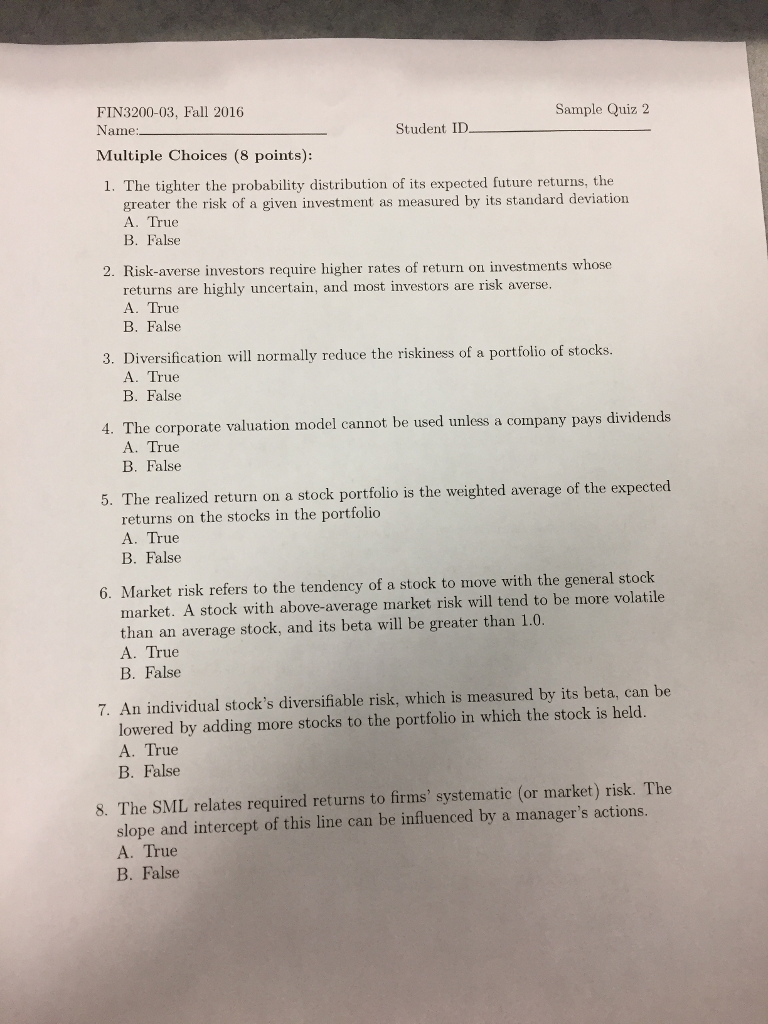

Question: FIN3200-03, Fall 2016 Sample Quiz 2 Name. Multiple Choices (8 points): 1. The tighter the probability distribution of its expected future returns, the Student ID.

FIN3200-03, Fall 2016 Sample Quiz 2 Name. Multiple Choices (8 points): 1. The tighter the probability distribution of its expected future returns, the Student ID. greater the risk of a given investment as measured by its standard deviation A. True B. False 2. Risk-averse investors require higher rates of return on investments whose returns are highly uncertain, and most investors are risk averse. A. True B. False 3. Diversification will normally reduce the riskiness of a portfolio of stocks. A. True B. False 4. The corporate valuation model cannot be used unless a company pays dividends A. True B. False 5. The realized return on a stock portfolio is the weighted average of the expected returns on the stocks in the portfolio A. True B. False 6. Market risk refers to the tendency of a stock to move with the general stock market. A stock with above-average market risk will tend to be more volatile than an average stock, and its beta will be greater than 1.0. A. True B. False 7. An individual stock's diversifiable risk, which is measured by its beta, can be lowered by adding more stocks to the portfolio in which the stock is held. A. True B. False 8. The SML relates required returns to firms' systematic (or market) risk. The slope and intercept of this line can be influenced by a manager's actions. A. True B. False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts