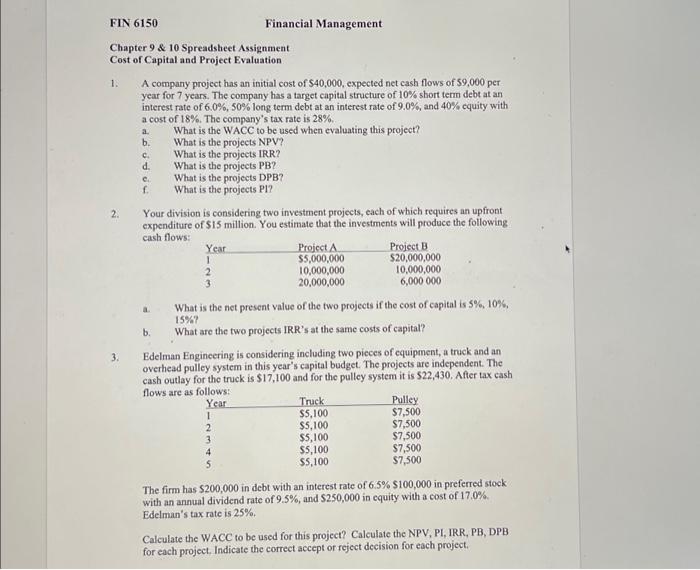

Question: FIN 6150 Chapter 9 & 10 Spreadsheet Assignment Cost of Capital and Project Evaluation 1. 2. 3. A company project has an initial cost of

1. A company project has an initial cost of $40,000, expected net eash flows of $9,000 per year for 7 years. The company has a target capital structure of 10% short term debt at an interest rate of 6.0%,50% long term debt at an interest rate of 9.0%, and 40% equity with a cost of 18%. The company's tax rate is 28%. a. What is the WACC to be used when evaluating this project? b. What is the projects NPV? c. What is the projects IRR? d. What is the projects PB? c. What is the projects DPB? f. What is the projects P1? 2. Your division is considering two investment projects, each of which requires an upfront expenditure of \$15 million. You estimate that the investments will produce the following cash flows: a. What is the net present value of the two projects if the cost of capital is 5%,10%. 15\%? b. What are the two projects IRR's at the same costs of capital? 3. Edelman Engineering is considering including two pieces of equipment, a truck and an overhead pulley system in this year's capital budget. The projects are independent. The cash outlay for the truck is $17,100 and for the pulley system it is $22,430. After tax cash flows are as The firm has $200,000 in debt with an interest rate of 6.5%$100,000 in preferred stock with an annual dividend rate of 9.5%, and $250,000 in equity with a cost of 17.0%. Edelman's tax rate is 25%. Calculate the WACC to be used for this project? Calculate the NPV, PI, IRR, PB, DPB for each project. Indicate the correct accept or reject decision for each project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts