Question: Fin security analysis & Portfollo MNGMT 1-5 T/F 1) When a portfolio containing 2 risky assets has a variance 0, the correlation between the two

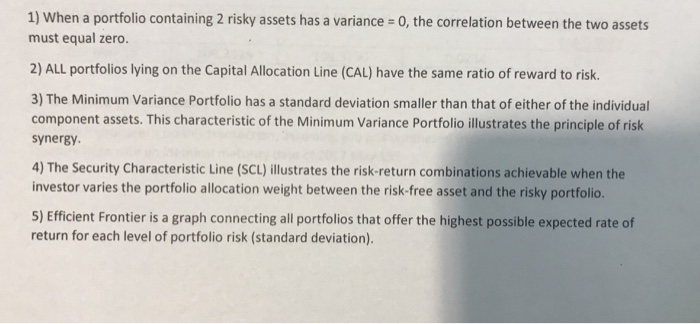

1) When a portfolio containing 2 risky assets has a variance 0, the correlation between the two assets must equal zero. 2) ALL portfolios lying on the Capital Allocation Line (CAL) have the same ratio of reward to risk. 3) The Minimum Variance Portfolio has a standard deviation smaller than that of either of the individual component assets. This characteristic of the Minimum Variance Portfolio illustrates the principle of risk synergy 4) The Security Characteristic Line (SCL) illustrates the risk-return combinations achievable when the investor varies the portfolio allocation weight between the risk-free asset and the risky portfolio. 5) Efficient Frontier is a graph connecting all portfolios that offer the highest possible expected rate of return for each level of portfolio risk (standard deviation)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts