield b. Growth Company also has preferred stock outstanding that pays a $2,00 per share fixed dividend. If this stock in currently priced at $28.00, what is Growth Company's coat of preferred toch? The cost of capital for preferred stock is 7.14% (Round to two decimal places) Grown Company has existing debt issued three years ago with a coupon rate of 6.0%. The firm just issued new debt ot par with a coupon into of 6.5%. What is Grown Company's cost od dabe? (Select from the drop-down menus) The pro-tax cost of debt is the firm's YTM on current debt Since the form recently issued debt st par then the coupon rate of that debt must be equal to the YTM of the debt. Thus, the pre-tax cost of debt is d. Growth Company has 5.0 million common shares outstanding and 1.0 million creferred shares outstanding, and its equity has a total book value of $60.0 million its ibilities have a market value of $200 million, Growth Company's common and preferred shares are priced as in parts (a) and (b), what is the market value of Growth Company's assets? The market value of assets is 5 145 milion (Round to two decimal places) Growth Company forces a 25% tax rate. Given the information in ports (a) through (d) and your answers to those probleme, what is Growin Company's WACOM The weighted average cost of capital is (Round to two decimal places Enter your answer in the answer box and then click Check Answer All parts showing Clear All Chce

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts