Question: FIn! Mark: Plesee submi via Btackboard as one PDF document it possible. If unable to combine as one document, plosse make sure your name and

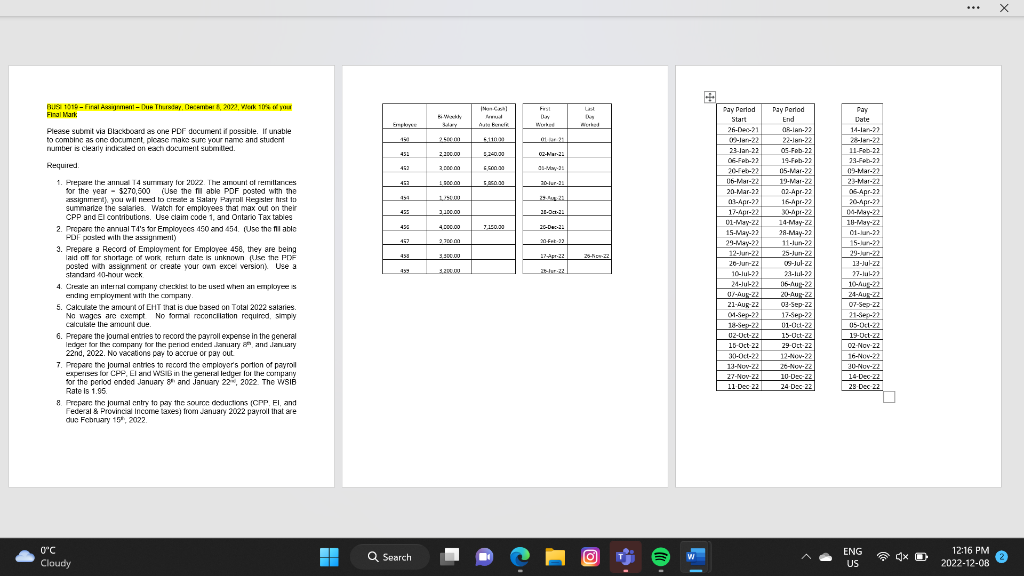

FIn! Mark: Plesee submi via Btackboard as one PDF document it possible. If unable to combine as one document, plosse make sure your name and student number is clearly indicaled un each document submitted. Required. 1. Prepore the amnual 14 surrmary lor 2022 . Ite amouni ol remallances for the year =$270,500 (Use the fil able PDF posted wth the assignimeril) you wil need to create ia Salary Payrull Fingster first in summarize the salaries. Watch for employees that max out on their CPP and EI contributions. Use ciaim code 1, and Ontario Tax tables 2. Propare the arnual T4's for Employoce 450 and 454 . (Use the fil able POF posted with the assigrinenl) 9. Prepere a Record of Employment for Employee 458 , they are being laid off for shertage wark, rehurn date is unknown fuse the PF posted with assigrment of create your onn exce version). Use a standand ADhour wack. 4. Creale an mler mal cornpany chuecklist bo to used when an eniplogoce is ending errpicymert with the corripany. 5. Calculate the amcurt of EHT that is due based on Total 2022 salaries. No wages are cxcmpt No forma reconcilation required, simpy calculale the amount due. 6. Prepare the foumal enties to recond the payroll expense in the general Ierger for the compary for the pencod ended danuary 80. and darn.ary 22 nd, 2022 . No vacations pery to accrue or pay out. 7. Propare the joumal entries to recond the employer's portion of payrol expe'rses lor CPP, El and WSSB in the general ledige Iuc Une company for the period ended sanuary 8n and January 22w,2022. The waIB Rate is 1.95. 8. Prepare the joumal entry to pay the soume dedurtions fCPP. EI, and Federal & Prowincal inceme taxesi from vanuary 2022 payrol that are dus Fehnary 15n,2022. FIn! Mark: Plesee submi via Btackboard as one PDF document it possible. If unable to combine as one document, plosse make sure your name and student number is clearly indicaled un each document submitted. Required. 1. Prepore the amnual 14 surrmary lor 2022 . Ite amouni ol remallances for the year =$270,500 (Use the fil able PDF posted wth the assignimeril) you wil need to create ia Salary Payrull Fingster first in summarize the salaries. Watch for employees that max out on their CPP and EI contributions. Use ciaim code 1, and Ontario Tax tables 2. Propare the arnual T4's for Employoce 450 and 454 . (Use the fil able POF posted with the assigrinenl) 9. Prepere a Record of Employment for Employee 458 , they are being laid off for shertage wark, rehurn date is unknown fuse the PF posted with assigrment of create your onn exce version). Use a standand ADhour wack. 4. Creale an mler mal cornpany chuecklist bo to used when an eniplogoce is ending errpicymert with the corripany. 5. Calculate the amcurt of EHT that is due based on Total 2022 salaries. No wages are cxcmpt No forma reconcilation required, simpy calculale the amount due. 6. Prepare the foumal enties to recond the payroll expense in the general Ierger for the compary for the pencod ended danuary 80. and darn.ary 22 nd, 2022 . No vacations pery to accrue or pay out. 7. Propare the joumal entries to recond the employer's portion of payrol expe'rses lor CPP, El and WSSB in the general ledige Iuc Une company for the period ended sanuary 8n and January 22w,2022. The waIB Rate is 1.95. 8. Prepare the joumal entry to pay the soume dedurtions fCPP. EI, and Federal & Prowincal inceme taxesi from vanuary 2022 payrol that are dus Fehnary 15n,2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts