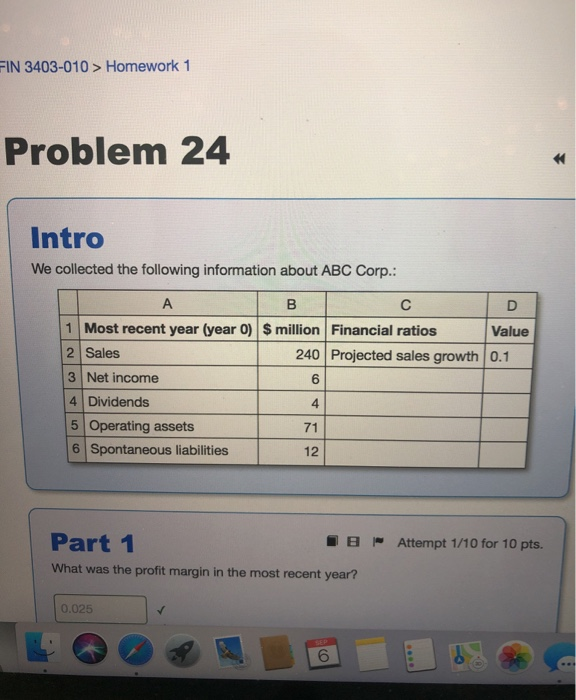

Question: FIN 3403-010 > Homework 1 Problem 24 Intro We collected the following information about ABC Corp.: A B D 1 Most recent year (year o)

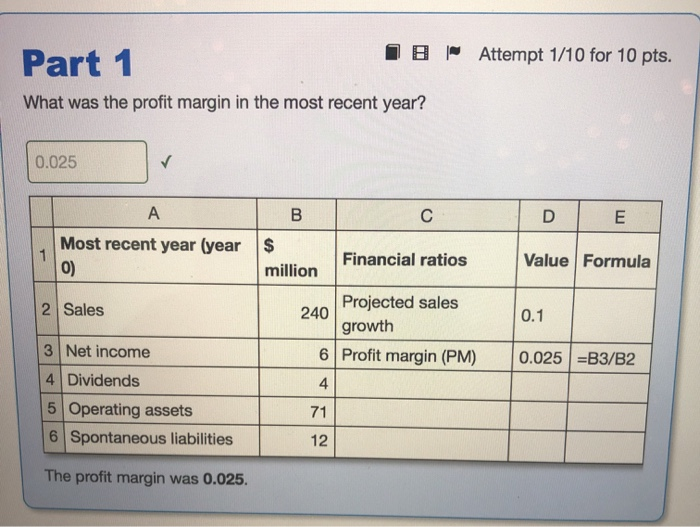

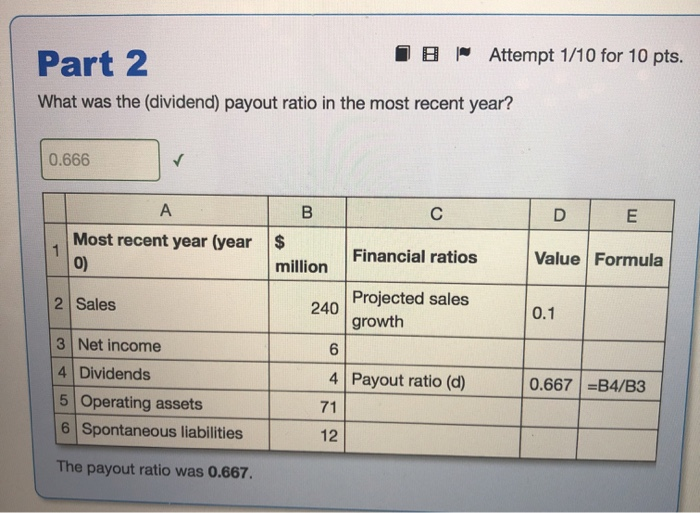

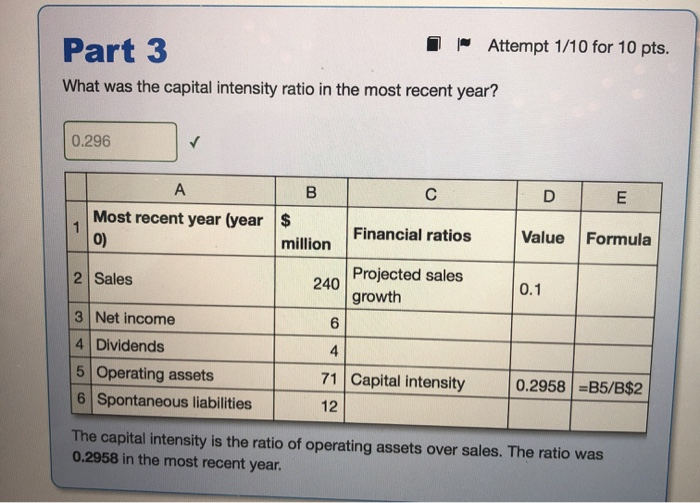

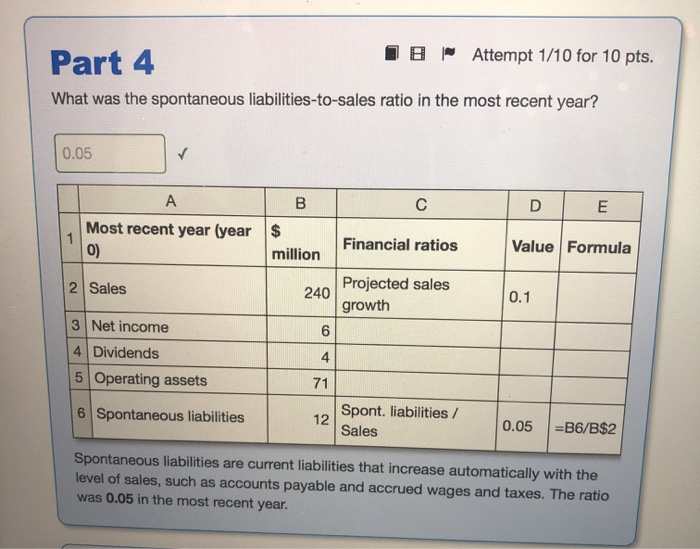

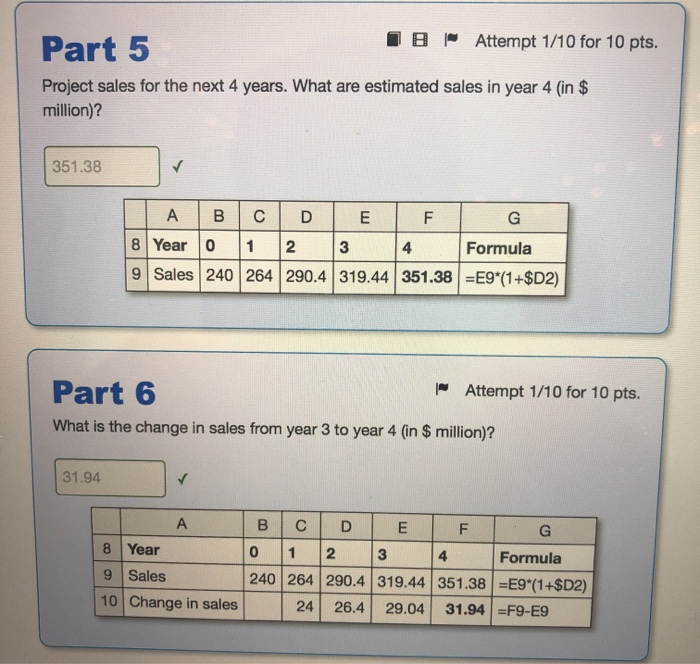

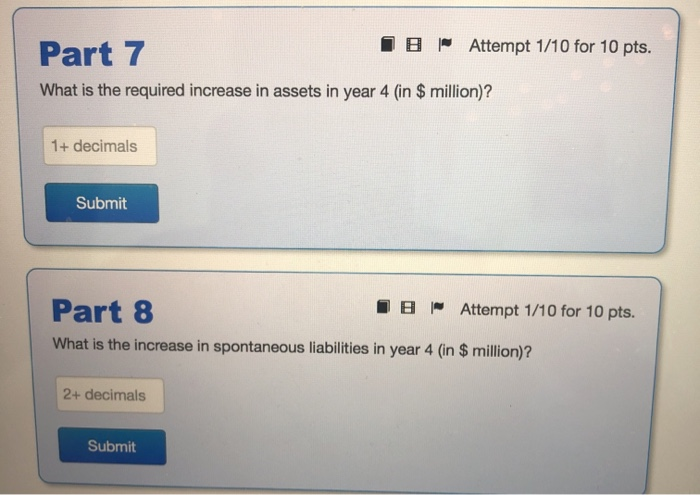

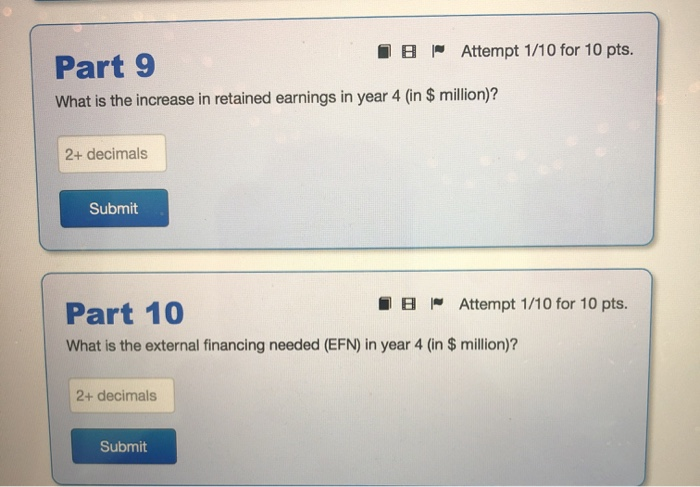

FIN 3403-010 > Homework 1 Problem 24 Intro We collected the following information about ABC Corp.: A B D 1 Most recent year (year o) $ million Financial ratios Value 2 Sales 240 Projected sales growth 0.1 3 Net income 6 4 Dividends 4 5 Operating assets 71 6 Spontaneous liabilities 12 Part 1 IB Attempt 1/10 for 10 pts. What was the profit margin in the most recent year? 0.025 6 18 Attempt 1/10 for 10 pts. Part 1 What was the profit margin in the most recent year? 0.025 D E 1 Value Formula A B Most recent year (year $ Financial ratios 0) million Projected sales 2 Sales 240 growth 3 Net income 6 Profit margin (PM) 4 Dividends 4 0.1 0.025 =B3/B2 71 5 Operating assets 6 Spontaneous liabilities 12 The profit margin was 0.025. Part 2 18 Attempt 1/10 for 10 pts. What was the dividend) payout ratio in the most recent year? 0.666 D E B Most recent year (year $ 0) million 1 Financial ratios Value Formula 2 Sales 240 Projected sales growth 0.1 6 3 Net income 4 Dividends 5 Operating assets 6 Spontaneous liabilities 4 Payout ratio (d) 71 0.667 =B4/B3 12 The payout ratio was 0.667. Part 3 Attempt 1/10 for 10 pts. What was the capital intensity ratio in the most recent year? 0.296 D E A B Most recent year (year $ 0) million 1 Financial ratios Value Formula 2 Sales 240 Projected sales growth 0.1 6 3 Net income 4 Dividends 5 Operating assets 6 Spontaneous liabilities 4 71 Capital intensity 12 0.2958 =B5/B$2 The capital intensity is the ratio of operating assets over sales. The ratio was 0.2958 in the most recent year. Part 4 IB Attempt 1/10 for 10 pts. What was the spontaneous liabilities-to-sales ratio in the most recent year? 0.05 D E B Most recent year (year $ 0) million 1 Financial ratios Value Formula 2 Sales 240 Projected sales growth 0.1 3 Net income 6 4 Dividends 4 5 Operating assets 71 6 Spontaneous liabilities 12 Spont. liabilities/ Sales 0.05 =B6/B$2 Spontaneous liabilities are current liabilities that increase automatically with the level of sales, such as accounts payable and accrued wages and taxes. The ratio was 0.05 in the most recent year. IB Attempt 1/10 for 10 pts. Part 5 Project sales for the next 4 years. What are estimated sales in year 4 (in $ million)? 351.38 A B D E F G 8 Year 0 1 2 3 4 Formula 9 Sales 240 264 290.4 319.44 351.38 =E9*(1+$D2) Part 6 Attempt 1/10 for 10 pts. What is the change in sales from year 3 to year 4 (in $ million)? 31.94 N 3 B D E F G 8 Year 0 1 3 Formula 9 Sales 240 264 290.4 319.44 351.38 =E9*(1+$D2) 10 Change in sales 24 26.4 29.04 31.94 =F9-E9 8 Attempt 1/10 for 10 pts. Part 7 What is the required increase in assets in year 4 (in $ million)? 1+ decimals Submit Part 8 IB Attempt 1/10 for 10 pts. What is the increase in spontaneous liabilities in year 4 (in $ million)? 2+ decimals Submit IB | Attempt 1/10 for 10 pts. Part 9 What is the increase in retained earnings in year 4 (in $ million)? 2+ decimals Submit Part 10 IB Attempt 1/10 for 10 pts. What is the external financing needed (EFN) in year 4 (in $ million)? 2+ decimals Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts