Question: Fin 4200 Spreadsheet assignment 1 Use the spreadsheet provided and go to cnbc.com to answer the following questions. The ticker symbol for Coke is KO.

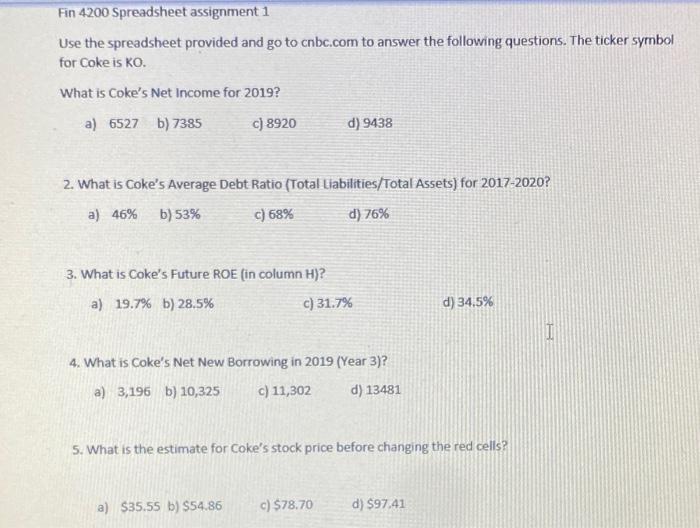

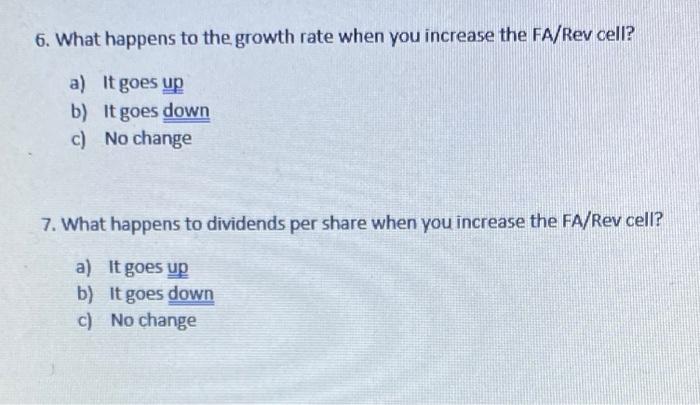

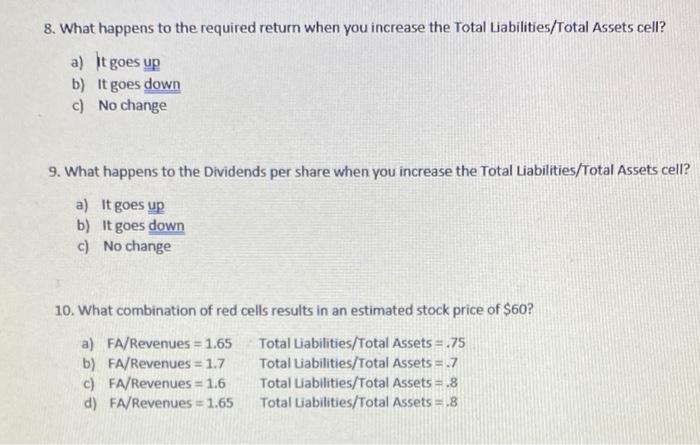

Fin 4200 Spreadsheet assignment 1 Use the spreadsheet provided and go to cnbc.com to answer the following questions. The ticker symbol for Coke is KO. What is Coke's Net Income for 2019? a) 6527 b) 7385 c) 8920 d) 9438 2. What is Coke's Average Debt Ratio (Total Liabilities/Total Assets) for 2017-2020? a) 46% b) 53% c) 68% d) 76% 3. What is Coke's Future ROE (in column H)? a) 19.7% b) 28.5% c) 31.7% d) 34.5% I 4. What is Coke's Net New Borrowing in 2019 (Year 3)? a) 3,196 b) 10,325 c) 11,302 d) 13481 5. What is the estimate for Coke's stock price before changing the red cells? a) $35.55 b) $54.86 c) $78.70 d) $97.41 6. What happens to the growth rate when you increase the FA/Rev cell? a) It goes up b) It goes down c) No change 7. What happens to dividends per share when you increase the FA/Rev cell? a) It goes up b) It goes down c) No change 8. What happens to the required return when you increase the Total Liabilities/Total Assets cell? a) It goes up b) It goes down c) No change 9. What happens to the Dividends per share when you increase the Total Liabilities/Total Assets cell? a) It goes up b) It goes down c) No change 10. What combination of red cells results in an estimated stock price of $60? a) FA/Revenues = 1.65 b) FA/Revenues = 1.7 c) FA/Revenues = 1.6 d) FA/Revenues = 1.65 Total Liabilities/Total Assets = .75 Total Liabilities/Total Assets = .7 Total Liabilities/Total Assets = .8 Total Liabilities/Total Assets = .8 Fin 4200 Spreadsheet assignment 1 Use the spreadsheet provided and go to cnbc.com to answer the following questions. The ticker symbol for Coke is KO. What is Coke's Net Income for 2019? a) 6527 b) 7385 c) 8920 d) 9438 2. What is Coke's Average Debt Ratio (Total Liabilities/Total Assets) for 2017-2020? a) 46% b) 53% c) 68% d) 76% 3. What is Coke's Future ROE (in column H)? a) 19.7% b) 28.5% c) 31.7% d) 34.5% I 4. What is Coke's Net New Borrowing in 2019 (Year 3)? a) 3,196 b) 10,325 c) 11,302 d) 13481 5. What is the estimate for Coke's stock price before changing the red cells? a) $35.55 b) $54.86 c) $78.70 d) $97.41 6. What happens to the growth rate when you increase the FA/Rev cell? a) It goes up b) It goes down c) No change 7. What happens to dividends per share when you increase the FA/Rev cell? a) It goes up b) It goes down c) No change 8. What happens to the required return when you increase the Total Liabilities/Total Assets cell? a) It goes up b) It goes down c) No change 9. What happens to the Dividends per share when you increase the Total Liabilities/Total Assets cell? a) It goes up b) It goes down c) No change 10. What combination of red cells results in an estimated stock price of $60? a) FA/Revenues = 1.65 b) FA/Revenues = 1.7 c) FA/Revenues = 1.6 d) FA/Revenues = 1.65 Total Liabilities/Total Assets = .75 Total Liabilities/Total Assets = .7 Total Liabilities/Total Assets = .8 Total Liabilities/Total Assets = .8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts