Question: FIN 4620 Capital Adequacy - Chapter Exercises 1. Recent negative market impacts to the telecommunications industry have resulted from changes in trade agreements. A $10,000,000

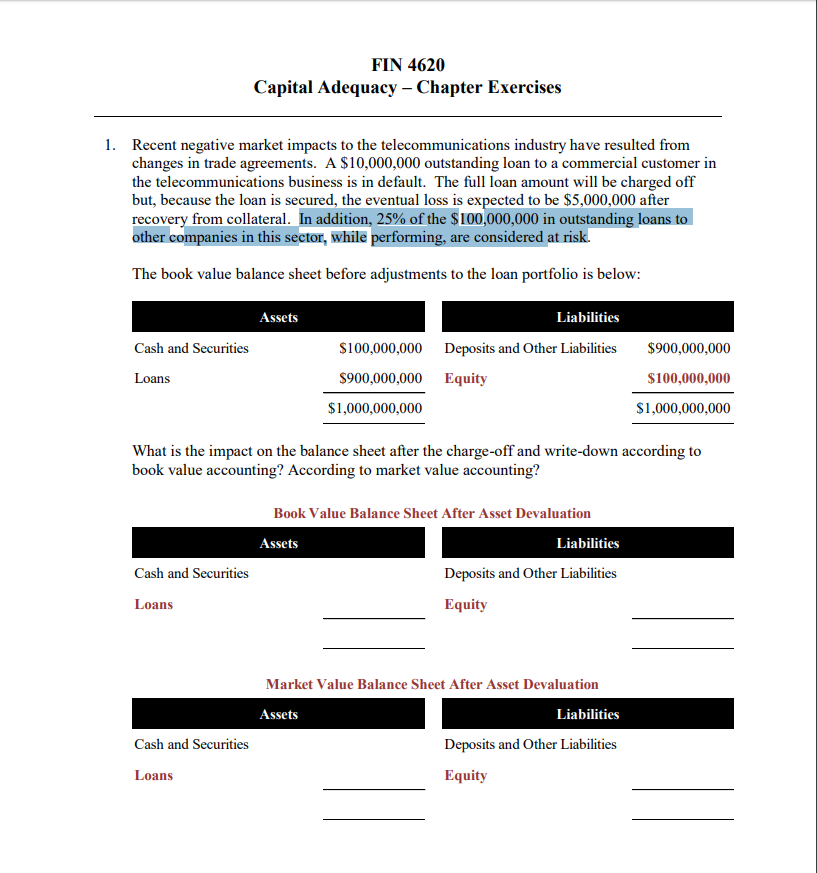

FIN 4620 Capital Adequacy - Chapter Exercises 1. Recent negative market impacts to the telecommunications industry have resulted from changes in trade agreements. A $10,000,000 outstanding loan to a commercial customer in the telecommunications business is in default. The full loan amount will be charged off but, because the loan is secured, the eventual loss is expected to be $5,000,000 after recovery from collateral. In addition, 25% of the $100,000,000 in outstanding loans to other companies in this sector, while performing, are considered at risk. The book value balance sheet before adjustments to the loan portfolio is below: Assets Cash and Securities $900,000,000 Liabilities $100,000,000 Deposits and Other Liabilities $900,000,000 Equity $1,000,000,000 Loans $100,000,000 $1,000,000,000 What is the impact on the balance sheet after the charge-off and write down according to book value accounting? According to market value accounting? Book Value Balance Sheet After Asset Devaluation Assets Liabilities Deposits and Other Liabilities Cash and Securities Loans Equity Market Value Balance Sheet After Asset Devaluation Assets Liabilities Deposits and Other Liabilities Cash and Securities Loans Equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts