Question: FIN 4 1 0 : Retirement Planning Project 2 Learning Goals: Understand the changing retirement system ( including Social Security ) and be able to

FIN : Retirement Planning Project

Learning Goals:

Understand the changing retirement system including Social Security and be able to acknowledge the importance of lifestyle needs, age, and gender in retirement planning.

Demonstrate the ability to perform time value of money calculations that relate to savings and retirement planning.

Notes:

Use only your TVM calculator or equivalent app and show your inputs on each calculation. This allows me to award partial credit if necessary.

Before attempting this project, I recommend rereading pages Practice the annuity method outlined on page

This project is a learning opportunity I encourage you to utilize the discussion boards to ask for clarification or guidance. Please do not email me about questions in the project, if we discuss the questions in the discussion board others with the same question may benefit too.

Please have realistic expectations for responses, questions asked the day before the due date may be missed, so be proactive.

There is a Day late penalty for this assignment.

Client Background:

Your new client is Michael Johnson, an energetic yearold with a love for travel and a methodical approach to life planning. As he prepares for retirement, he envisions a future rich with adventures and new opportunities. His desired retirement age is and he aims to enjoy his golden years until a projected life expectancy of Currently, Michael's annual expenses are $ covering his daily needs and occasional luxuries. He anticipates this will not change. He has been carefully managing his finances and has amassed retirement savings of $ which he has nurtured over the years. However, Michael's aspirations extend beyond his personal comfort. With a strong commitment to philanthropy, he dreams of leaving a lasting legacy by donating $$ to a charity dear to his heart upon his passing.

Amidst his goals, Michael is also considering the impact of Social Security benefits on his retirement plan. He is aware that his full retirement age for Social Security is at which point he could receive a benefit of $in today's dollars Considering various scenarios, Michael is contemplating the possibility of retiring at and incorporating Social Security benefits from that age onward. Balancing his desire for a fulfilling retirement and a meaningful legacy, Michael seeks to determine the optimal financial strategy. With an annual inflation rate of and a projected interest rate of Michael understands the importance of a comprehensive approach to his financial planning. As he steps into this crucial phase of his life,

Michael looks to navigate the complex landscape of retirement preparedness with strategic foresight and informed decisionmaking.

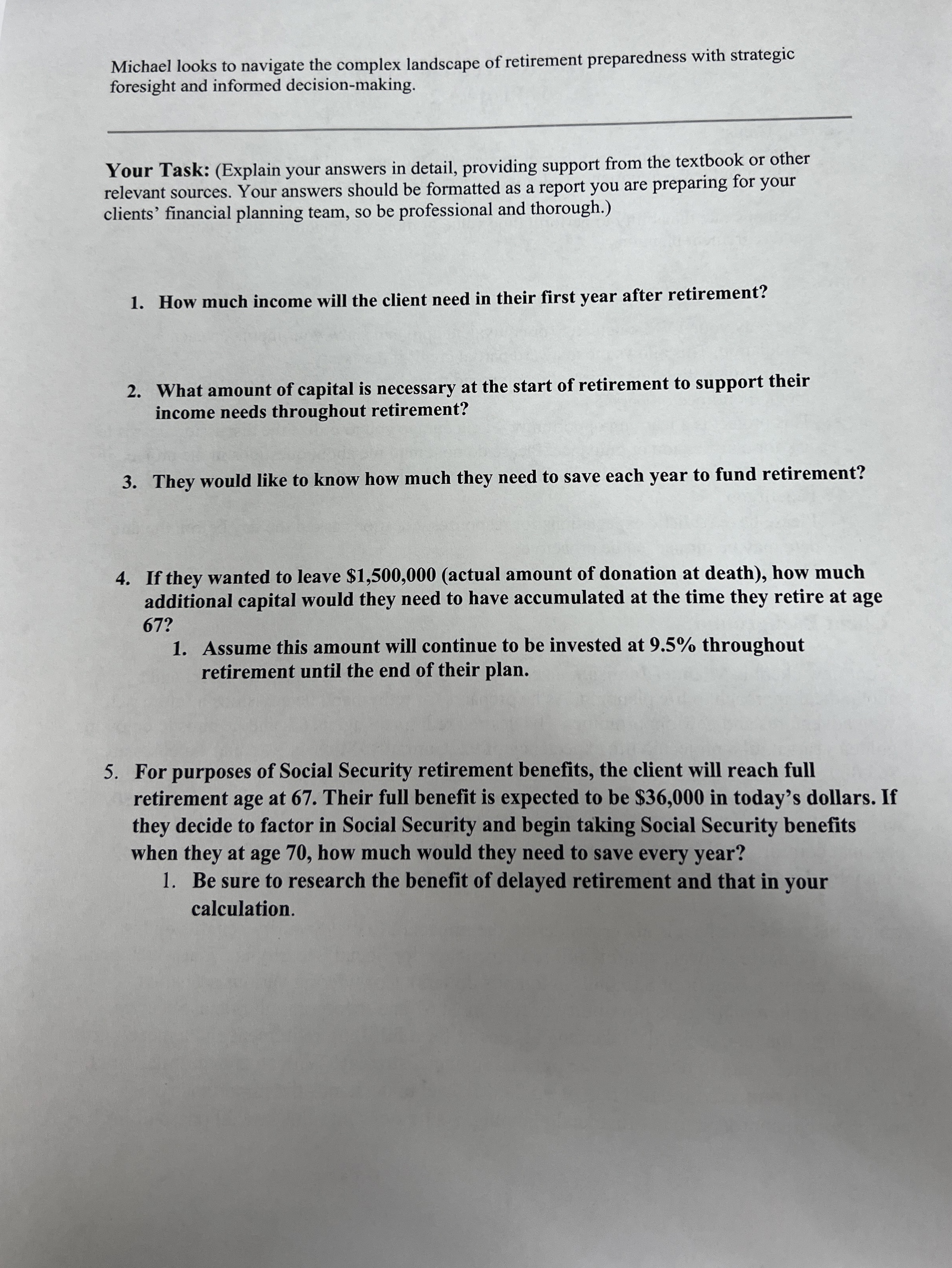

Your Task: Explain your answers in detail, providing support from the textbook or other relevant sources. Your answers should be formatted as a report you are preparing for your clients' financial planning team, so be professional and thorough.

How much income will the client need in their first year after retirement?

What amount of capital is necessary at the start of retirement to support their income needs throughout retirement?

They would like to know how much they need to save each year to fund retirement?

If they wanted to leave $actual amount of donation at death how much additional capital would they need to have accumulated at the time they retire at age

Assume this amount will continue to be invested at throughout retirement until the end of their plan.

For purposes of Social Security retirement benefits, the client will reach full retirement age at Their full benefit is expected to be $ in today's dollars. If they decide to factor in Social Security and begin taking Social Security benefits when they at age how much would they need to save every year?

Be sure to research the benefit of delayed retirement and that in your calculation.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock