Question: FIN 6644 Practice Question Set 1 (1) (Compatibility Mode) -Word ailings Review View Tell me what you want to do 2abcDa Aab EEmphasis Heading 11

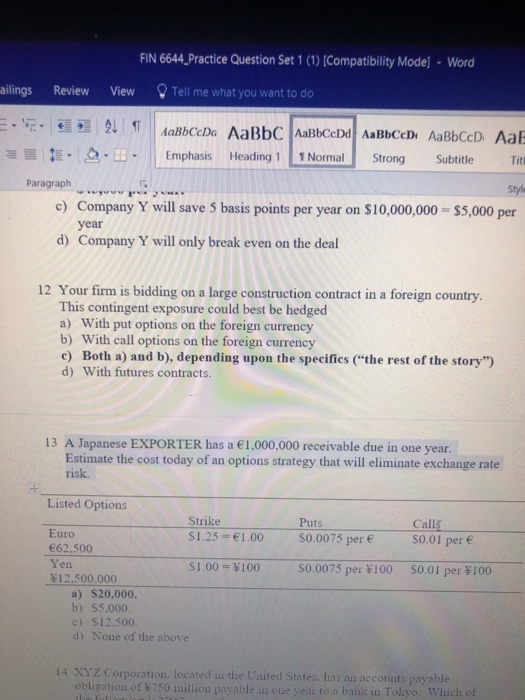

FIN 6644 Practice Question Set 1 (1) (Compatibility Mode) -Word ailings Review View Tell me what you want to do 2abcDa Aab EEmphasis Heading 11 Normal Strong Subtitle Tit Paragraph Style c) Company Y will save 5 basis points per year on $10,000,000 $5,000 per year d) Company Y will only break even on the deal 12 Your firm is bidding on a large construction contract in a foreign country. This contingent exposure could best be hedged a) With put options on the foreign currency b) With call options on the foreign currency c) Both a) and b), depending upon the specifics ("the rest of the story") d) With futures contracts. 13 A Japanese EXPORTER has a 1,000,000 receivable due in one year. Estimate the cost today of an options strategy that will eliminate exchange rate risk. -1 Listed Options Strike $1.25-1.00S0.0075 per S0.01 per e S1.00 100 0.0075 per 100 S0.01 per 100 Puts Cally Euro 62.500 Yen $12.500.000 a) S20,000. b) S5.000 c) $12.500 d) None of the above 4 XYZ Corporation. located in the United States, has au accounts payable obligation of 750 million payable in oue year to a bank in Tokyo. Which oft

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts