Question: FIN220 Financial Management-I Part 2: CFA Problems 1) Common-size analysis is used in financial analysis to A. evaluate changes in a company's operating cycle over

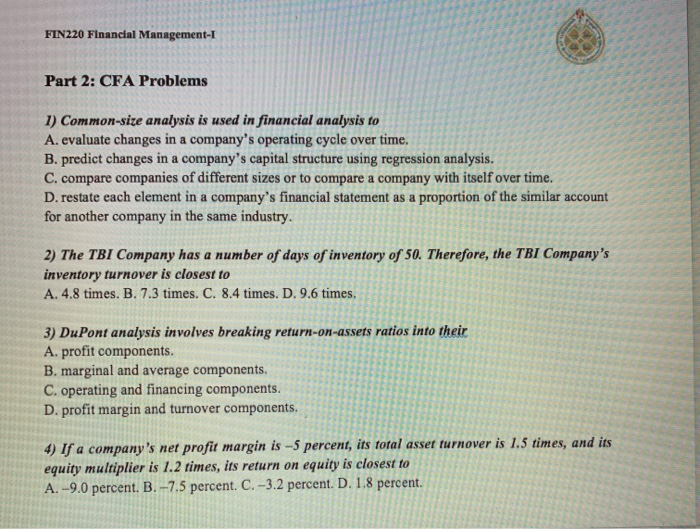

FIN220 Financial Management-I Part 2: CFA Problems 1) Common-size analysis is used in financial analysis to A. evaluate changes in a company's operating cycle over time. B. predict changes in a company's capital structure using regression analysis. D. restate each element in a company's financial statement as a proportion of the similar account for another company in the same industry. 2) The TBI Company has a number of days of inventory of 50. Therefore, the TBI Company's inventory turnover is closest to A. 4.8 times. B. 7.3 times. C. 8.4 times. D. 9.6 times. 3) DuPont analysis involves breaking return-on-assets ratios into their A. profit components. B. marginal and average components. C. operating and financing components. D. profit margin and turnover components. 4) If a company's net profit margin is - 5 percent, its total asset turnover is 1.5 times, and its equity multiplier is 1.2 times, its return on equity is closest to A. -9.0 percent. B.-7.5 percent. C.-3.2 percent. D. 1.8 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts