Question: FIN3125 Group Coursework Assignment 2021/22 Bryson plc is a multi-product manufacturer operating several plants and factories based in the north of England. After a long

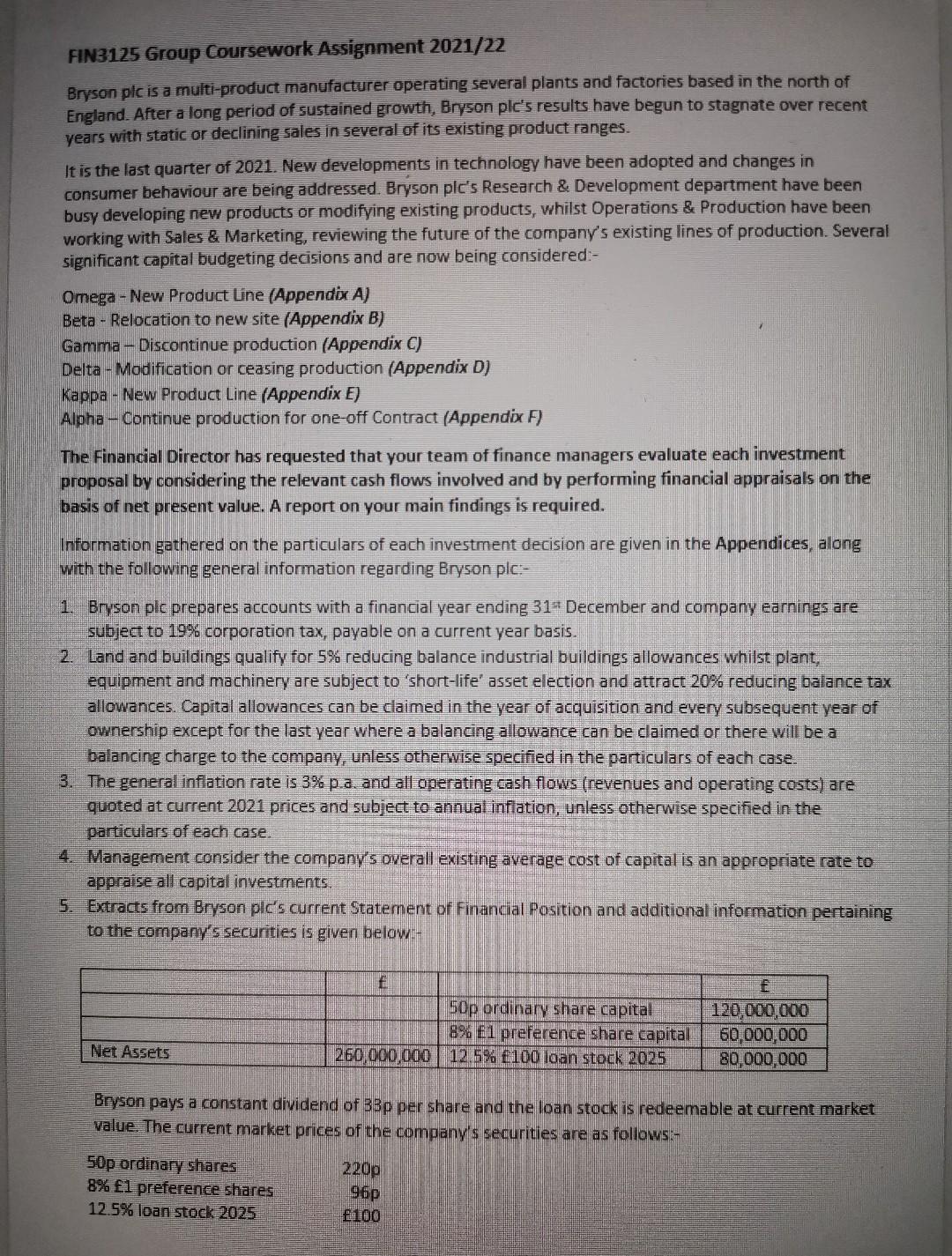

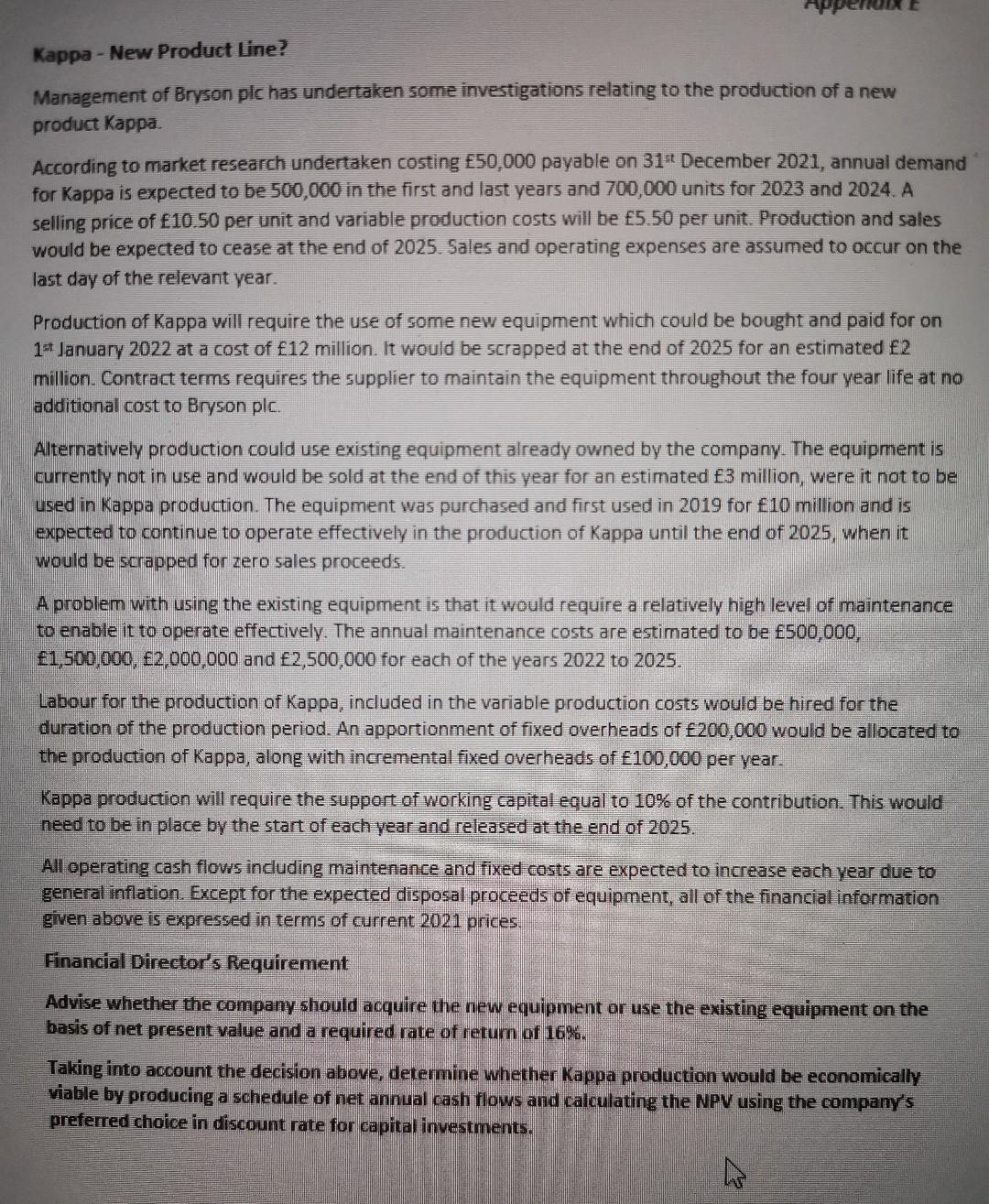

FIN3125 Group Coursework Assignment 2021/22 Bryson plc is a multi-product manufacturer operating several plants and factories based in the north of England. After a long period of sustained growth, Bryson plc's results have begun to stagnate over recent years with static or declining sales in several of its existing product ranges. It is the last quarter of 2021. New developments in technology have been adopted and changes in consumer behaviour are being addressed. Bryson ple's Research & Development department have been busy developing new products or modifying existing products, whilst Operations & Production have been working with Sales & Marketing, reviewing the future of the company's existing lines of production. Several significant capital budgeting decisions and are now being considered:- Omega - New Product Line (Appendix A) Beta - Relocation to new site (Appendix B) Gamma - Discontinue production (Appendix C) Delta - Modification or ceasing production (Appendix D) Kappa - New Product Line (Appendix E) Alpha - Continue production for one-off Contract (Appendix F) The Financial Director has requested that your team of finance managers evaluate each investment proposal by considering the relevant cash flows involved and by performing financial appraisals on the basis of net present value. A report on your main findings is required. Information gathered on the particulars of each investment decision are given in the Appendices, along with the following general information regarding Bryson plc:- 1. Bryson plc prepares accounts with a financial year ending 31 December and company earnings are subject to 19% corporation tax, payable on a current year basis. 2. Land and buildings qualify for 5% reducing balance industrial buildings allowances whilst plant, equipment and machinery are subject to 'short-life' asset election and attract 20% reducing balance tax allowances. Capital allowances can be claimed in the year of acquisition and every subsequent year of ownership except for the last year where a balancing allowance can be claimed or there will be a balancing charge to the company, unless otherwise specified in the particulars of each case. 3. The general inflation rate is 3% p.a. and all operating cash flows (revenues and operating costs) are quoted at current 2021 prices and subject to annual inflation, unless otherwise specified in the particulars of each case. 4. Management consider the company's overall existing average cost of capital is an appropriate rate to appraise all capital investments. 5. Extracts from Bryson ple's current Statement of Financial Position and additional information pertaining to the company's securities is given below:- 50p ordinary share capital 8% 21 preference share capital 260,000,000 12.5% 8100 loan stock 2025 f 120,000,000 60,000,000 80,000,000 Net Assets Bryson pays a constant dividend of 3Bp per share and the loan stock is redeemable at current market value. The current market prices of the company's securities are as follows:- 50p ordinary shares 8% 1 preference shares 12.5% loan stock 2025 220p 962 100 Kappa - New Product Line? Management of Bryson plc has undertaken some investigations relating to the production of a new product Kappa. According to market research undertaken costing 50,000 payable on 31st December 2021, annual demand for Kappa is expected to be 500,000 in the first and last years and 700,000 units for 2023 and 2024. A selling price of 10.50 per unit and variable production costs will be 5,50 per unit. Production and sales would be expected to cease at the end of 2025. Sales and operating expenses are assumed to occur on the last day of the relevant year. Production of Kappa will require the use of some new equipment which could be bought and paid for on 19 January 2022 at a cost of 12 million. It would be scrapped at the end of 2025 for an estimated 2 million. Contract terms requires the supplier to maintain the equipment throughout the four year life at no additional cost to Bryson plc. Alternatively production could use existing equipment already owned by the company. The equipment is currently not in use and would be sold at the end of this year for an estimated 3 million, were it not to be used in Kappa production. The equipment was purchased and first used in 2019 for 10 million and is expected to continue to operate effectively in the production of Kappa until the end of 2025, when it would be scrapped for zero sales proceeds. A problem with using the existing equipment is that it would require a relatively high level of maintenance to enable it to operate effectively. The annual maintenance costs are estimated to be 500,000, 1,500,000, 2,000,000 and 2,500,000 for each of the years 2022 to 2025. Labour for the production of Kappa, included in the variable production costs would be hired for the duration of the production period. An apportionment of fixed overheads of 200,000 would be allocated to the production of Kappa, along with incremental fixed overheads of 100,000 per year. Kappa production will requ the support of working capital equal to 10% of the contribution. This would need to be in place by the start of each year and released at the end of 2025. All operating cash flows induding maintenance and fixed costs are expected to increase each year due to general inflation. Except for the expected disposal proceeds of equipment, all of the financial information given above is expressed in terms of current 2021 prices. Financial Director's Requirement Advise whether the company should acquire the new equipment or use the existing equipment on the basis of net present value and a required rate of retum of 16%. Taking into account the decision above, determine whether Kappa production would be economically viable by producing a schedule of net annual cash flows and calculating the NPV using the company's preferred choice in discount rate for capital investments. W FIN3125 Group Coursework Assignment 2021/22 Bryson plc is a multi-product manufacturer operating several plants and factories based in the north of England. After a long period of sustained growth, Bryson plc's results have begun to stagnate over recent years with static or declining sales in several of its existing product ranges. It is the last quarter of 2021. New developments in technology have been adopted and changes in consumer behaviour are being addressed. Bryson ple's Research & Development department have been busy developing new products or modifying existing products, whilst Operations & Production have been working with Sales & Marketing, reviewing the future of the company's existing lines of production. Several significant capital budgeting decisions and are now being considered:- Omega - New Product Line (Appendix A) Beta - Relocation to new site (Appendix B) Gamma - Discontinue production (Appendix C) Delta - Modification or ceasing production (Appendix D) Kappa - New Product Line (Appendix E) Alpha - Continue production for one-off Contract (Appendix F) The Financial Director has requested that your team of finance managers evaluate each investment proposal by considering the relevant cash flows involved and by performing financial appraisals on the basis of net present value. A report on your main findings is required. Information gathered on the particulars of each investment decision are given in the Appendices, along with the following general information regarding Bryson plc:- 1. Bryson plc prepares accounts with a financial year ending 31 December and company earnings are subject to 19% corporation tax, payable on a current year basis. 2. Land and buildings qualify for 5% reducing balance industrial buildings allowances whilst plant, equipment and machinery are subject to 'short-life' asset election and attract 20% reducing balance tax allowances. Capital allowances can be claimed in the year of acquisition and every subsequent year of ownership except for the last year where a balancing allowance can be claimed or there will be a balancing charge to the company, unless otherwise specified in the particulars of each case. 3. The general inflation rate is 3% p.a. and all operating cash flows (revenues and operating costs) are quoted at current 2021 prices and subject to annual inflation, unless otherwise specified in the particulars of each case. 4. Management consider the company's overall existing average cost of capital is an appropriate rate to appraise all capital investments. 5. Extracts from Bryson ple's current Statement of Financial Position and additional information pertaining to the company's securities is given below:- 50p ordinary share capital 8% 21 preference share capital 260,000,000 12.5% 8100 loan stock 2025 f 120,000,000 60,000,000 80,000,000 Net Assets Bryson pays a constant dividend of 3Bp per share and the loan stock is redeemable at current market value. The current market prices of the company's securities are as follows:- 50p ordinary shares 8% 1 preference shares 12.5% loan stock 2025 220p 962 100 Kappa - New Product Line? Management of Bryson plc has undertaken some investigations relating to the production of a new product Kappa. According to market research undertaken costing 50,000 payable on 31st December 2021, annual demand for Kappa is expected to be 500,000 in the first and last years and 700,000 units for 2023 and 2024. A selling price of 10.50 per unit and variable production costs will be 5,50 per unit. Production and sales would be expected to cease at the end of 2025. Sales and operating expenses are assumed to occur on the last day of the relevant year. Production of Kappa will require the use of some new equipment which could be bought and paid for on 19 January 2022 at a cost of 12 million. It would be scrapped at the end of 2025 for an estimated 2 million. Contract terms requires the supplier to maintain the equipment throughout the four year life at no additional cost to Bryson plc. Alternatively production could use existing equipment already owned by the company. The equipment is currently not in use and would be sold at the end of this year for an estimated 3 million, were it not to be used in Kappa production. The equipment was purchased and first used in 2019 for 10 million and is expected to continue to operate effectively in the production of Kappa until the end of 2025, when it would be scrapped for zero sales proceeds. A problem with using the existing equipment is that it would require a relatively high level of maintenance to enable it to operate effectively. The annual maintenance costs are estimated to be 500,000, 1,500,000, 2,000,000 and 2,500,000 for each of the years 2022 to 2025. Labour for the production of Kappa, included in the variable production costs would be hired for the duration of the production period. An apportionment of fixed overheads of 200,000 would be allocated to the production of Kappa, along with incremental fixed overheads of 100,000 per year. Kappa production will requ the support of working capital equal to 10% of the contribution. This would need to be in place by the start of each year and released at the end of 2025. All operating cash flows induding maintenance and fixed costs are expected to increase each year due to general inflation. Except for the expected disposal proceeds of equipment, all of the financial information given above is expressed in terms of current 2021 prices. Financial Director's Requirement Advise whether the company should acquire the new equipment or use the existing equipment on the basis of net present value and a required rate of retum of 16%. Taking into account the decision above, determine whether Kappa production would be economically viable by producing a schedule of net annual cash flows and calculating the NPV using the company's preferred choice in discount rate for capital investments. W

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts