Question: FIN 485 Module Four Activity Guidelines and Rubric Overview An investment portfolio is a crucial element in the financial planning process. In this activity, you

FIN 485 Module Four Activity Guidelines and Rubric

Overview

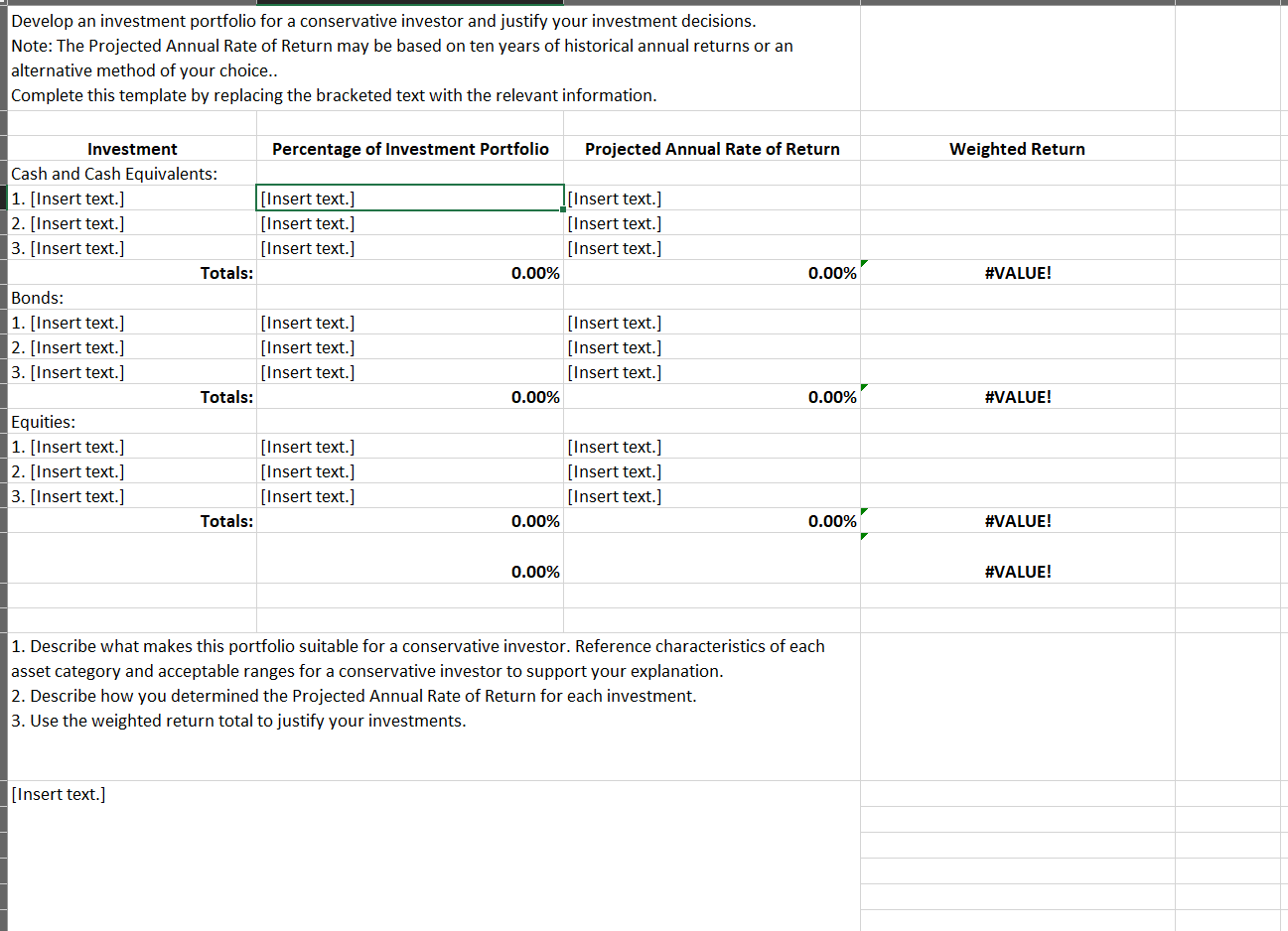

An investment portfolio is a crucial element in the financial planning process. In this activity, you will develop investment portfolios for three clients based on their risk tolerance.

Prompt

For this activity, use the Module Four Activity Template to develop investment portfolios for three clients: a conservative investor, a moderate investor, and an aggressive investor. Address the following criteria and justify your decisions on the basis of characteristics for each asset category:

- Select three investments for each asset category (cash and cash equivalents, bonds, and equities).

- For each portfolio, assign each investment a percentage of the portfolio based on the risk tolerance.

- Calculate projected annual rates of return for each investment.

- Explain how each portfolio represents the investor type based on the characteristics of each asset category and the asset allocation.

What to Submit

This activity must be submitted as an Excel document using the Module Four Activity Template provided.

A Conservative, moderate and Aggressive investment portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts