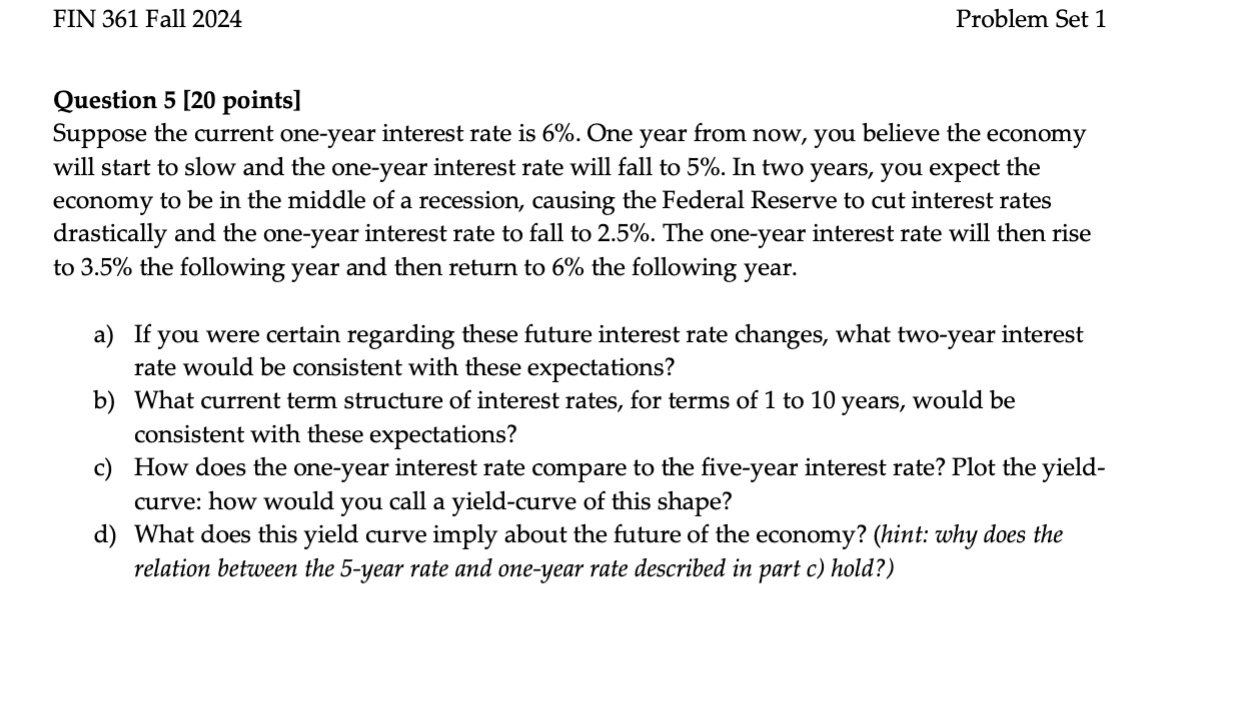

Question: FIN 361 Fall 2024 Problem Set 1 Question 5 [20 points] Suppose the current one-year interest rate is 6%. One year from now, you believe

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts